Saudi Arabia Cosmetics Market Size

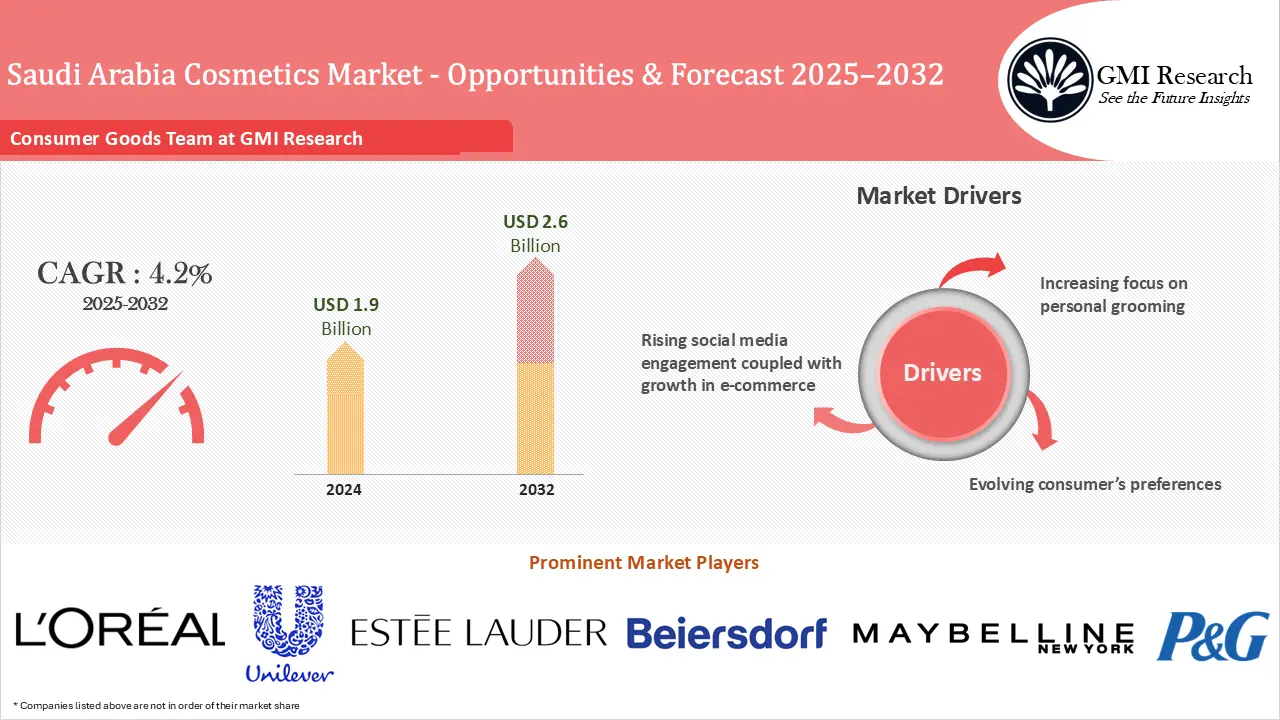

Saudi Arabia Cosmetics Market size was valued at USD 1.9 billion in 2024 and is forecast to touch USD 2.6 billion in 2032, and the market is expected to grow at a steady CAGR of 4.2% from 2025-2032, driven by increasing focus on personal grooming, evolving consumer’s preferences, rising social media engagement coupled with growth in e-commerce and increasing preference for halal cosmetics products in KSA.

Key Market Insights

Market Size:

-

- 2024 – USD 1.9 Billion

- 2032 – USD 2.6 Billion

- Market Forecast – CAGR of 4.2% from 2025-2032

Segment Insights

-

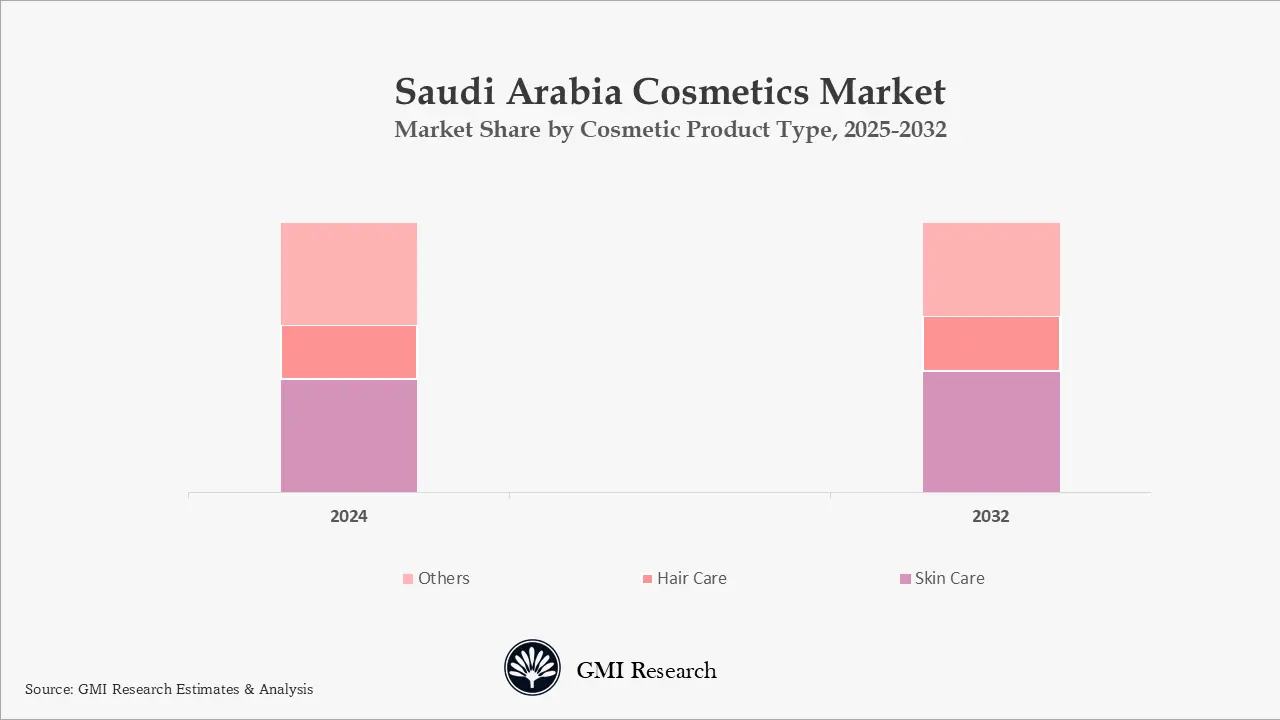

- Category Type Insights: Skin and sun care products segment is forecast to grow at a highest CAGR

- Distribution Channel Type Insights: Online sales is projected to grow at the fastest rate during the forecast period.

Saudi Arabia Cosmetics Market Drivers

Increasing Focus on Personal Grooming

Growing focus on personal appearance among millennials along with expanding retail outlets and rising social media penetration are fueling the Saudi Arabia cosmetics market size growth. Saudi Arabia has a large youthful population with two thirds among its population is under 35 years old. The growing social media influence on young population combined with rising incomes and better living standards is significantly supporting the cosmetics market demand in Saudi Arabia.

Evolving Consumer’s Preferences

Saudi Arabia cosmetics market size growth is also directly influenced by the changing beauty ideals and shifting consumer preferences. With ongoing cultural and social changes there is a steady demand for cosmetics which reflect local beauty standards while incorporating global innovations and trends. Female and male consumers are drawn to products which allow them to showcase their unique identity and improve their beauty. By introducing male grooming products the market is witnessing an expanding consumer base which contributes to higher sales. Consumers are actively spending on cosmetics to align with beauty ideals and improve their looks.

Rising Social Media Engagement Coupled with Growth in E-Commerce

Cosmetic brands rely heavily on social media because it is the preferred platform for millennials to explore new beauty products. The awareness about shifting beauty trends globally through social media also keeps consumers up to date which significantly contributes to market growth. Korean beauty brands have surged significantly in Saudi Arabia driven by the Hallyu wave along with the increasing Kpop and Kdrama popularity. Successful marketing strategies generally aims to build connection with Saudi consumers which emphasizes how cosmetics contribute to beauty and personal expression.

The rising online shopping and continuous improvements in packaging technology are further contributing to market growth. Online retail is growing rapidly driven by evolving consumer behavior and innovations in technology. With greater internet access Saudis are embracing the convenience offered by online platforms. The Saudi online market is primarily dominated by ecommerce platforms including Noon and Souq which is now Amazon. With improved logistics infrastructures consumers enjoy quick and dependable delivery which boosts their satisfaction.

Increasing Preference for Halal Cosmetics Products

The increasing preference for halal products is also contributing to market growth. The government has consistently supported the Islamic economy growth which includes expanding the halal industry in sectors like cosmetics. Efforts by the government to improve standards for halal certification and optimize regulatory processes have increased consumer trust in halal products. The support increases halal cosmetics credibility and drives local manufacturers to adopt this standard.

Saudi Arabia Cosmetics Market Segment Analysis

Category Type Market Insights: Skin and sun care products segment is forecast to grow at a highest CAGR

Based on category the market is divided into skin and sun care products, hair care, fragrances among others. The skin and sun care products segment is expected to experience the highest CAGR driven by increasing awareness about the benefits these products offer particularly among younger consumers. Additionally the rising preference for organic products to maintain natural skin and protect it from chemicals or pollution is further boosting segment growth. The demand for makeup products that serve corrective functions like blush for a healthier complexion is also supporting the makeup and color cosmetics segment growth.

Distribution Channel Insights: Online sales is projected to grow at the fastest rate during the forecast period.

Based on distribution channel the market is categorized into online sales and retail sale channel. The online sales category is projected to witness the highest CAGR. The rising online stores that provide a superior shopping experience is a significant driver behind the segment growth. The ability to read customer reviews and watch demonstration videos allows customers to better understand the product. Additionally online platforms offer various products and the ability to shop at any time. These platforms also offer special discounts which contribute to making them more popular with consumers.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

The offline channels also retain their popularity with consumers owing to various products available and trusted brand showrooms which offer authentic items. Offline channels are still popular in Saudi Arabia because they allow customers to test products physically and purchase items according to their specific skin needs.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

Saudi Arabia Cosmetics Market Major Players & Competitive Landscape

Several leading companies are L’Oréal S.A, Unilever, Estée Lauder Inc., Procter & Gamble, Beiersdorf, Maybelline, Shiseido Company, Arabian Oud, Chanel, Christian Dior SE, Coty Inc., MAC Cosmetics, Oriflame, Sephora and among others.

Leading brands focus on launching innovative products to maintain their presence. Companies are also focusing on mergers while introducing new services to be the main strategies to enhance their competitiveness. Additionally the cosmetics industry is being reshaped by technological progress and innovations.

Cosmetic companies are prioritizing R&D to craft innovative products which provide superior performance and customization possibilities. Environmentally friendly packaging designs are appealing to a fresh consumer base which boosts market demand. Factors like harsh weather and growing emphasis on personal wellness are leading to a greater demand for refined beauty along with personal care treatments.

The SFDA has selected SGS Societe Generale de Surveillance SA to provide Conformity Assessment for importing cosmetic or personal care items into Saudi Arabia. With the ecommerce market expanding at a faster pace companies will be able to make their offerings more easily available across various online platforms.

Saudi Arabia Cosmetics Market News

-

- In 2024, Believe Beauty which was originally based in Singapore plans to move its operations to Saudi Arabia and use it as the primary export hub for its products globally. The company will also establish production facilities in Saudi Arabia.

- In 2024 makeup company Flormar aims to increase its store presence in Saudi Arabia by threefold in the next four or five years to tap into the expanding market.

- In 2022 the French luxury brand Hermes launched its inaugural cosmetic and perfume store within Saudi Arabia situated in among the biggest shopping centers in Riyadh.

- In 2022 Bayer unveiled its new Bepanthen Derma skin care range in Saudi Arabia which offers eight products that include face creams and body lotions.

- In July 2022 Hermès, a major luxury goods company based out of France inaugurated its first ever perfume and cosmetic store in Saudi Arabia, which is located in one of the largest shopping malls in Riyadh.

- In March 2022, Bayer launched a new formulated Bepanthen Derma skin offering in Saudi Arabia, which consist of 8 products with face creams, cleansers, and body lotions.

Saudi Arabia Cosmetics Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 1.9 billion |

| Market Revenue Forecast in 2032 |

USD 2.6 billion |

| CAGR |

4.2% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Category, By Distribution Channel, By Gender |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | L’Oréal S.A, Unilever, Estée Lauder Inc., Procter & Gamble, Shiseido Company, Arabian Oud, Chanel, Christian Dior SE, Coty Inc., MAC Cosmetics, Oriflame, Sephora, Beiersdorf, Maybelline among others; a total of 14 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia Cosmetics Market Research Report Segmentation

The Saudi Arabia Cosmetics Market has been segmented on the basis of category, distribution channel, gender. Based on category, the market is segmented into skin and sun care products, hair care products, deodorants, makeup and color cosmetics, fragrances, and others. Based on distribution channel, the market is segmented into retail sales, and online sales. Based on gender, the market is segmented into men, and women.

Saudi Arabia Cosmetics Market by Category

-

- Skin and Sun care products

- Hair care products

- Deodorants

- Makeup and Color cosmetics

- Fragrances

- Others

Saudi Arabia Cosmetics Market by Distribution Channel

-

- Retail Sales Channel

- General departmental store

- Supermarkets

- Drug stores

- Brand outlets

- Others

- Online Sales Channel

- Retail Sales Channel

Saudi Arabia Cosmetics Market by Gender

-

- Men

- Women

Saudi Arabia Cosmetics Market Leading players

-

- L’Oréal S.A

- Unilever

- Estée Lauder Inc.

- Procter & Gamble

- Shiseido Company

- Arabian Oud

- Chanel

- Christian Dior SE

- Coty Inc.

- MAC Cosmetics

- Oriflame

- Sephora

- Beiersdorf

- Maybelline

Frequently Asked Question About This Report

Saudi Arabia Cosmetics Market [UP206A-00-1219]

Saudi Arabia Cosmetics Market was worth USD 1.9 billion in 2024, and expected to reach USD 2.6 billion in 2032, and expected to grow at a CAGR of 4.2% till 2032

Growth in the market is primarily propelled by shifts in consumer demographics, a rise in disposable income, social media influence, and a flourishing tourism industry.

The skin and sun care products segment is projected to register the highest CAGR in the market.

Several leading players include L’Oréal S.A, Unilever, Estée Lauder Inc., Procter & Gamble, Shiseido Company, Arabian Oud, Chanel, Christian Dior SE, Coty Inc., MAC Cosmetics, Oriflame, Sephora among others.

Related Reports

- Published Date: Aug-2025

- Report Format: Excel/PPT

- Report Code: UP206A-00-1219

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia Cosmetics Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research