The outlook for Global Aerospace and Defense companies seems promising, propelled by the sustained expansion of commercial aviation and increased defense spending. To thrive in this landscape, industry leaders must transform, as new entrants employ technology and unconventional approaches to disrupt the established aerospace industry. The rapid shifts within the aerospace and defense industry are opening doors for enterprises that are ready to transform and reposition for the future. Although, as of now, the commercial aviation industry continues to face the consequences of the considerable decrease in air travel caused by the pandemic. This downtime is having a substantial impact on aircraft production and the civilian aerospace workforce. Whereas, as of now, the market of Aerospace and defense is fostered by growing investments in the A&D sector and is aided by the significant rise in demand for the product of the A&D sector by both military and commercial end users.

On the contrary, the Defense and Security market has witnessed steady demand and has even recognized new growth opportunities. The challenge for aerospace companies engaged in both segments lies in encouraging innovation in defense while sustaining functions and stimulating their financial position to ease the decreases in the commercial aviation business. The aerospace and defense industry encounters a huge number of challenges associated with an unforeseen pandemic, swiftly improving technologies and weak supply chains. Our mission is to help our potential clients push the limits of innovation in both air and space domains while safeguarding livelihoods by deploying capabilities, cutting-edge technologies, and top-tier talent.

The Aerospace and Defence industry represents a complex network of participants constantly struggling to improve profitability and functional effectiveness. Speedy acceptance of new digital innovations is renovating the insight at a hurried pace. The vast volume of data collected through sensors and advanced analytics approaches now yields valuable insights into functions, customer behavior, and product performance. Leaders in the A&D Industry must speedily transition into comprehensive solution providers, emphasizing innovation and agility to accommodate evolving customer preferences.

Airline & Passenger Traffic

The global airlines significantly increased their 2023 profit outlook. However, they caution that the industry’s post-pandemic recovery might be restrained owing to potential delays in getting planes to meet the growing demand. International Air Transport Association (IATA) raised its industry profit predicted to USD 9.8 billion from USD 4.7 billion, thanks to robust travel requirements and a deduction in oil prices, bringing positive news for the airline industry. In addition, the updated profit review, revised since December, highlights an increase in Europe’s airline industry, even amid continuous strikes. Airlines, gearing up for a busy summer season, have presented robust results, with travel demand remaining high despite growing inflation. Although oil prices have eased this year, airlines were cautioned throughout their annual meeting that the cost might increase once more shortly, following present decisions by oil producers to limit supply.

Also, during 2023, airlines surpassed predictions in their financial expectations in their financial performance, driven by different favorable factors. China eased COVID-19 limitations earlier than predicted, fostering the industry. Cargo revenues, despite stable capacities, continue to surpass pre-pandemic levels.

The airline industry is witnessing a strengthening of profitability, with revenues growing at a rate of 9.7%, outpacing the growth in expenses, which stands at 8.1%. Passenger revenues are predicted to touch USD 546 billion, marking a 27% rise from 2022 but still 10% lower than the pandemic level of 2019. With COVID-19 limitations lifted in foremost markets, the industry is predicted to touch 87.8% of 2019 revenue passenger kilometers this year. In addition, passenger traffic is predicted to strengthen during a year owing to high travel demand, maintaining robust yields with a modest 1.1% decrease compared to 2022 levels, following previous rises of 9.8% during 2022 and 3.7% during 2021.

For instance, the global airline industry is predicted to recover profitability in 2023, marking a positive trend from the pandemic lows of 2020. However, the financial performance differs around regions. While industry financials are on the increase globally compared to the depths of 2020, not all regions are predicted to accomplish profitability this year.

In the airline industry, employment opportunities are also predicted to rise due to a significant rise in government spending, increased government assistance in the form of capital injections, and decreasing tax charges for airlines among the key factors fostering market expansion.

Defense Industry

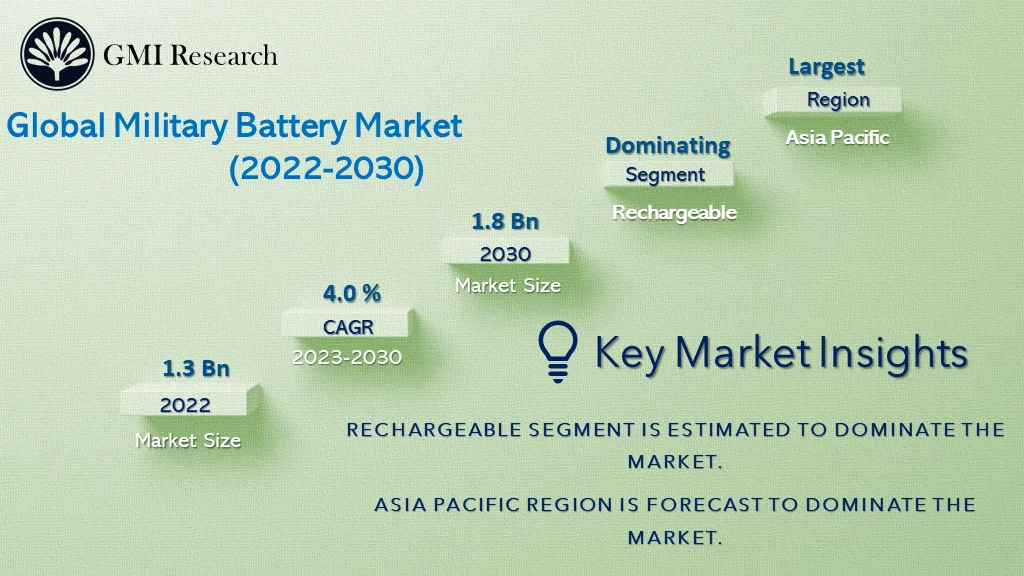

Based on the SIPRI Research, Global military spending rose by 3.7% in real terms in 2022, touching a record high of USD 2,240 billion. Europe experienced its most significant year-on-year rise in military expenditure in at least three decades. The US, Russia, and China made up 56% of the world’s total military expenditure in 2022.

The escalation of the conflict in Ukraine and heightened tensions in East Asia were key driving factors in fostering military spending. In 2022, world military expenditure reached an unprecedented height of USD 2,240 billion, marking the 8th consecutive year of growth. Europe witnessed the most significant rise in spending, with a 13% rise, primarily owing to increased military expenditures by Ukraine and Russia. Different other countries, propelled by concerns about the Russian threat and the condition of East Asia, also augmented their military budget.

Certainly, in 2022, the actual growth in global military expenditure was diminished due to the impact of inflation, reaching levels exceptional in different nations for different decades. When considering unadjusted figures, i.e., without accounting for inflation, the global total surged by 6.5% in nominal terms. For instance, India allocated USD 81.4 billion for its military expenditure, positioning itself as the 4th highest spender globally. This touched a 6.0% rise compared to the previous year, 2021.

In addition, Saudi Arabia, the 5th largest military spender, witnessed a 16% increase in military spending reaching USD 75.0 billion in 2022, marking its first rise since 2018. Increased defense spending by governments globally aids market growth significantly and creates new opportunities for defense, space, and security market players.

Space

Despite inflation challenges globally, the space economy presented robust growth with a significant rise in the adoption of expansion strategies by market players. Additionally, the implementation of improved technology and the existence of giant market players globally are probably to introduce a great number of growth opportunities for the space market. According to Thomas Dorame, senior VP at Space Foundation, conservative modeling aids the space economy is on track to approach the USD 800 billion mark within 5 years. This prediction is reinforced by the augmented space launch activity and the rise in the growth rate of space and security in 2023, predicted to surpass the record set in 2022.

In addition, innovations in technology, growing demand for space data, and increased private sector as well as government investment in infrastructure are the key factors to drive the growth of the Space Industry.

our expertise by the numbers

200+

aerospace & defence engagements

More than 200

15 different aerospace & defence

10 Years of Experience

15 different aerospace & defence

15

15 different aerospace & defence

1,000

15 different aerospace & defence