Press Release

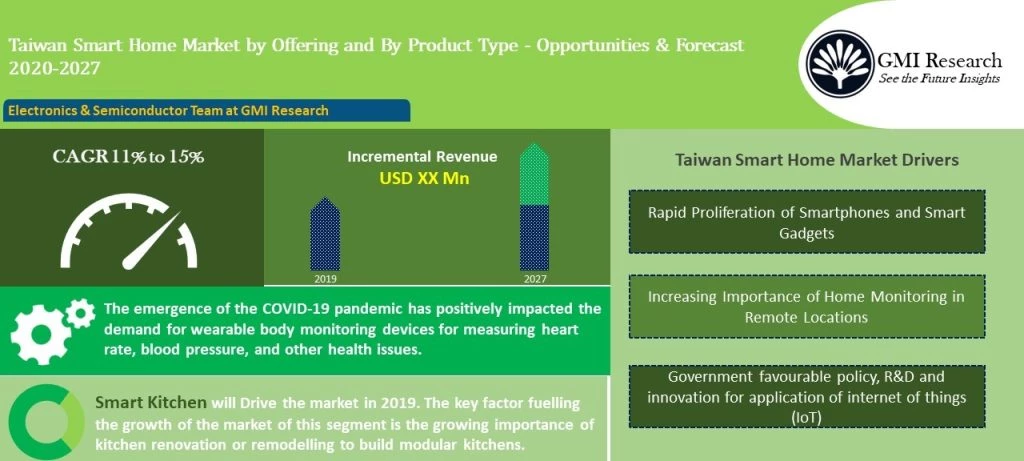

As per the GMI Research forecasts, development of smart cities in the country is expected to be one of the major factors contributing to the growth of the Taiwan Smart Homes market. The market was estimated to be USD xx Million in 2019 and is predicted to reach USD xx Million by the end of 2027, while growing at a CAGR of 11% to 15% during the forecast period (2020-2027).

The accelerating number of internet users, along with the rising adoption of smart devices, are the two key drivers that are contributing to market growth. To drive economic growth and improve the quality of life of people by enabling local area development and harnessing technology, the government implemented various national policies and initiatives, such as the “Smart Cities Development Project. Thus, the growing emphasis on the development of smart cities will open new doors for the growth of the market. In addition to this, the migration from 4G to 5G will indirectly impact the demand for smart home appliances in Taiwan.

To have an edge over the competition by knowing the market dynamics and current trends of “Taiwan Smart Home Market”, request for Sample Report here

Increasing importance of home monitoring in remote locations and security smart home solutions have significantly been adopted by the consumers which is contributing to market development. For instance, home monitoring systems are being installed at homes that connects with motion detectors, surveillance cameras, automated door locks, and other tangible security measures. Adoption of such technologies along the rising disposable income will further augment the market growth for smart homes in the country.

As the Smart Home market in Taiwan is growing significantly; the leading players are planning to expand their presence in the country to meet the growing demand of the customers. In 2020, Apple Inc. launched HomePod Mini, a smart speaker, which offers a great music listening experience, an intelligent assistant, and smart home capabilities. In 2018, Xiaomi’s launched new smart home experience store known as Xiaomi Base. This base covers around 70 different products, including smart home devices.

The emergence of the COVID-19 pandemic has positively impacted the demand for wearable body monitoring devices for measuring heart rate, blood pressure, and other health issues. In 2021, ITRI announced to represent its e-health wearable technologies, including iCardioGuard, Health Guardian, iSmartwear, and other devices. The Joint Commission of Taiwan is offering various smart home healthcare solutions such as the Mobile Cloud Health Platform (Biofit2), also known as the smart gym.

On the basis of product type, the smart speaker segment is expected to witness a faster CAGR during the forecast period. The smart speaker can control smart devices by the user’s voice, thus making day-to-day tasks easier. The user can control all smart devices by connecting the device to the internet. They play music as per the user’s choice, can control smart home devices with ease, and make hand-free phone calls to friends, family, and businesses. All these benefits are shifting the customer’s preference from traditional speakers to smart speakers. The leading players in the smart speaker market are focusing on expanding their presence in Taiwan to capture the growing demand of individuals. In 2019, Google LLC entered a partnership with Taiwan Mobile Co. to introduce its new smart speaker, “Nest Mini”. This speaker can respond to instructions in Mandarin Chinese language. In addition to this, Far EasTone Telecommunications Co., (FET) launched wireless smart speakers with an aim to increase its sales of smart home gadgets.

Key Developments:

-

- In 2020, Apple officially announced the launch of homepod mini smart speaker with smart home capabilities and built-in security and privacy. This strategic initiative helped in expanding the product portfolio of the company.

- In 2020, Xiaomi officially launched MI band 4C in Taiwan, which can provide 14 days of battery life on a single charge. It also displays heart rate monitoring. This launch helped in expanding the product portfolio of the company & increased the presence of the company in the country.

- In 2019, Johnson Controls and Hitachi Air Conditioning entered a strategic partnership for expanding its focus on applied systems business for offering HVAC systems in Taiwan. This partnership helped both the companies in expanding the geographical presence.

The Taiwan Smart Home market is segmented into offering and product type. Based on offering, the market has been segmented into Hardware, Software and Solutions. Based on the product type, the market has been segmented to Lighting Control, Security and Access Control, HVAC Control, Smart Speaker, Entertainment and Other Controls, Home Healthcare, Smart Kitchen, Home Appliances.