Brazil Frozen Food Market Size & Insights

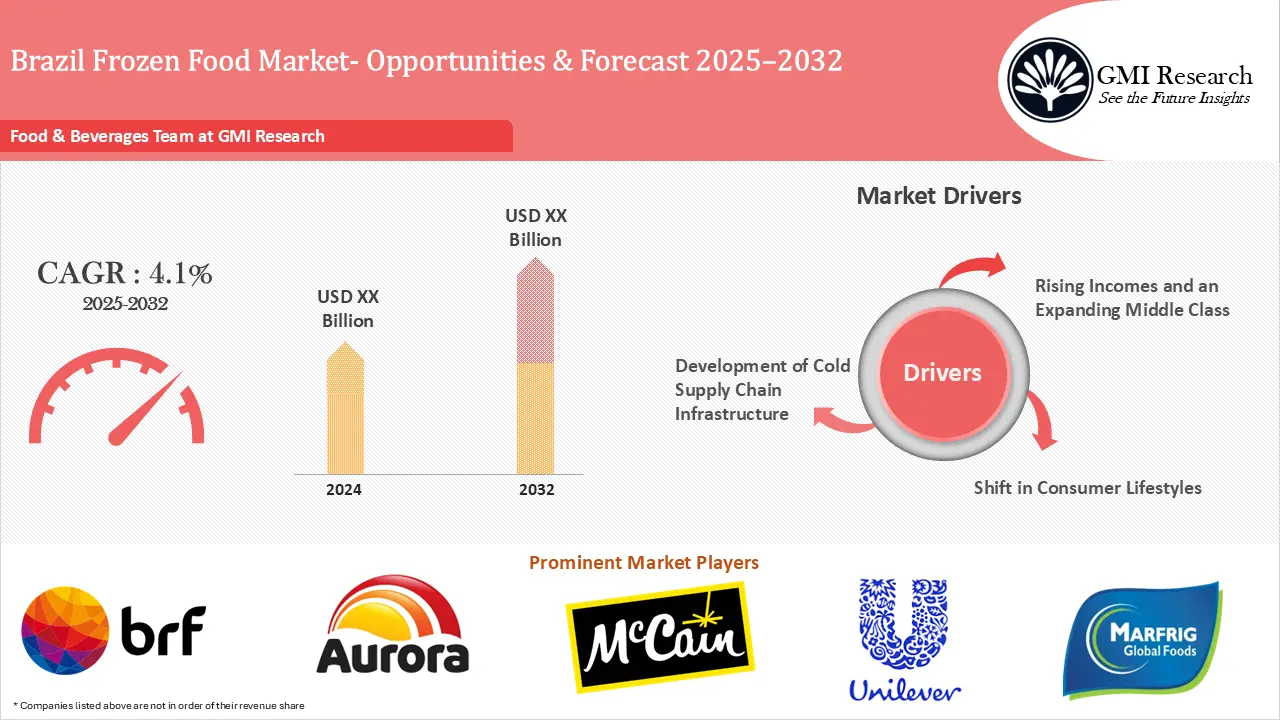

Brazil Frozen Food Market size is forecast to grow at a CAGR of 4.1% during the forecast period 2025-2032 and is primarily driven by the rising disposable incomes, an expanding middle class, shift in consumer lifestyle and advancements in cold supply chain infrastructure in the country.

Brazil Frozen Food Market Drivers

Rising Incomes and an Expanding Middle Class

Rising incomes and an expanding middle class have fueled the growing need for frozen foods as individuals are more willing to invest in time-saving meal solutions. The increasing prevalence of dual-income households and a larger middle class in the country are driving changes in consumer lifestyles with a strong preference for convenient food products which has also contributed to its wider consumer base.

Shift in Consumer Lifestyles

Brazil frozen food market forecast will observe substantial growth due to shifting consumer lifestyles, as increasing urbanization and hectic schedules drive the rising requirement for convenient and time-efficient food solutions. Frozen foods have seen a rising demand due to their ability to offer an effortless meal option which needs only minimal preparation. Consumers nowadays have access to diverse food choices which ensures they can find convenient solutions for hassle-free meal options. Frozen foods also experienced a surge in popularity during the covid pandemic due to movement limitations. Consumers embraced the convenience and longevity of frozen items which matched their changing lifestyles during the crisis.

A significant trend in the market is the rise of online shopping and user-friendly applications. These developments enhance consumer convenience in choosing products which contributes to the growing preference for online shopping. The frozen food industry is further evolving with new options like plant-based foods and personalized nutrition solutions which cater to the diverse consumers’ needs and preferences. By embracing the latest trends, manufacturers have transformed the product’s image, emphasizing natural ingredients that offer functional benefits and enabling the development of higher-quality and better-textured formulations.

Development of Cold Supply Chain Infrastructure

The Brazil frozen food market size expansion has been greatly supported by improvements in cold supply chain infrastructure including major investments in cold storage as well as transportation facilities. The development of robust cold supply chain infrastructure has safeguarded the product quality and freshness which ensures high-quality options for consumers. Furthermore, progress in freezing technology has improved both product taste and shelf life which further accelerates market growth.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Brazil Frozen Food Market Segment Analysis

Product Type Market Insights: Meat and seafood products hold the largest market share

Based on the product type, the meat and seafood products hold a leading position in the market due to the persistent high requirement for frozen seafood and meat. Brazil’s status as a leading meat exporter along with its extensive coastline enhance the availability of a wide variety of seafood and meat products. The sector’s dominance is further supported by the convenience and simple storage requirements that these products offer. Its robust standing is bolstered by consumer awareness of food quality along with the increasing popularity of ready-to-eat frozen food products.

Distribution Channel Insights: Offline Segment dominate the market revenues

Based on the distribution channel, the offline segment which includes supermarkets is expected to lead the market. The expansion of hypermarkets and supermarkets across the country has made frozen foods more readily available as they provide an extensive selection of frozen food items.

Brazil Frozen Food Market Major Players & Competitive Landscape

Several leading companies are Nestle, BRF S.A., Aurora Alimentos, McCain Foods, Marfrig Global Foods, Unilever Brasil Ltd among others.

Brazil Frozen Food Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR |

4.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Product, By Type, By Consumption, By Distribution Channel |

| Regional Coverage | Brazil |

| Companies Profiled | Nestle, BRF S.A., Aurora Alimentos, McCain Foods, Marfrig Global Foods, Unilever Brasil Ltd, among others; a total of 6 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Brazil Frozen Food Market Research Report Segmentation

The Brazil Frozen Food Market segmented on the basis of product, type, consumption, and distribution channel. Based on the product, the market is segmented into fruits & vegetables, dairy, bakery, meat & seafood, convenience food & ready meals, and others. Based on the type, the market is segmented into raw material, half cooked, and ready-to-eat. Based on consumption, the market is segmented into food service and retail. Based on the distribution channel, the market is segmented into offline and online.

Brazil Frozen Food Market by Product

-

- Fruits & Vegetables

- Frozen Fruits

- Frozen Vegetables

- Frozen Potatoes

- Other Vegetables

- Dairy Products

- Bakery Products

- Bread & Pizza Crusts

- Others Bakery Products

- Meat & Sea Foods

- Convenience Food & Ready Meals

- Others

Brazil Frozen Food Market by Type

-

- Raw Material

- Half Cooked

- Ready-to-Eat

Brazil Frozen Food Market by Consumption

-

- Food Service

- Retail

Brazil Frozen Food Market by Distribution Channel

-

- Offline

- Online

Brazil Frozen Food Market Leading players

-

- Nestle

- BRF S.A.

- Aurora Alimentos

- McCain Foods

- Marfrig Global Foods

- Unilever Brasil Ltd.

Frequently Asked Question About This Report

Brazil Frozen Food Market [GR24AB-01-00295]

Brazil Frozen Food Market size was estimated at USD XX billion in 2024

The market growth is primarily driven by primarily driven by the rising disposable incomes, an expanding middle class, shift in consumer lifestyle and advancements in cold supply chain infrastructure in the country.

What are the opportunities and Future outlook of the Brazil Frozen Food Market?

Some of the major players are BRF S.A., Aurora Alimentos, McCain Foods, Marfrig Global Foods, Unilever Brasil Ltd among others.

Meat and seafood products hold the largest market share in 2024.

Related Reports

- Published Date: Dec-2024

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00295

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Brazil Frozen Food Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research