No products in the cart.

Press Release

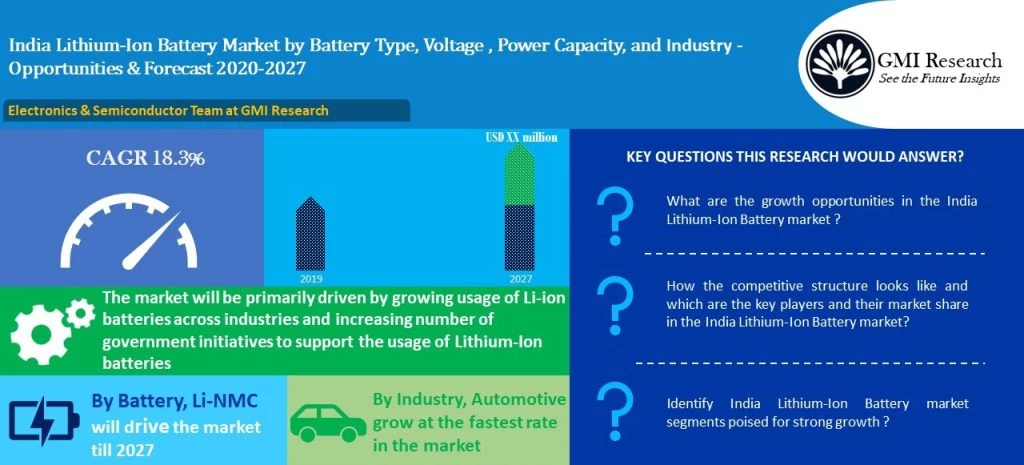

As per the GMI Research forecasts, the rising EV adoption in the country stands to be one of the major factors contributing to the growth of the India Lithium Ion Battery market. The market was estimated to be USD xx Million in 2019 and is predicted to reach USD xx Million by the end of 2027, while growing at a CAGR of 18.3% during the forecast period (2020-2027).

The accelerating demand for electric vehicles is one of the biggest factors that is surging the demand for Lithium-Ion batteries. Growing sales of EVs across the country, especially in the 2-wheeler and 3-wheeler segment has augmented the demand. Superior benefits of lithium batteries over lead acid have created a shift in the adoption of these type of batteries. As per the Society of Manufacturers of Electric Vehicles (SMEV), EV sales in FY19-20 were 156,000 units whereby 152,000 electric two-wheelers, 3,400 cars and 600 buses were sold in the year. For instance, in the passenger vehicle segment, Nexon EV’s sales figure stood at 2,200 units in November 2020, with 1,000 units being sold in the last three months (September to November).

To have an edge over the competition by knowing the market dynamics and current trends of “India Lithium Ion Battery market”, request for Sample Report here

Increasing number of government initiatives will further support the usage of Lithium-Ion batteries in the country. In 2020, the government planned to provide $4.6 billion incentives to companies, which are setting up advanced battery manufacturing facilities as it seeks to cut down the dependence on oil and encourage the use electric vehicles. Niti Aayog drafted a proposal to reduce the oil import bills by as much as $40 billion by 2030 if electric vehicles are highly adopted. Such factors are expected to supplement the demand for lithium batteries in the coming years.

The high price of Li-Ion batteries is one of the biggest factors that is likely to hamper the market’s demand. These batteries are costly due to high capital expenditure related to their manufacturing. In addition to this, the dependency on other countries for importing the key components used for the manufacturing of lithium-ion batteries is a major market challenge. The lithium-Ion batteries constitute 40% of the total price of electric vehicle, which in turn, has resulted in high prices of EVs. However, growing investment in this space with plans to set up manufacturing and assembling plants will significantly reduce the price of lithium batteries enabling wider market adoption. In 2020, Suzuki Motor Corp. entered a joint venture with Toshiba Corp. and Denso Corp. to invest INR 3,715 crore in the second phase of the battery venture in Gujarat. In 2019, Exide Industries collaborated with Switzerland-based Leclanch SA, which is one of the world’s leading energy storage solution companies, to start assembling lithium-ion batteries in India.

On the basis of industry, the telecom segment is expected to witness considerable growth demand during the forecast period. The demand for lithium-ion battery-based systems comes mainly from telecom service operators looking at environmentally friendly and sustainable solutions to power telecom towers and other services. As a result, several medium scale to large scale companies such as Goldstar Power Limited, Bharat Power Solutions have ventured into this space. For instance, Epower is one of the prominent solution providers for solar energy systems, UPS, inverters, and other storage power solutions. The company has GYFP4875T Li-Ion battery in 75Ah as well as 100Ah, which is small in volume and lightweight. This battery can be used in access network equipment, mobile telecom equipment, transmission equipment, satellite ground stations, and other devices.

Key Developments:

-

- In 2020, Amperex Technology Limited has acquired 180 acres of industrial land in Haryana to build a manufacturing unit for lithium-ion polymer batteries. The company further planned to invest INR 7,000 Crore in coming years to supply batteries to various industries such as smartphone, two and three-wheeler electric vehicle manufacturers in India.

- Inverted Energy launched a new range of lithium – ion batteries for solar plants, electric vehicles, and home usage in India. These new ranges of batteries will be manufactured in New Delhi at Inverted Energy’s facility. In addition, the company also planned to provide these batteries to large solar projects and electric vehicle manufacturers initially.

- Greenko Energy Holdings planned to invest approx. USD 1 Billion in a new battery storage business, which also includes setting up lithium-ion batteries in India. The company aimed to provide lithium-ion batteries for various applications including, electric vehicle and power grids applications across India.

The India Lithium-Ion battery market is segmented into battery type, by voltage, by power capacity, by industry. Based on the battery type, the market is segmented into Lithium Nickel Manganese Cobalt (Li-NMC), Lithium Iron Phosphate (LFP) and Others. By Voltage, the market is segmented into Low (Below 12 V), Medium (12 V – 36 V) and High (Above 36 V). By Power Capacity, the market is segmented into Less Than 3,000 mAH, 3,000 TO 10,000 mAH, 10,000 TO 60,000 mAH, 60,000 mAH to 100 000 mAH, 100 000 mAH to 200 000 mAH and > 200 000 mAH. By Industry, the market is segmented into Consumer electronics, Tele-communication, Automotive, Aerospace & Defense, Industrial and Commercial