India Lithium-Ion Battery Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

India Lithium-Ion Battery Market Overview

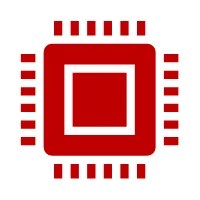

India Lithium-Ion Battery Market size reached USD 4.3 billion in 2024 and is forecast to reach USD 25.3 billion in 2032 and the market is projected to grow at a very high CAGR of 22.1% from 2025-2032 due to rising electric vehicle adoption & robust EV sales, government initiatives and support, growing demand from battery energy storage market, rapid growth of renewable energy adoption in India, increase in electric vehicle (EV) range.

Market Size & Forecast:

-

- 2024 – USD 4.3 Billion

- 2032 – USD 25.3 Billion

- Market Forecast – CAGR of 22.1% from 2025-2032

Key Segment Insights:

-

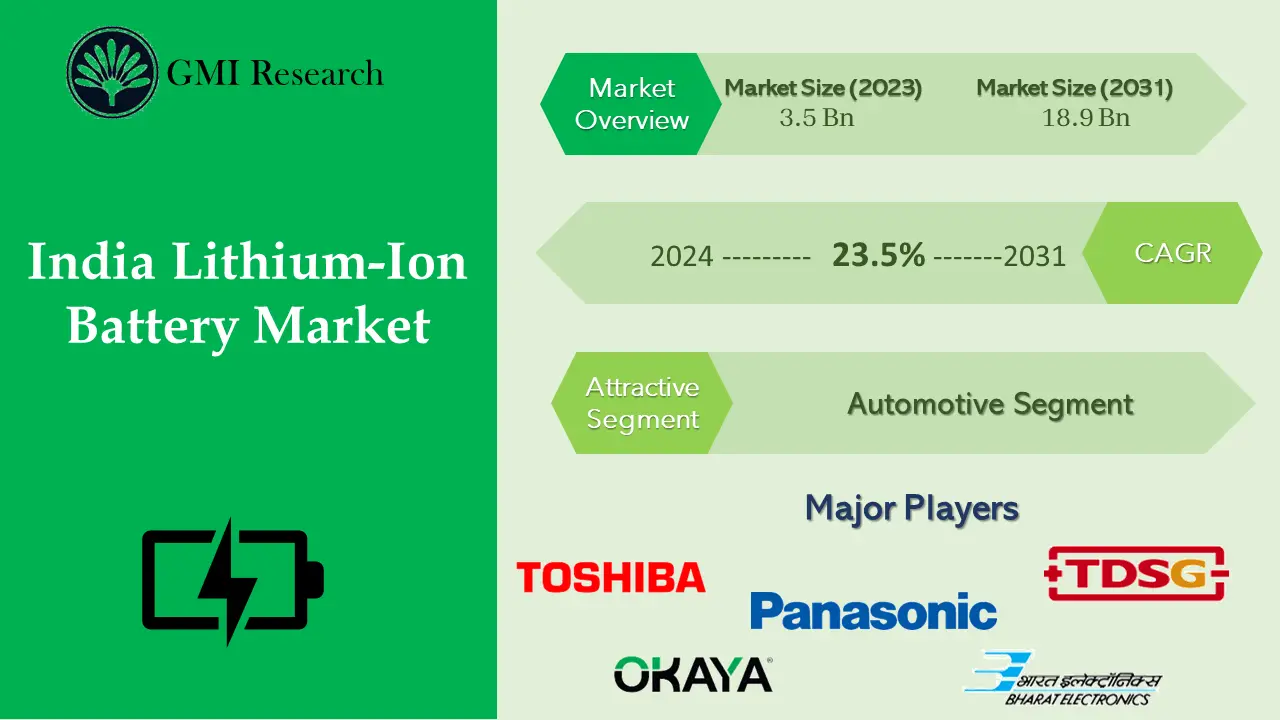

- Battery Chemistry Type Insights: Lithium Nickel Manganese Cobalt (Li-NMC) chemistry accounted for 35% of the market share in 2024.

- Power Capacity Type Insights: Batteries with a capacity of less than 3,000 mAh represented the largest share, at 38.7% in 2024.

- Form Factor Type Insights: Cylindrical cells dominated the Indian lithium-ion battery market, contributing over 50% of total demand in 2024.

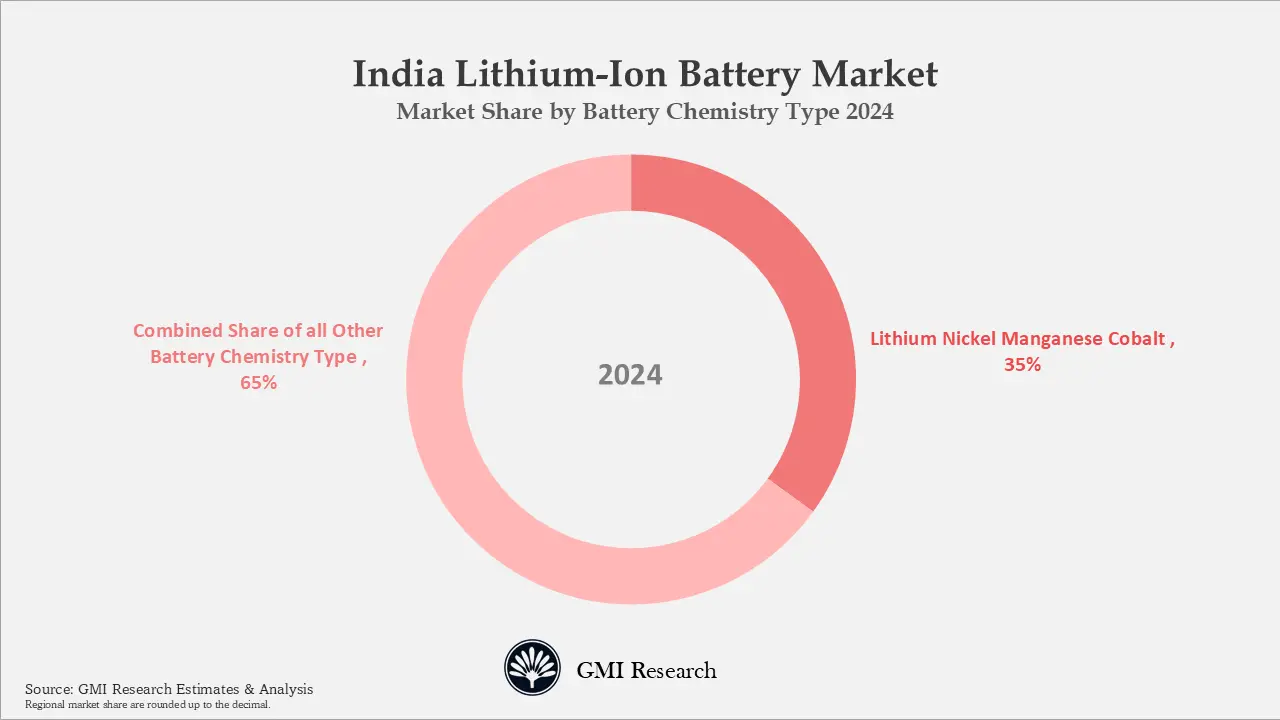

- End-Use Industry Insights: Consumer electronics end-use segment held the leading position, with a 32.2% market share in 2024.

India Lithium-Ion Battery Market Growth Drivers

Growing Electric Vehicle Adoption & Robust EV Sales

India is witnessing surge in electric vehicle adoption, the electric vehicle (EV) sales in India recorded 1.95 million units in 2024 growing 27% over 2023. The electric Two Wheller and Three Wheller captures the largest unit sales of the total EV sales in India, passenger cars sales are also witnessing a robust growth as OEM are launching more car with higher KM range to address customers range anxiety concern. Improvement in EV charging infrastructure, high fuel prices and lowering of EV prices are the factors propelling EV sales in India.

Government Initiatives and Support

Increasing government initiatives in terms of promoting clean energy and emphasis on reduction on oil imports is one of the primary reasons for boosting the demand for battery. For instance, to promote electric vehicles, the government has launched the “Nation Electric Mobility Mission Plan (NEMMP) to support the adoption of electric and hybrid vehicles. Moreover, an outlay of INR 10,000 crore has been allocated under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicle scheme (FAME 2) till 2022. The combination of these initiatives will surge the demand for Li-Ion batteries in electric vehicles, thus having positive impact on the growing demand of the market. Furthermore, tax benefits to OEMs in supporting local manufacturing of lithium batteries will further play a key role in shaping up the industry.

Growing Demand from Battery Energy Storage Market

Batteries are no longer just for power cuts. They sit at the heart of India’s renewable, EV, and distributed solar push, especially as the country works to cut emissions from power and transport. Rooftop solar, hybrid inverters, EVs, BESS all of these needs storage, currently lead acid batteries dominates the conventional backup systems storage market in India, but lithium ion is clearly gaining adoption owing to cycle life, better energy density, and suitability for solar & storage integration.

Rapid Growth of Renewable Energy Adoption in India

Energy storage plays an important role in renewable integration, grid stability, and decarbonisation. According to Ministry of New and Renewable Energy, the PM’s vision outlined at COP-26, the government’s objective is to reach Non-fossil energy capacity to 500 GW by the year 2030. Rapid growth of renewable energy expansion in India is witnessed in 2025, 44.5 GW of renewable energy capacity in 2025 (up to November) was added which is nearly doubling its annual capacity additions. The Solar Installed Capacity reaches 132.85 GW with 35 GW of new capacity addition and wind touches 54 GW with an 5.82 GW of new capacity addition in 2025. Costs are falling, policies are pushing adoption, and people actually understand the value now are driving the lithium-ion battery market growth.

Challenges Faced by India Lithium-Ion Battery Companies

One of the major restraint/barriers in the market is the low availability of raw materials due to which the OEMs are primarily dependent on countries such as China, Australia, Bolivia for import. India currently has limited lithium-ion cell manufacturing capacity and lacks domestic mining infrastructure, resulting in heavy dependence on imports of lithium-ion batteries cells and packs and critical raw materials such as lithium, cobalt, nickel, and manganese. However to reduce import reliance of raw materials, the industry is looking for Lithium sources in the country and in 2023, the Geological Survey of India (GSI) has established the Lithium inferred resources of 5.9 million tonnes in Jammu & Kashmir.

Are you Looking for a Partner for your India Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Indian market is the right choice for you./span>

India Lithium-Ion Battery Market Segment Analysis

Battery Type Market Insights: Lithium Nickel Manganese Cobalt (Li-NMC) hold 35% of the market share in 2024.

Based on battery type, Lithium Nickel Manganese Cobalt (Li-NMC) accounted for the lion’s share 35% of the India lithium-ion battery market in 2024. The accelerating demand for Lithium Nickel Manganese Cobalt batteries, especially in power banks, flashlights, laptop battery packs, and cordless power tools, is a key driver that is contributing to the growth of the segment. This type of battery has lithium nickel manganese cobalt oxide as the cathode and graphite as the anode and energy density is between 150-220 Wh/kg. This battery type is mostly used as these have features similar to Lithium Iron Phosphate (LFP). These batteries are safer compared to other battery types and is cost-effective than LFP.

Power Capacity Type Market Insights: Less Than 3,000 mAH battery capacity hold the largest market share of 38.7% in 2024.

Battery lower than 3,000 mAH capacity hold the largest market share owing to large size of the consumer electronics industry especially the mobile industry which registered total sales of 150 million units in 2024 coupled with large size of mobile manufacturing in India and surge in mobile exports in recent years as the country is the 3rd largest mobile exporter globally.

Form Factor Type Market Insights: Cylindrical cells accounted for more than 50% of the total lithium-Ion battery market in Indian in 2024.

Cylinder cells are the most popular type of cells used in India with a market share of over 50% in 2024 owing to as these are the most common and used widely across laptops, electric two-wheelers, three-wheelers, e-bikes, power tools etc. these cells are easy to manufacture and handle. One of the major manufacturer of electric scooter in India Ola, its electric scooters use cylindrical battery cells, specifically shifting from 21700 cells previously used in its scooters to its own proprietary 4680 format cells.

End-Use Industry Market Insights: Currently Consumer electronics end-use industry hold the largest market share of 32.2% in 2024.

In 2024, consumer electronics end user industry generates the largest demand for Lithium-ion battery in India with a revenue share of 32.2%. The automotive segment is expected to witness the fastest CAGR growth in the coming years. Increasing adoption of lithium batteries in electric vehicles in the two-wheeler and four-wheeler vehicles is augmenting the market growth. Growing adoption of electric vehicles across both passenger and commercial segment has created lucrative opportunity for several companies in this space.

India Lithium-Ion Battery Market Major Players & Competitive Landscape

Major players operating in India Lithium-Ion battery industry are TDS Lithium-Ion Battery Gujarat Pvt. Ltd., Nexcharge (Exide Industries Ltd), Amperex Technology Ltd. (ATL), Exicom Tele-Systems Ltd., Ola Electric Mobility, Okaya Power Group, Toshiba, Panasonic, Amara Raja Energy & Mobility Ltd, Tata AutoComp Systems Ltd, Shizen Energy India, Loom Solar Pvt. Ltd., Samsung SDI India Private Limited and many more.

Currently most of the lithium-Ion battery demand in India is met through imports from China, South Korea and other countries and the local production is very limited. However, some large lithium-ion battery production pants is project to come live in 2026 will reduce import slightly.

Key India Lithium-Ion Battery Market Developments

-

- In Jan 2026, Luminous Power Technologies has launched its first lithium-ion battery assembly line at its Baddi, Himachal Pradesh facility, with an annual capacity of 500 MWh. The automated plant will manufacture battery packs for residential, commercial, and industrial energy storage, stationary BESS, and e-rickshaws, offering pack sizes from 1.2 kWh to 16 kWh and scalability up to 1 MWh.

- In Nov 2025, Exide Industries plans to start lithium-ion cell production by the end of FY’26, targeting two-wheeler applications with its NCM-based cylindrical cell line. The company is in advanced talks with large OEMs for these batteries. Despite softer Q2 sales, Exide expects a sharp recovery in Q3, aiming to maintain margins through cost-efficiency and manufacturing upgrades.

- In Sep 2025, The Union Minister Ashwini Vaishnaw inaugurated a state-of-the-art lithium-ion battery plant in Sohna, Haryana, marking a major step toward local electronics manufacturing. The facility will produce 200 million battery packs annually, meeting around 40% of India’s demand and creating 5,000 jobs. The project supports advanced technology adoption and strengthens India’s Atmanirbhar Bharat vision by reducing reliance on imports and expanding domestic battery production.

India Lithium-Ion Battery Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 4.3 billion |

| Market Revenue Forecast in 2032 |

USD 25.3 billion |

| CAGR |

22.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Battery Type, By Voltage, By Power Capacity, By Industry |

| Regional Coverage | India |

| Companies Profiled | TDS Lithium-Ion Battery Gujarat Pvt. Ltd., Nexcharge (Exide Industries Ltd), Amperex Technology Ltd. (ATL), Exicom Tele-Systems Ltd., Ola Electric Mobility, Okaya Power Group, Toshiba, Panasonic, Amara Raja Energy & Mobility Ltd, Tata AutoComp Systems Ltd, Shizen Energy India, Loom Solar Pvt. Ltd., Samsung SDI India Private Limited among others; a total of 13 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

India Lithium-Ion Battery Market Research Report Segmentation

The India Lithium-Ion battery market is segmented into battery type, by voltage, by power capacity, by industry. Based on the Battery Type, the market is segmented into Lithium Nickel Manganese Cobalt (Li-NMC), Lithium Iron Phosphate (LFP) and Others. By Voltage, the market is segmented into Low (Below 12 V), Medium (12 V – 36 V) and High (Above 36 V). By Power Capacity, the market is segmented into Less Than 3,000 mAH, 3,000 TO 10,000 mAH, 10,000 TO 60,000 mAH, 60,000 mAH to 100 000 mAH, 100 000 mAH to 200 000 mAH and > 200 000 mAH. By Industry, the market is segmented into Consumer electronics, Tele-communication, Automotive, Aerospace & Defense, Industrial and Commercial

India Lithium Ion Battery Market by Battery Type

-

- Lithium Nickel Manganese Cobalt (Li-NMC)

- Lithium Iron Phosphate (LFP)

- Others

India Lithium Ion Battery Market by Voltage

-

- Low (Below 12 V)

- Medium (12 V – 36 V)

- High (Above 36 V

India Lithium Ion Battery Market by Power Capacity

-

- Less Than 3,000 mAH

- 3,000 TO 10,000 mAH

- 10,000 TO 60,000 mAH

- 60,000 mAH to 100 000 mAH

- 100 000 mAH to 200 000 mAH

- > 200 000 mAH

India Lithium Ion Battery Market by Voltage

-

- Consumer electronics

- Tele-communication

- Automotive

- Aerospace & Defense

- Industrial

- Commercial

India Lithium-Ion Battery Market Leading players

-

-

TDS Lithium-Ion Battery Gujarat Pvt. Ltd.

-

Nexcharge (Exide Industries Ltd)

-

Amperex Technology Ltd. (ATL)

-

Exicom Tele-Systems Ltd.

-

Ola Electric Mobility

-

Okaya Power Group

-

Toshiba

-

Panasonic

-

Amara Raja Energy & Mobility Ltd

-

Tata AutoComp Systems Ltd

-

Shizen Energy India

-

Loom Solar Pvt. Ltd.

-

Samsung SDI India Private Limited

-

Frequently Asked Question About This Report

India Lithium Ion Battery Market – Report Code [UP671A-00-0620]

India Lithium-Ion Battery Market size was estimated at USD 4.3 billion in 2024

Lithium-Ion Battery Market in India is driven by increasing electric vehicle adoption and strong EV sales, supportive government initiatives, rising demand from the battery energy storage sector, rapid growth in renewable energy deployment across India, and continuous improvements in EV driving range.

India Lithium-Ion Battery Market have significant growth potential and the market is forecast to reach USD 25.3 billion in 2032 and the market is projected to grow at a very high CAGR of 22.1% from 2025-2032.

Major players are TDS Lithium-Ion Battery Gujarat Pvt. Ltd., Exide Industries Ltd, Amperex Technology Ltd. (ATL), Exicom Tele-Systems Ltd., Ola Electric Mobility, Okaya Power Group, Toshiba, Panasonic, Amara Raja Energy & Mobility Ltd, Tata AutoComp Systems Ltd, Shizen Energy India, Loom Solar Pvt. Ltd., Samsung SDI India Private Limited and many more.

Lithium Nickel Manganese Cobalt (Li-NMC) chemistry accounted for 35% of the market share in 2024.

Consumer electronics end-use segment held the leading position, with a 32.2% market share in 2024.

Batteries with a capacity of less than 3,000 mAh represented the largest share, at 38.7% in 2024.

Cylindrical cells dominated the Indian lithium-ion battery market, contributing over 50% of total demand in 2024.

Related Reports

- Published Date: Feb-2026

- Report Format: Excel/PPT

- Report Code: UP671A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

India Lithium-Ion Battery Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research