Vietnam Automotive Aftermarket Market Size & Insights

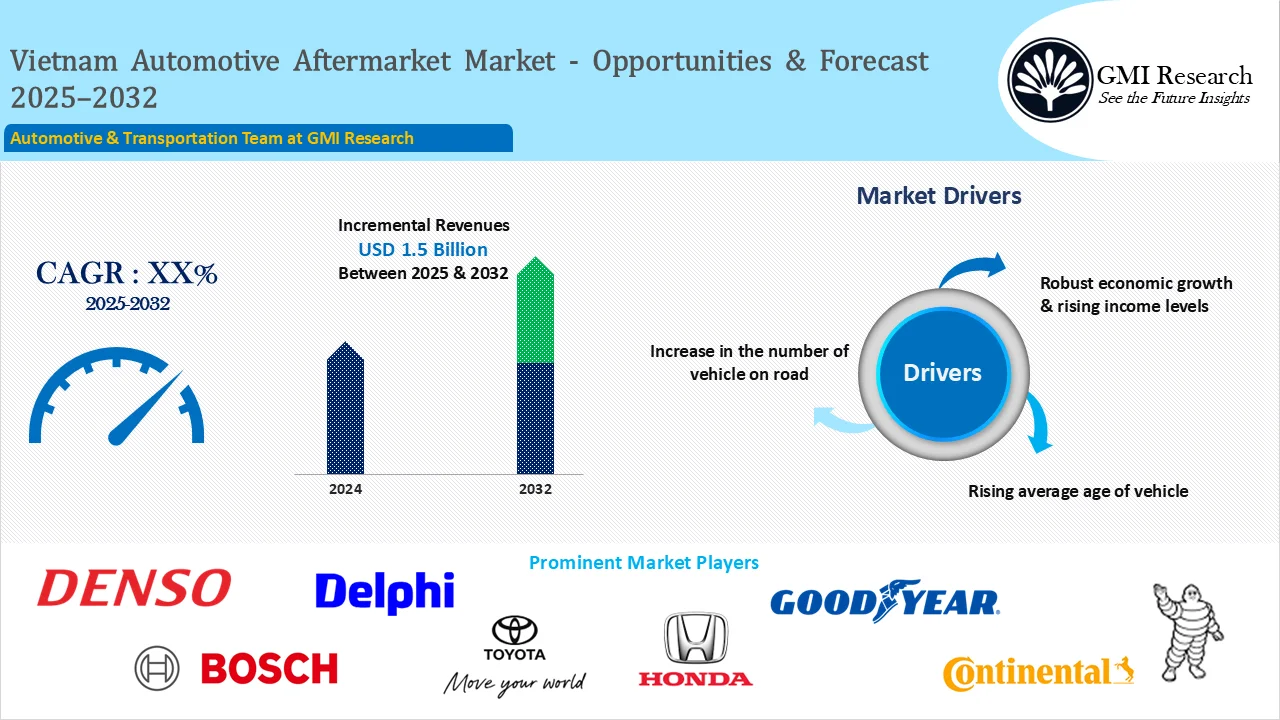

Vietnam Automotive Aftermarket Market size is estimated to add over USD 1.5 billion of market revenues between 2025 to 2032, growing at a robust CAGR till 2032 owing to growing number of vehicles on the robust driven by robust new vehicle sales, rising vehicle ownership, rise in the number of out of warranty vehicles in Vietnam.

Key Market Insights

Market Size:

-

- Incremental Revenues of USD 1.5 billion between 2025 to 2032

- Market Forecast – Robust CAGR between 2025 and 2032

Segment Insights

-

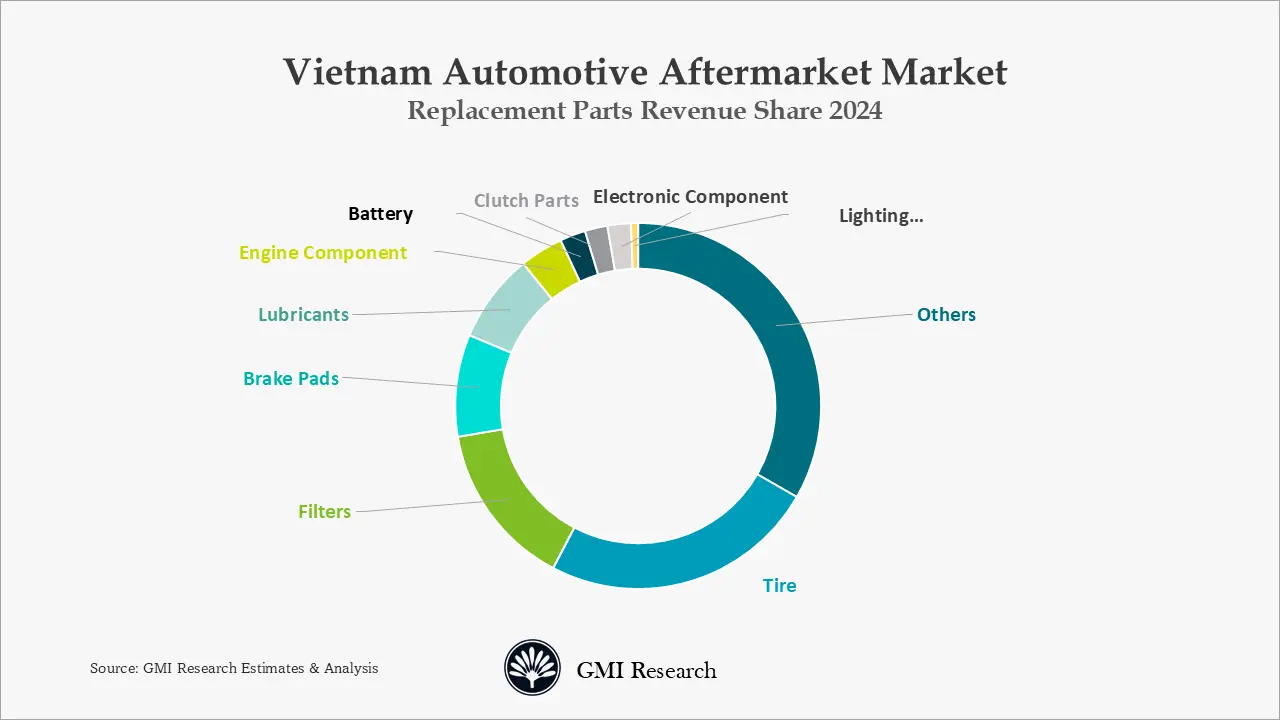

- Replacement Parts Type Insights: In Vietnam automotive aftermarket, tire hold the largest market share 2024.

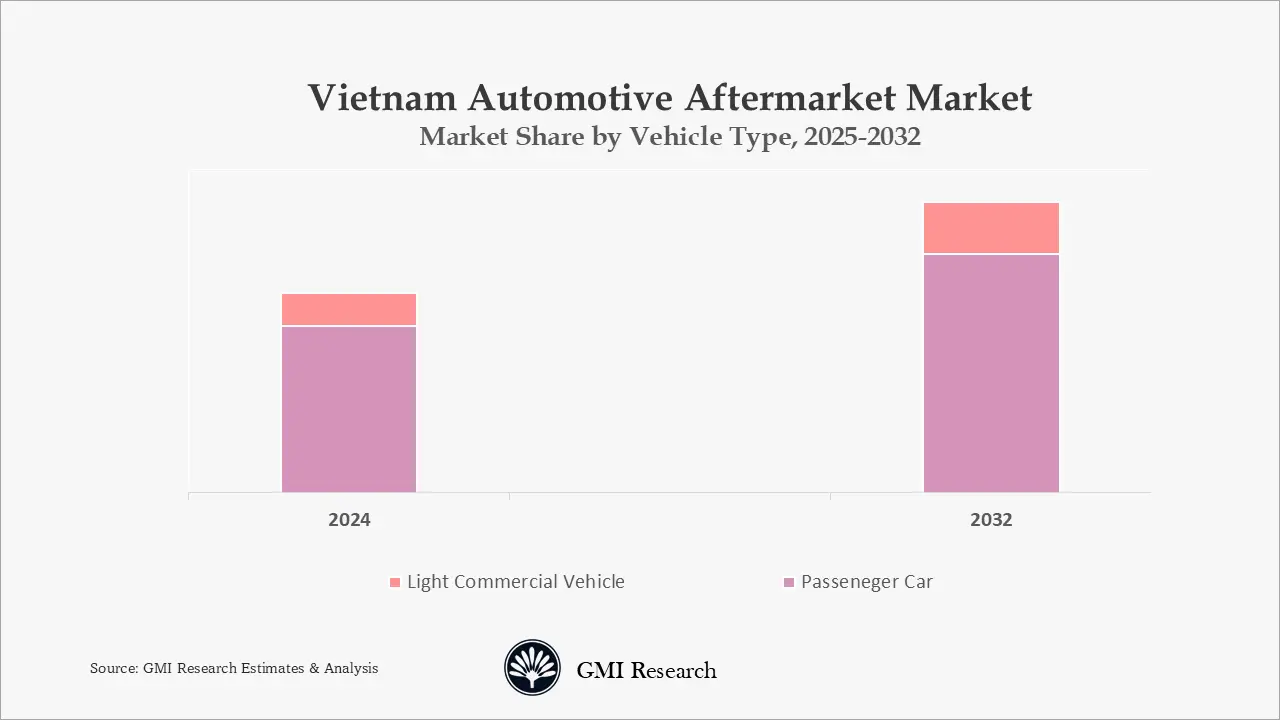

- Vehicle Type Insights: Passenger vehicles captures the largest market share.

- Parts Certification Type Insights: OE and aftermarket parts generates the largest revenues and together these two parts type dominates the market revenues.

Vietnam Automotive Aftermarket Market Overview

Vietnam automotive industry has been growing rapidly in past years driven by the increasing domestic demand, rising purchasing power of consumers and government initiatives for development of automotive industry. The government took various initiatives to support this industry, introduced policies such as encourage investment in infrastructure, tax incentives for domestic production and imposed imported tariffs on international vehicles.

The automotive industry is Vietnam is dominated by the international automakers such as Honda, Ford, Toyota and Mitsubishi which captured largest share in the market. The Vietnam government encouraged R&D activities by providing funds, skill development and promote innovation in the automotive sector. Due to these initiatives, local players such as VinFast and Thaco has been gaining traction in the domestic market. The government further planned to become regional hub for automobile production and exports and to increase domestic production to 60% by 2025.

The government emphasizes that its core strategy is to strengthen the internal capabilities in all sectors while fostering partnerships with leading vehicle manufacturers to align industry growth with traffic infrastructure development. The objective is to meet local vehicle demand efficiently and enhance competitiveness in spare part supply while supporting the broader push for economic modernization.

Major Vietnam Automotive Aftermarket Industry Drivers

Growing Number of Vehicle on the Road (VIO) Owing to Robust New Vehicle Sales

The automotive aftermarket continues to expand in Vietnam due to the increasing number of vehicles on roads, growing demand for maintenance and repair services, and favorable government initiatives to promote overall automotive industry. Furthermore, increasing sales of commercial and passenger vehicles will propel the Vietnam automotive aftermarket. As per the Vietnam Automobile Manufacturers Association, 494,000 vehicles were sold in 2024 and the market jumped of 22% YoY.

Rising vehicle ownership in Vietnam

Rising vehicle ownership is emerging as a major contributor to the Vietnam automotive aftermarket market growth. Rising disposable incomes coupled with an expanding middle class are encouraging more households to buy vehicles which serve functional and symbolic purposes. The trend is driving higher demand for automotive services and components. The growing focus on servicing in metropolitan hubs like Hanoi and Ho Chi Minch City is transforming the demand and supply dynamics. From essential components like tires or engine oils to modern infotainment systems many owners are making greater investments to maintain performance while enhancing aesthetics.

The Ministry of Industry and Trade highlighted that the vehicle market in Vietnam has experienced considerable growth. In 2023 the car ownership rate in Vietnam was 63 vehicles per one thousand people. Furthermore, the Vietnamese government targets increasing the component and spare part production locally to 55-60% of total demand in 2030. The mechanical engineering sector currently includes around 30,000 firms which account for almost thirty percent of the manufacturing industry. Annually Vietnam spends between USD 2 to 3.5 billion on importing spare parts and components for vehicle repair or assembly, mainly those featuring advanced technology and significant added value. Consequently its localization rate lags behind regional leaders like Thailand and Indonesia.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Rise in the number of Out of Warranty Vehicles

Vietnam Automotive Aftermarket Market present significant opportunities, with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR till 2032 is forecast to drive the demand for aftermarket.

Government Supports for the Automotive Industry

In 2020, the Vietnamese government lowered 50% registration fees for domestic production and zero import tax rates for raw materials, supplies and components which can’t be produced domestically. Through this initiatives, the domestic auto industry and automobile consumption will increase and imports cars has to reduce their profits, which will promote the Vietnam auto parts industry in aftermarket. For instance, THACO collaborated with the BMW to domestic produce BMW vehicles across the Asian country. Vietnam automotive aftermarket industry is driven by the expansion of the auto parts industry, increased demand for replacement parts and improvement in the localization rates of the vehicles.

Vietnam Automotive Aftermarket Industry Trends

The Vietnam automotive aftermarket market is also predict to become increasingly digital in the coming years. Online platforms now offer an extensive selection of car parts along with services like scheduling or diagnostics which deliver the convenience consumers seek. Ecommerce platforms along with local start-ups are addressing this demand by offering authentic spare parts delivered directly to customers. A lot of workshops and garages are also upgrading by adding digital equipment for client service or diagnostics.

Are you Looking for a Partner for your Vietnam Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Vietnam market is the right choice for you.

Vietnam Automotive Aftermarket Market Segment Analysis

Vehicle Type Insights: Passenger vehicle holds the largest market share

Passenger cars contributes the maximum share in the revenue pie and is expected to lead the aftermarkets of Vietnam.

Replacement Parts Market Insights: Tire replacement parts type dominate the revenue share

Tire segment leads the market revenues and in its projected to contribute the largest revenue during the coming year.

Vietnam Automotive Aftermarket Market Major Players & Competitive Landscape

Major players operating in the market are Denso, Robert Bosch, Delphi, Champion, Toyota, Valeo, Bridgestone, Hella, Continental etc.

Vietnam Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Incremental Market Size (2024-2032) |

USD 1.5 Billion |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | Vietnam |

| Companies Profiled | Denso, Robert Bosch, Delphi, Champion, Toyota, Valeo, Bridgestone, Hella, Continental among others; a total of 9 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Vietnam Automotive Aftermarket Industry Report Segmentation

Vietnam Automotive Aftermarket has been segmented on the basis of vehicle type, certification, replacement part. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

Vietnam Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Vietnam Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

Vietnam Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Vietnam Automotive Aftermarket Leading players

-

- Denso

- Robert Bosch

- Delphi

- Champion

- Toyota

- Valeo

- Bridgestone

- Hella

- Continental

Frequently Asked Question About This Report

Vietnam Automotive Aftermarket Market [UP3504-001001]

Vietnam Automotive Aftermarket Market size is estimated to add over USD 1.5 billion of market revenues between 2025 to 2032

Vietnam Automotive Aftermarket market growth is driven by growing number of vehicles on the robust driven by robust new vehicle sales, rising vehicle ownership, rise in the number of out of warranty vehicles in Vietnam.

Tire dominates the Vietnam automotive aftermarket revenue.

Vietnam automotive aftermarket is estimated to grow at a robust CAGR between 2025 and 2032.

Vietnam automotive aftermarket is dominated by Denso, Robert Bosch, Delphi, Champion, Toyota, Valeo, Bridgestone, Hella, Continental etc.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP3504-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research