Indonesia Non-Alcoholic Beverages Market Overview

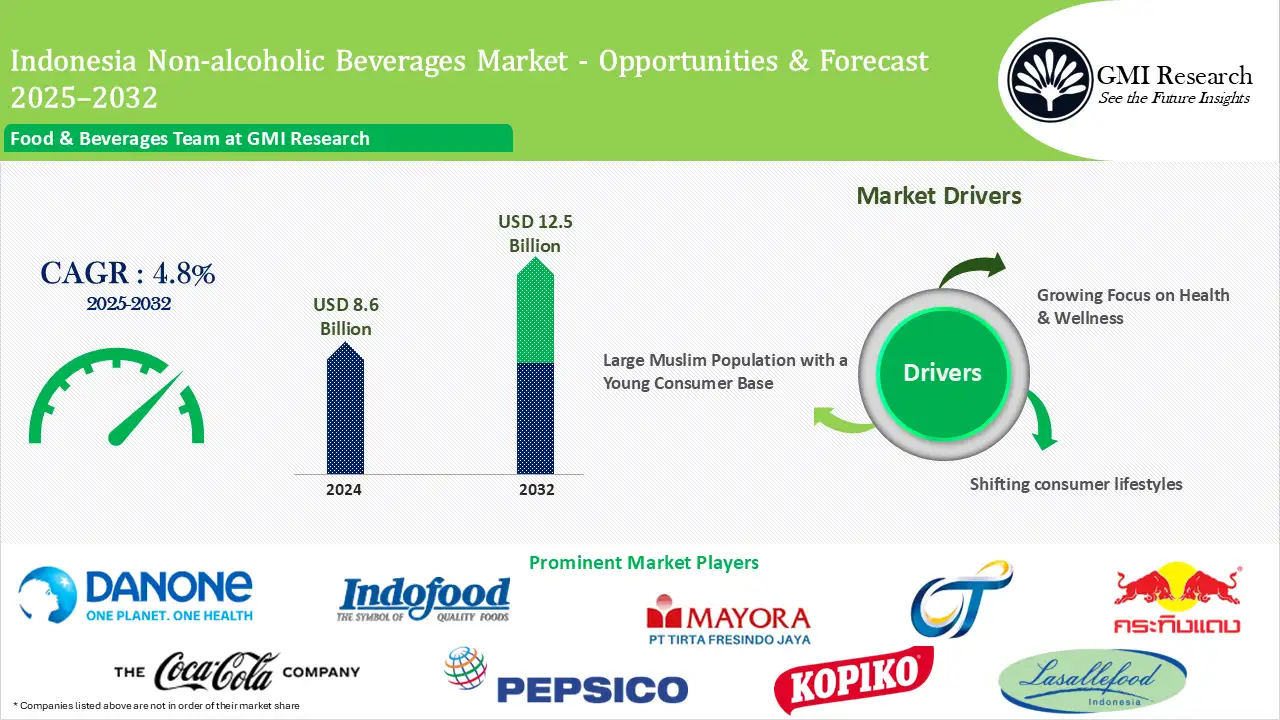

Indonesia Non-Alcoholic Beverages Market size reached USD 8.6 billion in 2024 and is estimated to reach USD 12.5 billion in 2032, and the Indonesia non alcoholic beverages market forecast to grow at a CAGR of 4.8% from 2025-2032 due to shifting consumer preferences & lifestyles, growing focus on health & wellness, digitalization and e-commerce, expanding middle class has led to increasing demand for premium products, large Muslim population with a young consumer base, tropical climate fueling demand.

Market Size & Forecast:

-

- 2024 – USD 8.6 Billion

- 2032 – USD 12.5 Billion

- Market Forecast – CAGR of 4.8% from 2025-2032

Indonesia Beverage Consumption Trends

Indonesia beverage consumption trends shows the increasing demand for functional drinks which provide extra health benefits in addition to just hydration. These drinks are often enriched with various bioactive compounds which promote wellness. The growing demand for functional beverages stems from consumers wanting products that deliver refreshment and health value. Growing number of beverages with local flavours are introduced in the market to target customers.

Functional beverages like energy and sports drinks also getting good traction owing to as consumer are looking for drinks to support health and wellness to have an active lifestyle. The demand for functional beverages primarily comes from urban areas where busy lifestyle and consumer focus on health consciousness is driving Indonesia functional beverages market growth during the forecast period.

Indonesia Non Alcoholic Beverages Market Growth Drivers

Growing Focus on Health & Wellness

Rising health consciousness among consumers are driving demand for non alcoholic drinks in the country. The shift towards healthier living and the demand for natural ingredients over artificial alternatives have driven companies to create new formulations tailored to meet various dietary preferences. The rising preference for products with clean labels across various categories like beverages has further amplified this shift toward healthier options.

The consumer shift toward packaged foods and beverages is also significantly driving market growth. Consumers increasingly favor RTD options like juices or bottled water for their convenience in comparison to traditional home preparation methods like boiling tea leaves which leads to rising RTD sales. Companies in this sector are increasingly expanding their product lines by adding new options to their portfolios.

Modern technologies are also changing how products are developed and produced. This further creates new possibilities for innovation within the food and beverage industry especially in nonalcoholic drinks. Nanotechnology among other modern innovations enables producers to improve beverages by utilizing natural ingredients without compromising on taste and texture. It also lowers sugar and fat content which aligns better with healthy eating preferences.

Moreover the government initiatives to encourage healthier living and curb sugary drink consumption have had a significant impact on the market. The upcoming tax on sugary drinks and regulations that encourage healthier options will drive Indonesia low sugar beverage market growth.

Digitalization and E-commerce

The growth of the E-commerce industry in the country is helping beverage brand to extend their customer reach by leverage e-commerce platforms to reach wider audience effectively. As customer are shopping more online owing to convenience and wide variety of product to choose from brands are reaching to customers through online platforms such as Shopee, Tokopedia, Lazada, and specialized e-grocery apps like HappyFresh are dominant by offering a wide range of products offering good discounts is driving the Indonesia soft drinks market growth during the forecast period.

Large Muslim Population with a Young Consumer Base

The non alcoholic beverages market in Indonesia is growing largely attributed to its large Muslim demographic. More than 87 percent among the population identified as Muslim which makes the country home to the largest Muslim population globally. The Islamic prohibition on alcohol has thereby contributed to the strong demand and growth of Indonesia halal beverage market. Given the Muslim majority, halal certification holds significant importance and serves as a product standard. Securing a halal label means ensuring that food products are entirely free from prohibited ingredients including alcohol across all stages from raw inputs to processing materials.

The beverage sector further benefits from favorable demographics which includes a young population along with increasing urban development and higher consumer spending power. Shifting lifestyle preferences are also prompting consumers to opt for higher quality and fortified beverages which contributes to the growing nonalcoholic drink market. Greater consumption driven by a growing middle class has led to greater purchasing power particularly among youth which results in broader beverages variety and drives demand for nonalcoholic options.

Are you Looking for a Partner for your Indonesia Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Indonesia market is the right choice for you.

Tropical Climate Driving Growth in Indonesia Beverage Industry

With its tropical weather Indonesia also offers an excellent market opportunity for Indonesia beverage industry. The consistent hot weather drives continuous demand for cooling and hydrating drinks throughout the year. This factor has contributed to the growing nonalcoholic beverages popularity like ice teas and flavored waters.

Challenges Faced by Indonesia Beverage Industry

However, stiff competition from international companies poses a major challenge for local producers. Their dominance is reinforced by large scale marketing efforts which makes it challenging for local competitors to keep up. Moreover the high tax rates on nonalcoholic beverages also create significant challenges for smaller companies to remain competitive in the Indonesia beverage industry. Poor infrastructure also remains a barrier to effective distribution which prevents many rural communities from accessing quality beverages.

Indonesia Non-Alcoholic Beverages Market Segment Analysis

Non Alcoholic Beverages Product Type Market Insights:

Based on product, RTD tea and coffee are the second most preferred drinks following bottled water. The segment growth is fueled by the surging coffee shops in large cities over recent years. The growing demand based on customer lifestyles and preferences led to a whopping number of 9,031 cafes and bars across Indonesia in 2023 which increased from the previous year. The increase in regional minimum wages effective from January 1, 2025, is expected to strengthen consumer purchasing power, supporting faster growth across the all non-alcoholic beverage segments.

Bottled water segment captured more than one third of the market share and the Indonesia bottled water market is forecast to grow at a steady growth rate market is driven by increasing consumer spending power and larger bottle pack sizes.

Indonesia energy drinks market growth in 2025 is being driven by competitive pricing, new packaging formats, and wider distribution. While brands are actively launching new products to boost engagement, evolving consumer perceptions and potential sugar taxes may influence long-term market dynamics, encouraging a shift toward healthier formulations.

Indonesia RTD Coffee market is driven by changing lifestyles and sizeable younger population are driving the RTD coffee growth, with flavour innovation and competitive pricing boosting consumer interest.

Indonesia RTD tea market tea is going through a stagnation phase amid market saturation, although reduced-sugar options are emerging as a key growth area driven by new brands, expanded reach, and new flavours and attractive packaging.

Indonesia Beverage Distribution Channels Type Market Insights:

Based on distribution channel, the retail segment is expanding quickly fueled by various products available in supermarkets and hypermarkets along with the growing online stores. The rapidly evolving ecommerce landscape has simplified life for customers and producers. It enables them to directly sell their products through online platforms without relying on physical stores which were once the primary distribution channels before the digital revolution. The accessibility and attractive pricing offered by online retailers combined with marketing advantages have made them especially popular among younger demographics like teens or college students. This ultimately drives sales and boosts revenue generated by digital outlets.

Indonesia Non-Alcoholic Beverages Market Major Players & Competitive Landscape

Several leading companies are Danone Aqua PT, Tirta Fresindo Jaya PT, Coca Cola, PepsiCo, Tirta Sukses Perkasa PT, PT Indofood Sukses Makmur Tbk, PT Fore Kopi Indonesia Tbk, Kopiko, Red Bull, PT Lasallefood Indonesia, Tirta Alam Segar, Orang Tua Group (OT) and many more.

The Indonesian Food packaged market share remains very highly fragmented while Beverage is highly concentrated market

Globally, there is an increase in health awareness and companies are innovating new products to cater to such need, leading to a proliferation of nutritious products. Sales through e-commerce channels are growing; there was a 50 per cent growth in sales through e-commerce between 2019 and 2020.

Key Indonesia Non-Alcoholic Beverages Market Developments

-

- In 2023, PepsiCo announced that their investments in Indonesia will be made directly without involving intermediaries. The US based company is making direct investments in Indonesia to tap into a larger market share.

- In 2023, a newly established tea packaging facility for retail was officially inaugurated by PT Perkebunan Nusantara IV located in North Sumatra. The facility features advanced technologies and modern packaging machinery which guarantees high quality tea along with visually appealing packaging.

Indonesia Non-Alcoholic Beverages Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 8.6 billion |

| Market Revenue Forecast in 2032 |

USD 12.5 billion |

| CAGR |

4.8% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Product, By Distribution channel |

| Regional Coverage | Indonesia |

| Companies Profiled | Danone Aqua PT, Tirta Fresindo Jaya PT, Coca Cola, PepsiCo, Tirta Sukses Perkasa PT, PT Indofood Sukses Makmur Tbk, PT Fore Kopi Indonesia Tbk, Kopiko, Red Bull, PT Lasallefood Indonesia, Tirta Alam Segar, Orang Tua Group (OT) among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Indonesia Non-Alcoholic Beverages Market Research Report Segmentation

The Indonesia Non-Alcoholic Beverages Market has been segmented on the basis of Product and Distribution channel. Based on the Product, the market is segmented into Carbonated Soft Drinks, Energy & Sports Drink, Bottled Water, RTD Tea & Coffee, Functional Beverages, Juices, Dairy-based Beverages and Others. Based on the Distribution channel, the market is segmented into Food Service and Retail.

Indonesia Non-Alcoholic Beverages Market by Product

-

- Carbonated Soft Drinks

- Energy & Sports Drink

- Bottled Water

- RTD Tea & Coffee

- Functional Beverages

- Juices

- Dairy-based Beverages

- Others

Indonesia Non-Alcoholic Beverages Market by Distribution channel

-

- Food Service

- Retail

Indonesia Non-Alcoholic Beverages Market Leading players

-

-

Danone Aqua PT

-

Tirta Fresindo Jaya PT

-

Coca-Cola

-

PepsiCo

-

Tirta Sukses Perkasa PT

-

PT Indofood Sukses Makmur Tbk

-

PT Fore Kopi Indonesia Tbk

-

Kopiko

-

Red Bull

-

PT Lasallefood Indonesia

-

Tirta Alam Segar

-

Orang Tua Group (OT)

-

Frequently Asked Question About This Report

Indonesia Non-Alcoholic Beverages Market [GR24AB-01-00488]

Indonesia Non-Alcoholic Beverages Market size was estimated at USD 8.6 billion in 2024.

Indonesia Non-Alcoholic Beverages Market is driven by evolving consumer preferences and lifestyles, a rising focus on health and wellness, increasing digitalization and e-commerce adoption, and an expanding middle class are driving demand for premium products. In addition, a large Muslim population with a young consumer base, along with the country’s tropical climate, continues to support strong beverage consumption.

Indonesia Non-Alcoholic Beverages Market has the potential for growth and the market is forecast to reach USD 12.5 billion in 2032, growing at a CAGR of 4.8% from 2025-2032.

Major players operating in market are Danone Aqua PT, Tirta Fresindo Jaya PT, Coca Cola, PepsiCo, PT Indofood Sukses Makmur Tbk, PT Fore Kopi Indonesia Tbk, Kopiko, Red Bull, PT Lasallefood Indonesia, Tirta Alam Segar, Orang Tua Group (OT) and many more.

Java region dominates the Indonesia and is forecast to drive Indonesia non alcoholic beverages market growth during the forecast period.

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00488

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Indonesia Non-alcoholic Beverages Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research