Lithium Ion Battery Market in India based on Market Size, Trends Analysis & Industry Forecast Report, 2024-2031

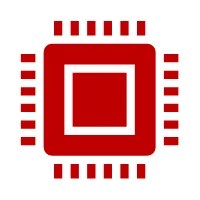

India Lithium-Ion Battery Market size reached USD 3.5 billion in 2023 and is estimated to reach USD 18.9 billion in 2031 and the market is estimated to grow at a very high CAGR of 23.5% from 2024-2031.

India Lithium Ion Battery market Overview

The India battery market has been primarily dominated by lead acid batteries occupy over 95% of the total battery market share in the country. However, the country is fast witnessing a major shift towards lithium-ion batteries owing its growing adoption in automotive, telecom and industrial applications. Several features such as faster charging, higher product lifecycle and compact size makes it the preferred medium to be used across industries.

Lithium Ion Battery Market Drivers

Increasing government initiatives in terms of promoting clean energy and emphasis on reduction on oil imports is one of the primary reasons for boosting the demand for battery. For instance, to promote electric vehicles, the government has launched the “Nation Electric Mobility Mission Plan (NEMMP) to support the adoption of electric and hybrid vehicles. Moreover, an outlay of INR 10,000 crore has been allocated under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicle scheme (FAME 2) till 2022. The combination of these initiatives will surge the demand for Li-Ion batteries in electric vehicles, thus having positive impact on the growing demand of the market. Furthermore, tax benefits to OEMs in supporting local manufacturing of lithium batteries will further play a key role in shaping up the industry.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Restraint in the India Lithium-Ion Battery Market

One of the major restraint/barriers in the market is the low availability of raw materials due to which the OEMs are primarily dependent on countries such as China, Australia, Bolivia for import. For instance, in 2019, both the countries signed a memorandum of understanding, whereby Bolivia will supply lithium carbonate to India and foster into joint ventures for lithium battery production plants in India.

Battery Type – Segment Analysis

Based on battery type, Lithium Nickel Manganese Cobalt (Li-NMC) accounted for the lion’s share of the India lithium-ion battery market in 2019. The accelerating demand for Lithium Nickel Manganese Cobalt batteries, especially in power banks, flashlights, laptop battery packs, and cordless power tools, is a key driver that is contributing to the growth of the segment. This type of battery has lithium nickel manganese cobalt oxide as the cathode and graphite as the anode and energy density is between 150-220 Wh/kg. This battery type is mostly used as these have features similar to Lithium Iron Phosphate (LFP). These batteries are safer compared to other battery types and is cost-effective than LFP.

End-Use Industry – Segment Analysis

Based on the end-use industry, the automotive segment is expected to witness the fastest CAGR growth in the coming years. Increasing adoption of lithium batteries in electric vehicles in the two-wheeler and four-wheeler vehicles is augmenting the market growth. Growing adoption of electric vehicles across both passenger and commercial segment has created lucrative opportunity for several companies in this space. As a result, the top two leading battery manufacturers in the country, Exide and AmaraRaja have also forayed in this space with plans to set up manufacturing plants in the country to meet the growing demand of electric vehicles. For instance, in 2019, Exide Industries collaborated with Switzerland-based Leclanch SA, which is one of the world’s leading energy storage solution companies, to start assembling lithium-ion batteries in India.

Segments covered in the Report:

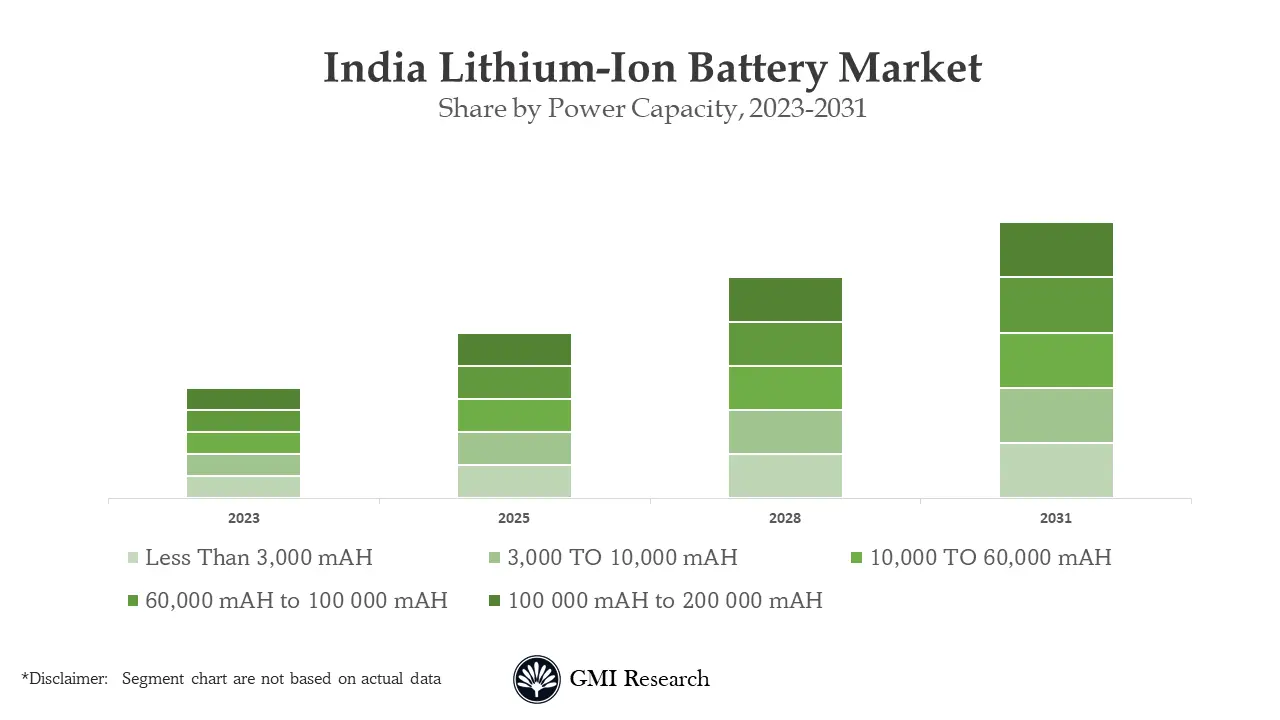

The India Lithium-Ion battery market is segmented into battery type, by voltage, by power capacity, by industry. Based on the Battery Type, the market is segmented into Lithium Nickel Manganese Cobalt (Li-NMC), Lithium Iron Phosphate (LFP) and Others. By Voltage, the market is segmented into Low (Below 12 V), Medium (12 V – 36 V) and High (Above 36 V). By Power Capacity, the market is segmented into Less Than 3,000 mAH, 3,000 TO 10,000 mAH, 10,000 TO 60,000 mAH, 60,000 mAH to 100 000 mAH, 100 000 mAH to 200 000 mAH and > 200 000 mAH. By Industry, the market is segmented into Consumer electronics, Tele-communication, Automotive, Aerospace & Defense, Industrial and Commercial

|

Report Coverage |

Details |

| Market Revenues (2023) |

USD Million |

| Market Base Year |

2023 |

| Market Forecast Period |

2024-2031 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Battery Type, By Voltage, By Power Capacity, By Industry |

| Regional Coverage | India |

| Companies Profiled | Profiles of Top 10 Major Companies Operating in “India Lithium Ion Battery Market” |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

India Lithium Ion Battery Market by Battery Type

-

- Lithium Nickel Manganese Cobalt (Li-NMC)

- Lithium Iron Phosphate (LFP)

- Others

India Lithium Ion Battery Market by Voltage

-

- Low (Below 12 V)

- Medium (12 V – 36 V)

- High (Above 36 V

India Lithium Ion Battery Market by Power Capacity

-

- Less Than 3,000 mAH

- 3,000 TO 10,000 mAH

- 10,000 TO 60,000 mAH

- 60,000 mAH to 100 000 mAH

- 100 000 mAH to 200 000 mAH

- > 200 000 mAH

India Lithium Ion Battery Market by Voltage

-

- Consumer electronics

- Tele-communication

- Automotive

- Aerospace & Defense

- Industrial

- Commercial

Frequently Asked Question About This Report

India Lithium Ion Battery Market – Report Code [UP671A-00-0620]

India Lithium-ion Battery Market is expanding at a CAGR of 23.5% during 2024-2031.

Based on the end-use industry, the automotive segment is expected to witness the fastest CAGR growth during the forecast Period.

- Published Date: Jun- 2024

- Report Format: Excel/PPT

- Report Code: UP671A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Lithium Ion Battery Market in India based on Market Size, Trends Analysis & Industry Forecast Report, 2024-2031

$ 4,499.00 – $ 6,649.00

Why GMI Research