Canada Automotive Aftermarket Market Size 2024

Canada Automotive Aftermarket market size was estimated at USD 22.4 billion in 2024 and is estimated to reach USD 29.0 billion in 2032 and the market is estimated to grow at a CAGR of 3.3% from 2025-2032 primarily driven by increase in vehicle in operation (VIO), robust new vehicle sales growth coupled with rise in vehicle age. The market present significant opportunities, with over millions of passenger vehicles are currently out of warranty in 2023, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Key Market Insights

Market Size:

-

- 2024 – USD 22.4 Billion

- 2032 – USD 29.0 Billion

- Market Forecast – CAGR of 3.3% from 2025-2032

Segment Insights

-

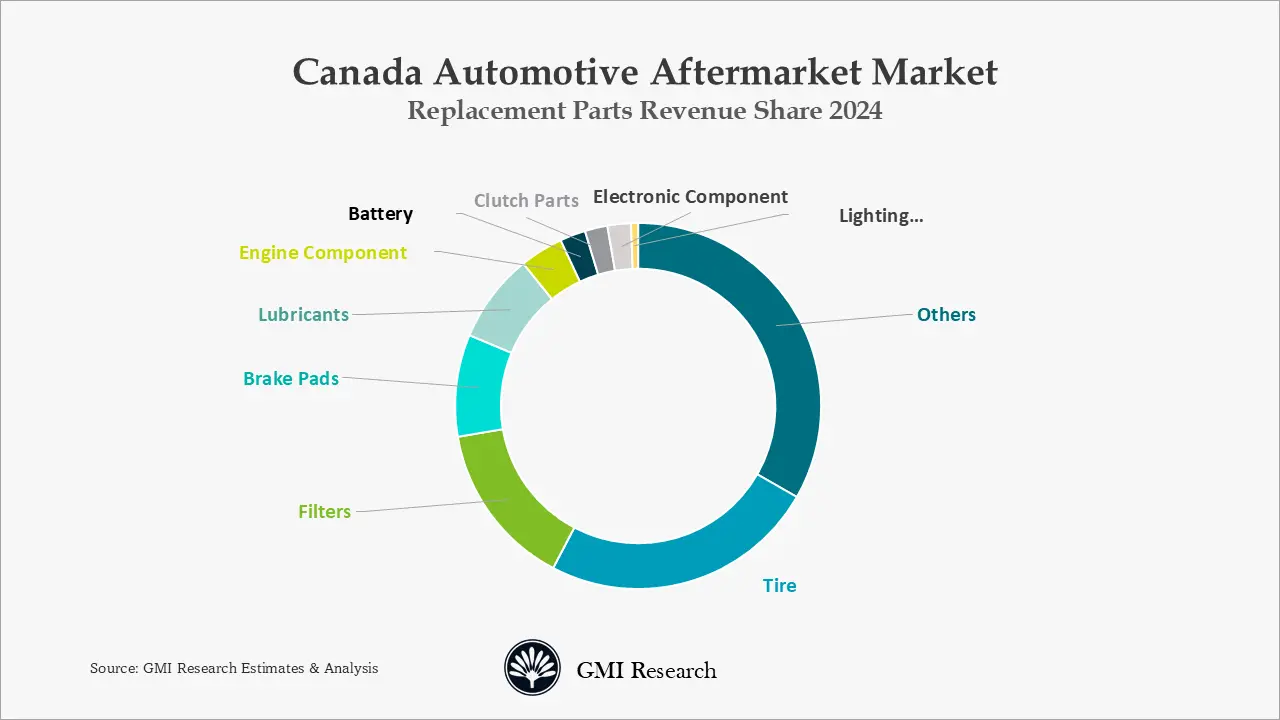

- Replacement Parts Type Insights: In Canada automotive aftermarkets, tire folds the largest market share in 2024.

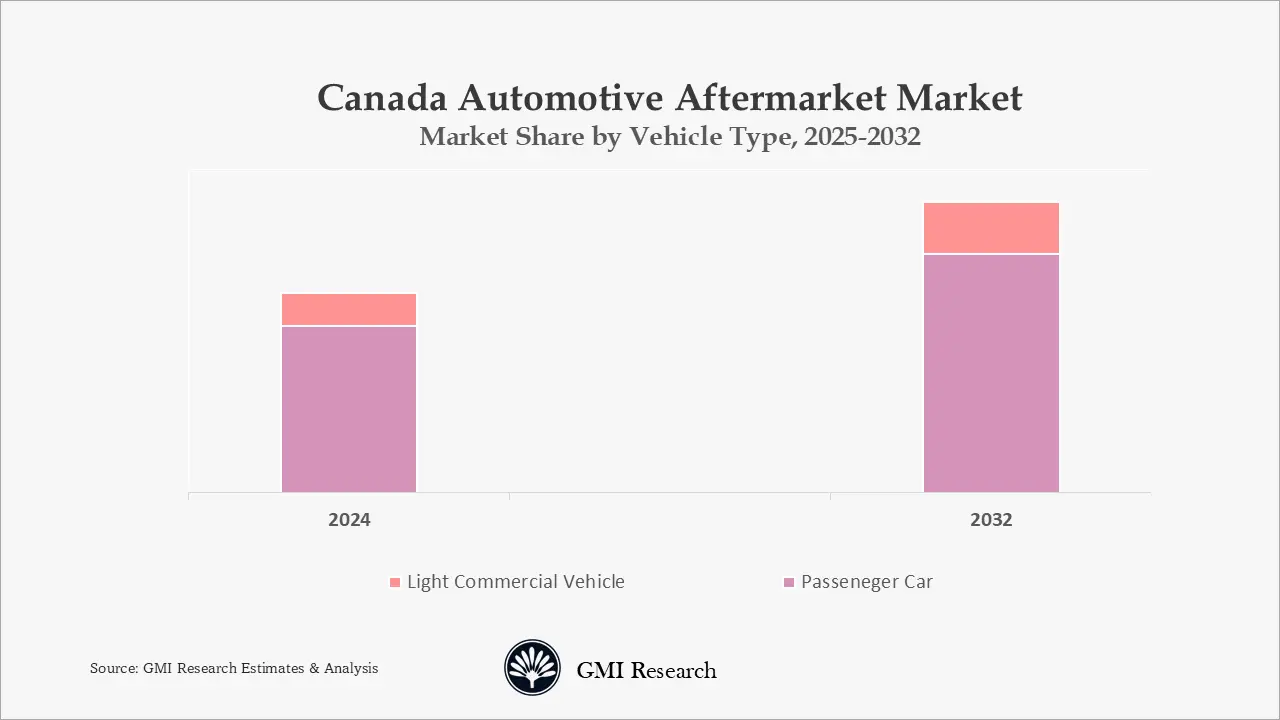

- Vehicle Type Insights: Passenger vehicles dominates the automotive aftermarket revenues.

- Parts Certification Type Insights: Genuine parts type dominated the market and hold the largest market share.

Canada Automotive Aftermarket Overview

Canada automotive industry is the second largest vehicle producer across the North America region. The industry provides employment to more than 125,000 people directly and 400,000 through aftermarket services. Canada is the one of the top 12 manufacturers of light vehicles and more than 1.4 million cars were assembled by the global players in the country. Major Automakers such as Ford, GM, Toyota, Honda and Stellantis supply around 700 auto parts, which makes Canadian automotive sector highly dependent on global supply chain. Automotive Parts Manufacturers Association was introduced by the country which represents OEM manufacturers of replacement parts, tools, aftermarket services and equipment.

Canada Automotive Aftermarket Parts and Component Market Drivers

Increasing Vehicle in Operation (VIO)

Canada has large number of registered vehicle and the vehicle in operation in Canada reached over 25 million vehicles in 2022 and the VIO is growing at a steady rate. Light-duty vehicles captured the lathest market share over 90% of the total vehicle registered in Canada the increase in VIO is generating demand for automotive aftermarket parts demand in Canada during the forecast period. As the vehicle age increases, the demand for replacement part will also increase, which will create more opportunities for the Canadian aftermarket in near future.

Robust New Vehicle Sales

Canadian new vehicle registration touched 1.8 million vehicles in 2024 and increase by 8.1% over 2023. The sales of new vehicles if projected to grow at a robust rate as Canada’s GDP growth is forecast at 2.0% in 2025 Vs. 1.1% in 2023 driven by a strong global outlook and a favourable, lower interest rates, growing exports. Big pickups are becoming more popular and currently captures half of the market share compared to 10% before 15 years, however sales of passenger car is on the decline from 40% to just merely 10% now.

Canada Auto Parts Market Segment Analysis

Canada Automotive Aftermarket Market Replacement Parts Insights: Tire is estimated to dominate the market share

Tire captures the largest market share of Canada auto parts market owing to rising tire sales as compared to other replacement parts as tire undergo maximum wear and tear and need to be changed more frequently. Tires demand in Canada is driven primarily by stable demand from passenger vehicles and light trucks. The sales of other parts types is also projected to soar due to led by increase in the age of vehicle, increase in VIO among others.

Canada Automotive Aftermarket Market Vehicle Type Insights: Passenger vehicles segment is projected to grow at the faster CAGR.

Passenger cars and light trucks owing to their largest share in the overall VIO and this trend is projected to continue over the forecast period. The parts which are Canada in servicing, put all these parts together make up a big portion of automotive aftermarkets revenue in Canada. The market for light commercial vehicle aftermarket is expected to expand at a healthy over 2025-2032.

Canada Automotive Aftermarket Market Certification Type Insights: Genuine parts segment is estimated to hold the largest market share

The desire of the consumers to choose the same efficiency, performance and less maintenance cost of the light weight vehicles is the key driver for the genuine parts market. Replacement parts market for original parts is driven by customer’s preference towards the quality, reliability of the car and assures replacement parts which conform to quality and warranty of the car manufacturers. Original parts are manufactured by the same company that built your car. These parts are made to the car manufacturer’s requirements and standards. The main advantage of original spare parts is that they are compatible assured. Since these are made for the exact make and model this should fit perfectly, since that is how it is supposed to. Most OEM parts come with a warranty so there is less need to worry of damage or breakdown.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

The sale for certified is also expected to increase at the fast pace during the forecast period, as the certified parts are manufactured by the manufacturers who manufacture parts for the OEM as well. Although these parts doesn’t carry OEM logo, OES is the same as OEM are used in new vehicle parts.

Aftermarket parts demand is constant due to its lower cost vs. OEM and OES though the quality level of aftermarket parts varies greatly between manufacturers. Some other aftermarket parts meet or exceed the quality procedures of certified parts, but at a substantially reduced cost.

Canada Automotive Aftermarket Industry Major Players & Competitive Landscape

Several leading companies are Toyota, ACDelco, Ford, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

Canada Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 22.4 Billion |

| Market Revenues Forecast in 2032 |

USD 29.0 Billion |

| CAGR |

3.3% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | Canada |

| Companies Profiled | Toyota, ACDelco, Ford, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental among others; a total of 11 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Canada Automotive Aftermarket Market Research Report Segmentation

Canada Automotive Aftermarket has been segmented on the basis of vehicle type, replacement part, certification. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

Canada Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Canada Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electroniccomponents

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

Canada Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Canada Automotive Aftermarket Leading players

-

- Toyota

- ACDelco

- Ford

- Denso

- Robert Bosch

- Delphi

- Champion

- Valeo

- Bridgestone

- Hella

- Continental

Frequently Asked Question About This Report

Canada Automotive Aftermarket market

Canada automotive aftermarket size was USD 22.4 billion in 2024.

Canada Automotive Aftermarket market growth is driven by increase in vehicle In operation (VIO), robust new vehicle sales growth coupled with rise in vehicle age. The market present significant opportunities, with over millions of passenger vehicles are currently out of warranty in 2023, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Tire dominates the Canada automotive aftermarket revenue.

The Canada automotive aftermarket is projected to grow at a steady CAGR of 3.3% from 2025-2032, the market is forecast to reach USD 29 billion in 2032.

Canada automotive aftermarket is dominated by Toyota, ACDelco, Ford, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

Related Reports

- Published Date: Feb-2025

- Report Format: Excel/PPT

- Report Code: UP3494-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Canada Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research