United Kingdom (UK) Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

UK Automotive Aftermarket Market Size 2024

United Kingdom (UK) Automotive Aftermarket Market size is forecast to grow at a CAGR of 2.3% between 2025-2032 driven by increase in growing vehicle in operation (VIO), growth in new vehicle sales and coupled with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Key Market Insights

Market Size:

-

- Market Forecast – CAGR of 2.3% from 2025-2032

Segment Insights

-

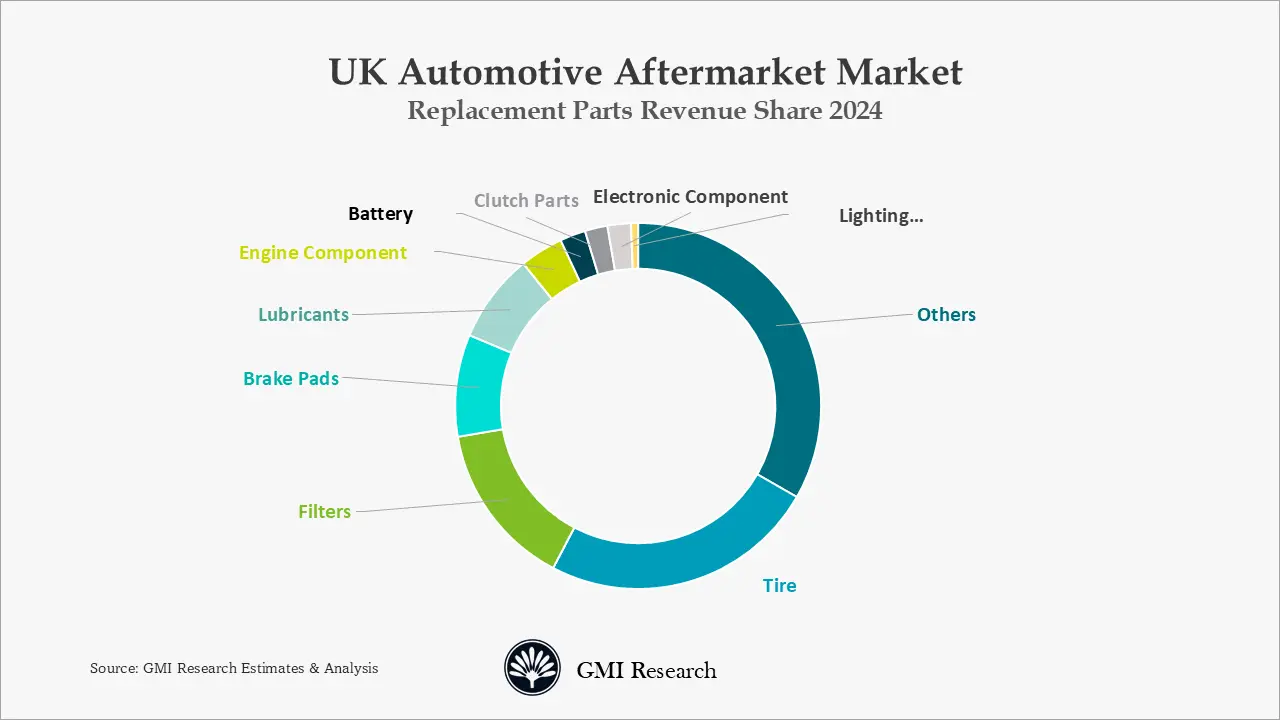

- Replacement Parts Type Insights: In UK automotive aftermarkets, tire leads the market revenues in 2024 and it is forecast to dominate during the forecast period.

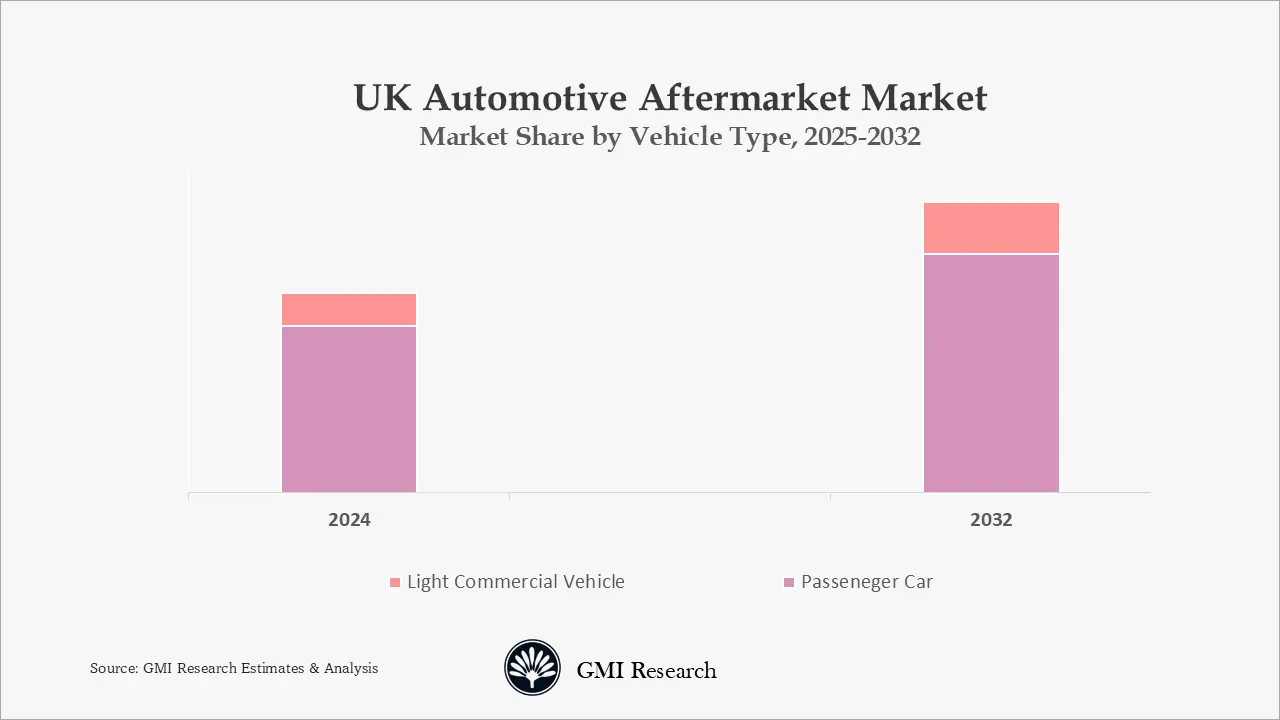

- Vehicle Type Insights: Passenger vehicles generates the largest automotive aftermarket revenues.

- Parts Certification Type Insights: Genuine parts is forecast to grow owing to as it enhances the performance and efficiency of the vehicle.

UK Automotive Aftermarket Parts and Component Market Drivers

Surge in Vehicle in Operation (VIO)

UK has ranked among the top countries in Europe in terms of number of total vehicles registered. According Gov.uk, the total number of vehicles registered (VIO) in UK surpassed 41 million vehicles in 2023 and the Vehicle parc is forecast to grow during the forecast period owing to robust new vehicles sales. The automotive aftermarket in UK looks promising in the coming years owing to growing vehicle in operation in the country.

Robust New Vehicle Sales

UK automotive industry is among the top in Europe only second after Germany. As per Society of Motor Manufacturers and Traders (SMMT), the car registration reached 1.95 million unit in 2024, and unit sales grew by 2.6% over 2023. In 2023, vehicles sales witnessed a surge in sales and the units sales grew by 16.4% over 2022 reaching 2.5 million vehicles. The passenger cars units sales even grew faster than the total vehicle units sales, the passenger car sales grew by 17.8% in 2023 over 2022, reaching sales 1.9 million in 2023. The vehicle sales is led by household consumption and government spending, even as long-term growth prospects remain weak because of slower labor supply and sluggish business investment. Although the unit sales is higher than the year before, sales were still below pre-pandemic levels. Volkswagen was the best-selling brand for a fourth successive year.

Increase in Vehicle Age

Vehicle’s average age in UK is on the rise and is expected to rise during the forecast period. Rise in average vehicle age is creating more demand for automotive aftermarket parts in the country as older vehicles are mostly out warranty and require more frequent repair and maintenance. As genuine parts are expensive most of the owner whose vehicles are out of warranty are more inclined to opt for independent aftermarket which is cheaper. The older vehicle requires more maintenance and repairs and is projected to drive the UK auto parts market during the forecast period.

UK Auto Parts Market Segment Analysis

UK Auto Parts Market by Replacement Parts Insights: Tire leads the market revenues

Rise in demand for tire sale is more as they are the most wear out parts and there is need to change tire more often compare to other replacement parts and dominates the UK auto parts market. Demand of tires is being driven by consistent demand passenger vehicles in the UK. Other replacement parts demand to also witness boom due to increasing vehicle age, expanding VIO etc. Additionally, as the EV have heavier weight and instant torque, the tires on EVs wear down more quickly than those on traditional ICE cars by almost 10,000 km which results in earlier replacement more often and driving the need for longer-lasting, specialized rubber fit for the extra strain.

UK Automotive Aftermarket Market Vehicle Type Insights: Passenger vehicles segment is projected to grow at the faster CAGR.

Passenger cars segment held the largest share of the VIO and also the UK aftermarket and it is expected to remain dominant over the forecast period. All Replacement Parts combined together also accounts for a substantial part of automotive aftermarkets market sales. The passenger car aftermarket market is anticipated to expand at a significant CAGR over the forecast period.

UK Automotive Aftermarket Market Certification Type Insights: Genuine parts segment is estimated to hold the largest market share

Growing awareness among the vehicle owners on benefits of original parts such as it enhances the performance and efficiency of the vehicle, is driving the sales of genuine parts. Authentic replacement parts market is largely influenced by customer’s need for quality, consistent performance and also for higher guarantee on quality and warranty on replacement parts guaranteed by the automobile manufacturers. As these parts are made by the same company that manufactured your car. They’re engineered to meet the demanding specifications of the car manufacturer. The main thing with real car parts is that they are compatible to them. Since these components are made specifically for the specific make and model, it fits well, doing what it is supposed to do. You know that with OEM parts you won’t have to worry about your warranty either as long as it is in the auto warranty.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

The market for certified is also expected to witness a sustainable growth rate over the forecast period as certified parts are produced by the same manufacturers that produce parts for the OEM. Independent aftermarket parts is fairly constant due to it being cheaper than genuine/certified parts and the quality also varies by brand. Some aftermarket components may be as good or better than the quality level of genuine or certified parts.

UK Automotive Aftermarket Industry Major Players & Competitive Landscape

Several leading companies are Volkswagen, Nissan, Hyundai, Ford, Toyota, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

The automotive aftermarket industry is expected to witness consolidation in years to come. It’s expected that tier-1 players will acquire distributors and suppliers globally. One trend is observed that the PE firms are targeting automotive aftermarket distributors owing to their stable cash flow.

UK Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR |

2.3% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | United Kingdom |

| Companies Profiled | Volkswagen, Nissan, Hyundai, Ford, Toyota, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental, among others; a total of 13 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

UK Automotive Aftermarket Market Research Report Segmentation

The UK Automotive Aftermarket has been segmented on the basis of vehicle type, replacement parts, certification. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

UK Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

UK Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

UK Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

UK Automotive Aftermarket Leading players

-

- Volkswagen

- Nissan

- Hyundai

- Ford

- Toyota

- Denso

- Robert Bosch

- Delphi

- Champion

- Valeo

- Bridgestone

- Hella

- Continental

Frequently Asked Question About This Report

UK Automotive Aftermarket Market [UP3491-001001]

UK automotive aftermarket size was USD XX billion in 2024.

UK Automotive Aftermarket market growth is driven by increase in growing vehicle in operation (VIO), growth in new vehicle sales and coupled with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Tire hold largest revenue of UK automotive aftermarket.

United Kingdom (UK) Automotive Aftermarket size is forecast to grow at a CAGR of 2.3% between 2025-2032.

United Kingdom automotive aftermarket is dominated by Volkswagen, Nissan, Hyundai, Ford, Toyota, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP3491-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

United Kingdom (UK) Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research