Indonesia Animal Feed Market Size

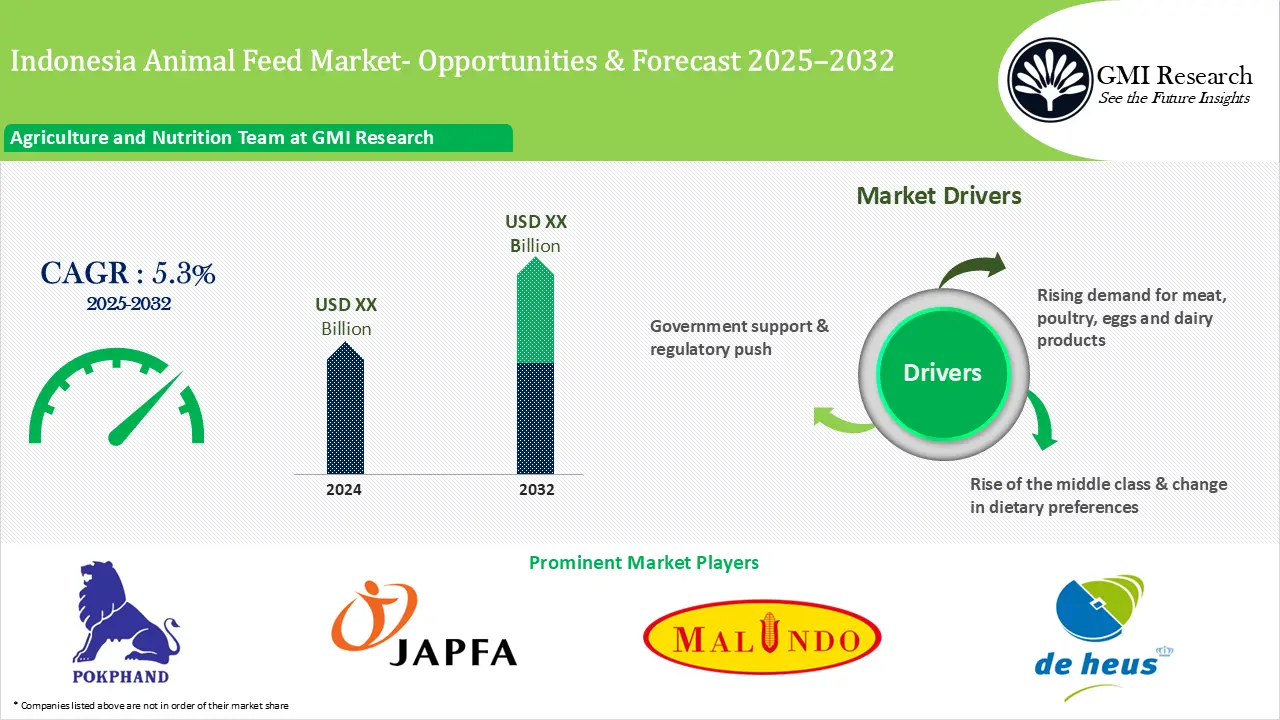

Indonesia Animal Feed Market size is forecast to grow at steady CAGR of 5.3% between 2025 and 2032 primarily driven by rising demand for meat, poultry, eggs and dairy products, rise of the middle class & change in dietary preferences and government support & regulatory push.

Market Forecast & Key Segment Insights

-

- Market Forecast – CAGR of 5.3% from 2025-2032

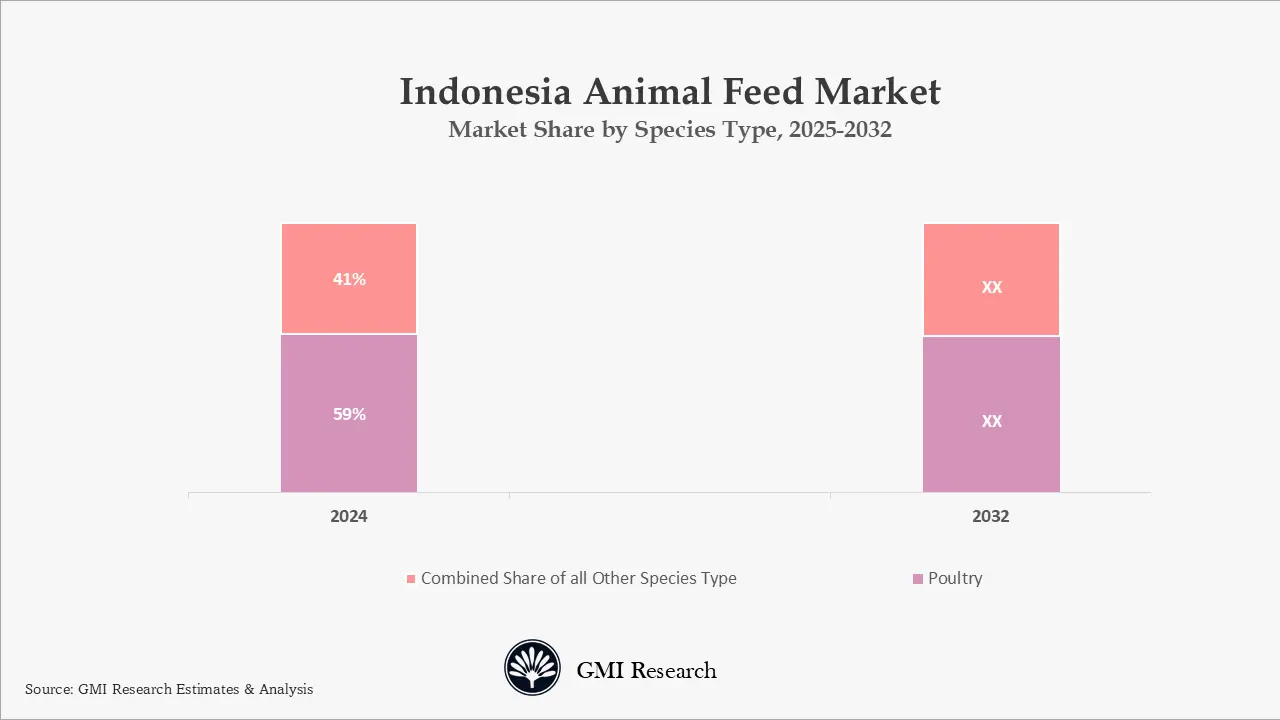

- Species Type Insights: Poultry sector dominates the market revenue with a market share of 59% in 2024 and is projected to drive revenues during forecast period.

- Product Type Insights: Pellets accounted for the largest market share

- Feed Type Insights: Complete/Mixed or compound feeds hold the largest revenue share

Indonesia Animal Feed Market Growth Drivers

Rising Demand For Meat, Poultry, Eggs and Dairy Products

The increasing demand for animal-based products is a major contributor for the growth of Indonesia animal feed market, as the country’s population is witnessing increased wealth and urbanization, there is a simultaneous increase in the demand for eggs, meats, or dairy products. The rise in the consumption levels coupled with shifting dietary preferences towards diet high in protein especially in urban areas is challenging the livestock industry to increase production of high-grade animal feed. .

Furthermore, the growing consumer consciousness about the safety and quality of animal products has stimulated investments in innovative feed formulations, which can further drive the expansion of Indonesia animal feed market. Farmers are increasingly adopting nutritionally enriched and specialized feeds for their animals which aim to provide livestock with the necessary nutrients crucial for health, reproductive success, and optimal growth.

Rise of The Middle Class & Change In Dietary Preferences

Growing income per capita especially noticeable among wealthier consumers who want to invest in premium meat products from animals receiving high-quality feed. In addition, the expanding middle-class demographic changing their eating habits towards higher-quality foods has driven an uptick in meat consumption in recent years. According to a publication by the Australian Bureau of Agricultural and Resource Economics and Sciences, in 2050 the meat consumption in Indonesia is estimated to increase by 132 percent which is expected to foster market growth in the years ahead.

Government Support & Regulatory Push

The government efforts and regulations focused on ensuring the safety and quality of animal feed are also contributing to Indonesia animal feed market expansion, creating a competitive environment that emphasizes responsible manufacturing approaches. Furthermore, the government’s commitment and focus on sustainable agricultural methods influences market dynamics, as there is a growing recognition of the environmental footprint of livestock farming which is fostering a move towards environmentally friendly alternatives.

The agricultural sector in the country is reach in resources, facilitating the cultivation of diverse feed ingredients such as soybeans, palm, and corn which can serve as the opportunity for market growth. In addition, the expansion of cattle farming sector driven by demand from both domestic and international markets enables the cost-effective production of a variety of ingredients and provide local feed marketers with opportunities to expand their businesses.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Growing Demand for Organic Meat and Products

The increasing demand for organic products is fueling market expansion, as consumers are choosing naturally sourced eggs and meat driven by a rising awareness regarding environmental sustainability and well-being. The shifting consumer preference requires a change in livestock management practices focusing on organic feed for animals.

The rising preference for organic animal-based products has compelled farmers to implement natural farming methods, leading to the use of specialized feed formulation for animals that meet strict organic criteria. The rise in consumer preference for organic feed which excludes synthetic pesticides is fueling the expansion of animal feed industry as manufacturers are prioritizing organic and natural ingredients in their innovative formulations responding to consumer preferences for animal products produced ethically and are chemical-free.

Growing Population and Increase in Urbanization Rate

Growing population growth and urbanization, increased poultry product consumption has spurred a robust market for specialized feed that cater specifically to the nutritional needs of layers, turkeys, and broilers. In response to this demand, feed manufacturers are developing formulations aimed at improving growth rates, fertility, and general poultry health by innovating in feed technology with the integration of essential supplements and nutrients.

Challenges Faced by Indonesia Animal Feed Companies

Nevertheless, the expansion of Indonesia animal feed market presents certain challenges including the fluctuating prices of raw materials which represents a critical issue that can affect the costs and profitability of manufacturing animal feed. The feed industry is constrained by declining local corn supply, rising ingredient costs, currency depreciation, and stricter import and tax regulations.

Are you Looking for a Partner for your Indonesia Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Indonesia market is the right choice for you.

In addition, the environmental concerns stemming from greenhouse gas output and the consumption of water in the livestock industry are constraining the growth of the animal feed sector. Additionally, disease outbreaks represent a critical aspect leading to losses in livestock, reduced productivity, and the implications for Indonesia animal feed market.

Indonesia Animal Feed Market Segment Analysis

Species Type Market Insights: Poultry sector dominates the market revenue with a market share of 59% in 2024 and is projected to drive revenues during forecast period

Broiler feed ranks as the leading segment in animal feed production in Indonesia on a species basis. The poultry sector (chicken, eggs) dominates in Indonesia and is a major user of feed. Broilers make up the largest share of Indonesia’s poultry population. As economy slows down, consumers shifted toward more affordable food options, particularly chicken and eggs, which cost roughly four times less than beef. In terms of production structure, Indonesia’s poultry sector consists of about 60% large-scale farms and 40% small- and medium-scale operations. Growth in aquaculture also adds demand for specialized feed.

Product Type Market Insights: Pellets accounted for the largest market share

Pellet feed type accounted for the largest revenue as it helps maintain vitamin potency, reduces nutrient loss during storage, prevents feed disintegration, and ensures uniform ingredient mixing, making transportation and storage more efficient.

Feed Type Market Insights: Complete/Mixed or compound feeds hold the largest revenue share

Complete/Mixed or compound feeds account for the majority of the animal feed market, with compound feeds leading the segment as they are specifically formulated to supply all essential nutrients required by poultry. Their extensive use in commercial poultry operations further boosts the overall demand for compound feeds.

Indonesia Animal Feed Market Major Players & Competitive Landscape

Several leading companies are PT Japfa Comfeed Indonesia Tbk, Charoen Pokphand Indonesia, PT Cargill Indonesia, Archer Daniels Midland Company, De Heus, Malindo Feedmill, Cibadak Indah Sari Farm etc. Companies such as Charoen Pokphand Indonesia, PT Japfa Comfeed Indonesia Tbk , Malindo Feedmill, De Heus, Cibadak Indah Sari Farm dominated the Indonesia animal feed market share.

In Indonesia, large scale feed manufacturers have an edge as they can achieve operational efficiency compared to small scale players as these small companies cannot achieve very high volumes to reduce product cost.

Indonesia Animal Feed Market News

-

- In Oct 2025, Royal De Heus expands its Asian footprint with the acquisition of CJ Feed & Care. Royal De Heus signed a Share Purchase Agreement to acquire 100% of CJ Feed & Care’s operations in Vietnam, Indonesia, South Korea, Cambodia, and the Philippines. The transaction marks a significant step in De Heus’ long-term growth strategy. This acquisition includes 17 feed mills.

Indonesia Animal Feed Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR | 5.3% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Species, By Product , By Application, By Feed Type |

| Regional Coverage | Indonesia |

| Companies Profiled | PT Japfa Comfeed Indonesia Tbk, Charoen Pokphand Indonesia, PT Cargill Indonesia, Archer Daniels Midland Company, De Heus, Malindo Feedmill, Cibadak Indah Sari Farm among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Indonesia Animal Feed Market Research Report Segmentation

The Indonesia Animal Feed Market has been segmented on the basis of Species, product and Feed Type. Based on the Species, the market is segmented into swine, poultry, aquaculture, ruminant and others. Based on the product, the market is segmented into pellets, mash, crumbles. Based on the Feed Type, the market is segmented into Concentrates, Roughages, Supplements and Complete Feeds

Indonesia Animal Feed Market by Species

-

- Poultry

- Swine

- Ruminant

- Aquaculture

- Others

Indonesia Animal Feed Market by Product

-

- Pellets

- Mash

- Crumbles

Indonesia Animal Feed Market by Feed Type

-

- Concentrates

- Roughages

- Supplements

- Complete Feeds

Indonesia Animal Feed Market Leading players

-

- PT Japfa Comfeed Indonesia Tbk

- Charoen Pokphand Indonesia

- PT Cargill Indonesia

- Archer Daniels Midland Company

- De Heus

- Malindo Feedmill

- Cibadak Indah Sari Farm

Frequently Asked Question About This Report

Indonesia Animal Feed Market [GR24AB-01-00274]

Indonesia Animal Feed Market size was estimated at USD XX billion in 2024

The market size is growing owing to rising demand for meat, poultry, eggs and dairy products, rise of the middle class & change in dietary preferences and government support & regulatory push.

Companies such as Charoen Pokphand Indonesia, PT Japfa Comfeed Indonesia Tbk , Malindo Feedmill, Cibadak Indah Sari Farm dominated the Indonesia animal feed market share.

Java is the largest market for animal feed in Indonesia.

Pellets feed type accounted for the largest market share.

Mixed/Compound feeds type dominate the animal feed market due to their complete nutritional formulation for poultry, and their widespread use in commercial poultry farming continues to drive demand.

Related Reports

- Published Date: Mar- 2025

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00274

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Indonesia Animal Feed Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research