No products in the cart.

Press Release

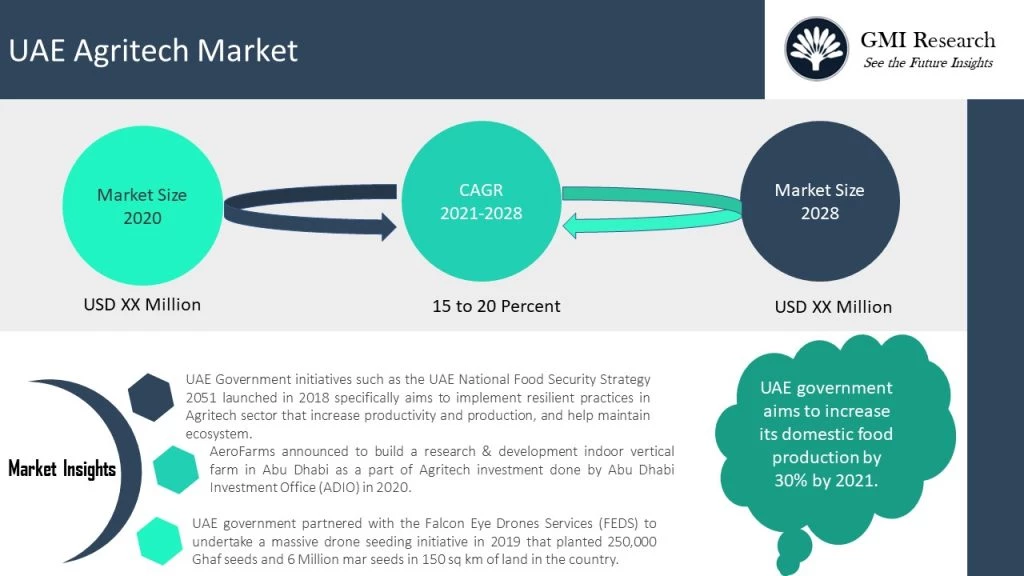

As per the GMI Research forecasts, favourable government initiatives and rising investments in the country for agritech is expected to be one of the major factors contributing to the growth of the UAE agritech market. The market was estimated to be USD xx Million in 2019 and is predicted to reach USD xx Million by the end of 2027, while growing at a CAGR of 15% to 20% during the forecast period (2020-2027).

The UAE government has been increasingly investing in research and development programs that can boost sustainability in agriculture and agritech industries. An amount of US$ 1.5 billion has been committed over the next five years for such initiatives. For instance, the Netherlands embassy to the UAE announced in May 2020, the set-up of a joint economic committee within the UAE. The aim is to support the UAE in becoming increasingly self-sufficient by boosting local production using Dutch agricultural technologies and attain food security in the post-Covid-19 world. ADIO committed $100 million in 2020, to grant funding to further the R&D of four Agritech companies in the emirate: microgreens-focused vertical farming group Madar Farms, fertilizer group RNZ, Responsive Drip Irrigation (RDI) and New Jersey-based vertical farming group AeroFarms. The funding is being dispersed as part of ADIO’s $272 million. Agritech Incentive Program is to advance the emirate’s agricultural technologies, capabilities and leadership.

To have an edge over the competition by knowing the market dynamics and current trends of “UAE Agritech Market”, request for Sample Report here

Focus on reducing the food imports in the country is another significant factor that is expected to boost the agritech sector in the coming years. VeggiTech, an Agritech company in UAE, uses the hydroponics and grow lights assisted hydroponics for the high corn yield by drip irrigation. In response to the FoodTech Challenge, the company Smart Acres delivered a technique that uses hydroponic vertical farming to support the UAE’s food security and innovation program. They use South Korean vertical farming technology to decrease water usage and monitor temperature and nutrients. Regarding the UAE’s water issue, vertical farms save over 90% of the water in comparison to conventional farming methods. Smart Acres’ vertical farming technology enables them to produce approximately 8 tons of lettuce per cropping cycle.

One of the most prevalent form of Agritech being incorporated in the UAE’s agricultural sector is the use of sensors, with their adoption resulting in increased yields in both large-scale agricultural projects and smaller organic farms. For instance, greenheart Organic Farms in Sharjah relies heavily on sensors to agree on the salinity of the water and the soil as well as mineral levels to make certain that the crops grown are satisfactory.

On the basis of agriculture type, greenhouses is expected to witness a faster CAGR during the forecast period. Greenhouses are being used in the UAE to produce vegetables that contribute toward UAE food security, including offering fresh vegetable produce in the off-season. In 2020, The Abu Dhabi Investment Office (AIDO) partnered with al-Badia Farms in Dubai to develop technologies for producing food in arid conditions. The partnerships include a greenhouse venture focused on growing fruit and vegetables with less water.

Key Developments:

-

- In 2020, Pure Harvest Smart Farms signed a multi-year partnership agreement with The Sultan Center (TSC), which is a leading supermarket and general merchandise retailer. Pure Harvest has planned to build a dedicated greenhouse facility to deliver locally green, premium quality fresh vegetables and fruits to TSC’s supermarkets.

- In 2020, Madar Farms announced their partnership with the Abu Dhabi Investment Office (ADIO) to assist the operation of the world’s first commercial-scale indoor tomato farm by using only LED lights along with a new research facility to support in accelerating the agritech industry in the UAE.

- In 2020, Elite Agro LLC planned to invest in Indonesia, which is a continuation of the growing bilateral cooperation between UAE and Indonesia. The company aims to boost food security in the country and enhance the quality of domestically grown products to give them export value.

The UAE Agritech Market is segmented into application and agriculture type. Based on application, the market has been segmented into Market Linkages – Farm Inputs, Precision Agriculture and Farm Management, Quality Management and Traceability, Supply Chain Tech and Output Market Linkages, Financial Services. Based on the agriculture type, the market has been segmented into Precision Farming, Livestock, Aquaculture, Greenhouse, Horticulture.