Saudi Arabia Tire Market Size

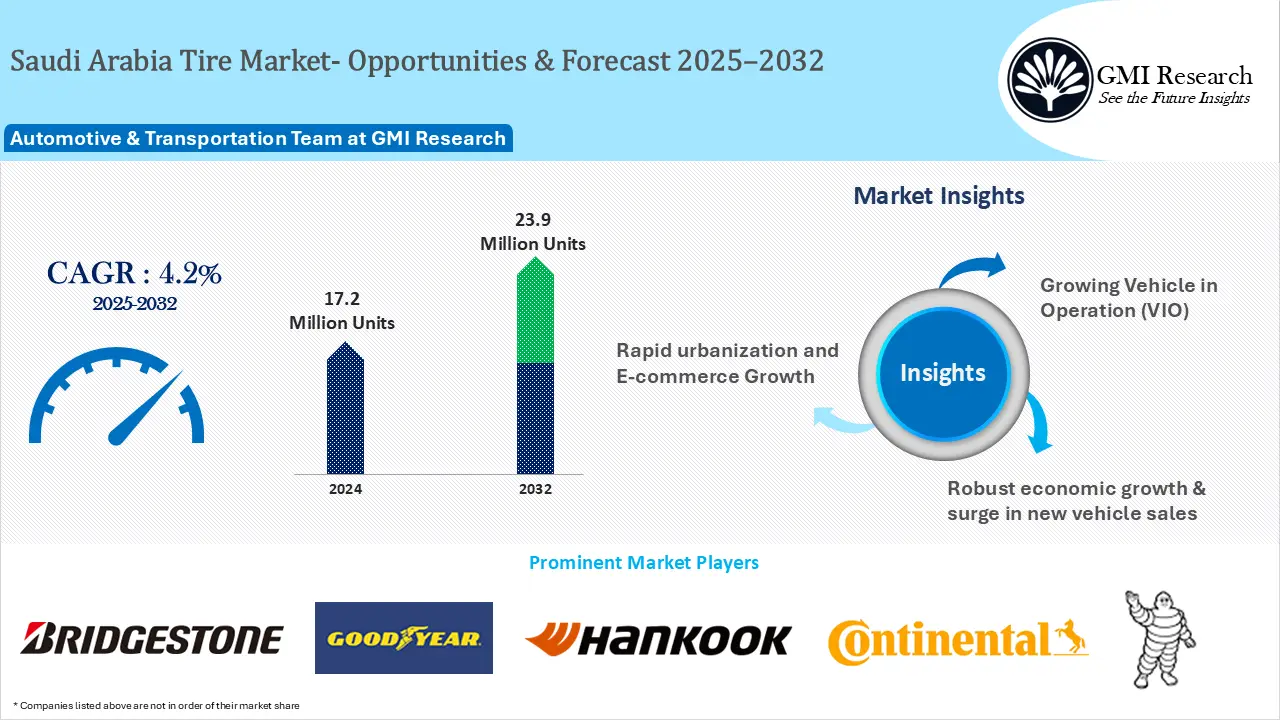

Saudi Arabia Tire market size reached 17.2 million units in 2024 and is forecast to reach 23.9 million units growing at a steady CAGR of 4.2% between 2025 and 2032 primarily driven by increasing vehicle fleet size, surge in new vehicle sales, rising disposable incomes, robust economic growth.

Key Market Insights

Market Size:

-

- 2024 – USD 17.2 Billion

- 2032 – USD 23.9 Billion

- Market Forecast – CAGR of XX% from 2025-2032

Segment Insights

-

- Vehicle Type Insights: Passenger car segment dominates the market revenues and is expected to grow at a higher CAGR during the forecast period

- Product Type Insights: Tubeless Tire segment holds the largest market share

- Tire Design Type Insights: Radial Tires are projected to grow at a higher CAGR between 2025 and 2032

- End Use Market Insights: Replacement tires captured the largest revenue share

- Distribution Channel Market Insights: Offline distribution channel dominates the sales however online sales channel is growing at the highest CAGR during the forecast period

Saudi Arabia Tire Market Drivers

Growing Vehicle in Operation

Saudi Arabia has the largest vehicle population in GCC and in the Middle East, the country has also one of the highest per capita car ownership globally primarily driven by robust economic growth, higher per capita income, low fuel prices, subpar public transportation, cultural preference for having owning a car coupled with growing female drivers.

Robust Economic Growth

Saudi Arabia’s GDP is expected to expand by 3.0% in 2025, according to the IMF. The nation’s economy remains highly dependent on fossil fuels, and the World Bank projects that oil prices averaged USD 92 per barrel in 2023, USD 80 in 2024, and will be around USD 64 in 2025. This steady GDP growth is likely to drive higher government spending, which will, in turn, boost consumers’ disposable incomes. As purchasing power rises, consumers are expected to spend more on various goods and services and increasing vehicle usage and thereby driving demand for replacement tires.

Moreover, government of Saudi Arabia is heavily investing in infrastructural development such as the development of smart cities “NEOM” and other programs, including the National Industrial Development and Logistics Program (NIDLP), to facilitate the Saudi Vision 2030.

Moreover, government of Saudi Arabia is heavily investing in infrastructural development such as the development of smart cities “NEOM” and other programs, including the National Industrial Development and Logistics Program (NIDLP), to facilitate the Saudi Vision 2030. The continuous expansion in the construction activities will drastically increase the demand for commercial vehicles such as trucks and trailers, which is propelling the Saudi Arabia Tire Market. Increasing requirement of replacing Tire within a short period due to extreme weather condition is another factor, pushing the demand for Tire in Saudi Arabia.

Surge in New Vehicle Sales

New passenger car sales in the Saudi Arabia grew by 9.3% in 2023, surpassing the 700,000-unit mark, the highest level ever recorded in Saudi Arabia. This milestone was driven by strong economic growth, rising consumer spending, and proactive government initiatives. The momentum was further supported by robust expansion in non-oil sectors, including manufacturing, tourism, and construction, all contributing to the Kingdom’s sustained economic growth. The robust new vehicle sales is making significantly contributing to VIO in KSA and is projected to drive demand for replacement tires during the forecast period.

Saudi Arabia Tire Market Segment Analysis

Vehicle Type Market Insights: Passenger car segment dominates the market revenues and is expected to grow at a higher CAGR during the forecast period

The Passenger car segment dominates the market revenues and is expected to grow at a higher CAGR during the forecast period. The increasing demand for personal vehicles, followed by the growing size of the automobile industry in Saudi Arabia are the major factors boosting the demand for Tires in this region. The government is supporting the increasing demand of Tires by facilitating cheaper pricing of passenger cars. Furthermore, affordable financing plans offered by numerous automobile insurance companies will encourage the consumers to opt for personal cars rather than traveling in public transports.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Product Type Market Insights: Tubeless Tire segment holds the largest market share

Tubeless Tire segment holds the largest market share owing to the increasing demand for tubeless Tires driven by its exceptional properties such as improved lifespan in the extreme weather conditions. The tubeless Tires are lightweight, provides excellent mileage while giving a stable driving experience. These Tires support high speeding of the vehicles even in extreme conditions while eliminating its chances of bursting.

Tire Design Type Market Insights: Radial Tires are projected to grow at a higher CAGR between 2025 and 2032

Radial Tires are projected to grow at a higher CAGR during the forecast period owing to its exceptional benefits such as better strength and enhanced flexibility as compared to the regular Tires. The radial Tires easily absorbs the bumps and socks while providing a comfortable ride to the driver and passenger in the vehicle. It also reduces the ground compaction and minimizes the chances of damage caused to the vehicles. All these factors make it more suitable for the end-users, thus accelerating the demand for radial Tires in Saudi Arabia.

End Use Market Insights: Replacement tires captured the largest revenue share

Replacement tires hold the largest market share in KSA as there is no OEM car manufacturing plants locally and very little production of commercial vehicle in the country. Most of the cars in Saudi Arabia are imported as CBU from various countries.

Saudi Arabia Tire Market Major Players & Tire Market Share Analysis

Several leading companies operating market are Bridgestone Corporation, Hankook Tire Co., Ltd, Pirelli & C. S.p.A., Dunlop (Goodyear Tire & Rubber Company), Yokohama Rubber Co. Ltd., Continental AG, Toyo Tire & Rubber Co. Ltd., Michelin Group, Apollo Tires Ltd, Kumho, Sumitomo, and Cooper Tire & Rubber Company among others.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

Tire market in Saudi Arabia is primarily import driven and the tire demand is met from other countries across the globe as there no manufacturing units in the kingdom. Increase in vehicle in operation is projected to create opportunities to set up manufacturing plants for global and local companies in Saudi Arabia. In order capture more tyre industry market share. PIF and Pirelli and Blatco and Golden star joined hands to set up a tire manufacturing plant in KSA to meet the local demand and also to export to other countries.

Its has been observed that there is rapid growth in Saudi Arabia’s premium tier 2 market, driven by local consumers’ increasing preference for high-quality products offered at competitive prices. Chinese brands are becoming increasingly popular in the KSA tire market as these brands are easily accessible and cheaper as compared to other brands, which is boosting their sales.

Saudi Arabia Tire Market News

-

- In Nov 2024, Black Arrow Tire Co. (Blatco) has joined forces with Thailand’s Golden Star Rubber Co. to establish the Middle East’s largest tire manufacturing facility in Yanbu, backed by a $470 million investment. The plant will begin by producing 4 million passenger vehicle tires annually, with future plans to ramp up output to 6 million tires per year, expanding into truck and bus tire production.

- In Oct 2023, Public Investment Fund (PIF) and Pirelli Tyre S.P.A (Pirelli), a leading global tire manufacturer, signed a joint venture (JV) agreement to establish a tire manufacturing facility in Saudi Arabia. Under the agreement, PIF will own a 75% stake in the venture, while Pirelli will hold the remaining 25% and serve as a strategic technology partner, providing technical and commercial expertise to support the project’s development. The total investment under this JV would amount to USD 550 million and the plant is slated to begin production in 2026, producing premium passenger vehicle tires under the Pirelli brand, as well as a new local brand aimed at the domestic and regional markets.

- In 2021, Toyo Tires Japanese and Korean Nexen Tires launched platinum warranty for 3 years for all of its products through its agent AI-Amoudi Co. Ltd. In Saudi Arabia.

- In 2021, Saudi Arabia Ministry of Commerce and Industry has closed 4 recycling factories for violating quality and safety regulations in Saudi Arabia.

Saudi Arabia Tyre Market Report Scope

|

Report Coverage |

Details |

| Market Size Value in 2024 |

17.2 Million units |

| Market Revenue Forecast in 2032 |

23.9 million units |

| CAGR |

4.2% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Product Type, By Vehicle Type, By Design, By End-use, and By Distribution Channel |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | Bridgestone Corporation, Hankook Tire Co., Ltd, Pirelli & C. S.p.A., Dunlop (Goodyear Tire & Rubber Company), Yokohama Rubber Co. Ltd., Continental AG, Toyo Tire & Rubber Co. Ltd., Michelin Group, Apollo Tires Ltd, Kumho, Sumitomo, and Cooper Tire & Rubber Company among others; a total of 12 companies covered |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia Tire Market Research Report Segmentation

The KSA Tire market has been segmented on the basis of product type, vehicle type, design, end-use, and distribution channel. Based on the product type, the market is segmented into Tube Tire and Tubeless Tire. Based on the Vehicle Type, the market is segmented into Passenger car, Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, Off-The-Road, and Two-Wheeler, and Three Wheelers. Based on the Design, the market is segmented into Radial Tire and Bias Tire. Based on End-Use, the market is segmented into OEM market and Replacement market. Based on the Distribution Channel, the market is segmented into Online and Offline.

Saudi Arabia Tire Market by Product Type

-

- Tube Tire

- Tubeless Tire

Saudi Arabia Tire Market by Vehicle Type

-

- Passenger Car

- Light Commercial Vehicle

- Medium & Heavy Commercial Vehicle

- Off-the-Road

- Two-wheeler

- Three Wheeler

Saudi Arabia Tire Market by Design

-

- Radial Tire

- Bias Tire

Saudi Arabia Tire Market by End-Use

-

- OEM market

- Replacement market

Saudi Arabia Tire Market by Distribution Channel

-

- Offline

- Online

Saudi Arabia Tire Market Leading market players

-

- Bridgestone Corporation

- Hankook Tire Co., Ltd.

- Pirelli & C. S.p.A.

- Dunlop (Goodyear Tire & Rubber Company)

- Yokohama Rubber Co. Ltd.

- Continental AG

- Toyo Tire & Rubber Co. Ltd.

- Michelin Group

- Apollo Tyres Ltd.

- Kumho Tire

- Sumitomo Rubber Industries, Ltd.

- Cooper Tire & Rubber Company

Frequently Asked Question About This Report

Saudi Arabia Tire Market [UP590A-00-0620]

Saudi Arabia Tire Market size was estimated at 17.2 million units in 2024.

Saudi Arabia Tire market growth is primarily driven by increasing vehicle fleet size, surge in new vehicle sales, rising disposable incomes, robust economic growth.

Saudi Arabia Tire market size is forecast to reach 23.9 million units growing at a steady CAGR of 4.2% between 2025 and 2032.

Major players operating in KSA tyre market are Bridgestone Corporation, Hankook Tire Co., Ltd, Pirelli & C. S.p.A., Dunlop (Goodyear Tire & Rubber Company), Yokohama Rubber Co. Ltd., Continental AG, Toyo Tire & Rubber Co. Ltd., Michelin Group, Apollo Tires Ltd, Kumho, Sumitomo, and Cooper Tire & Rubber Company among others.

Passenger car segment dominates the market revenues and is expected to grow at a higher CAGR during the forecast period

Tubeless Tire segment holds the largest market share and is projected to dominate during the forecast period.

Replacement tires hold the largest market share in KSA as there is no OEM car manufacturing plants locally and very little production of commercial vehicle in the country.

Related Reports

- Published Date: Mar-2025

- Report Format: Excel/PPT

- Report Code: UP590A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia Tire Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research