Brazil Automotive Aftermarket Market Size 2024

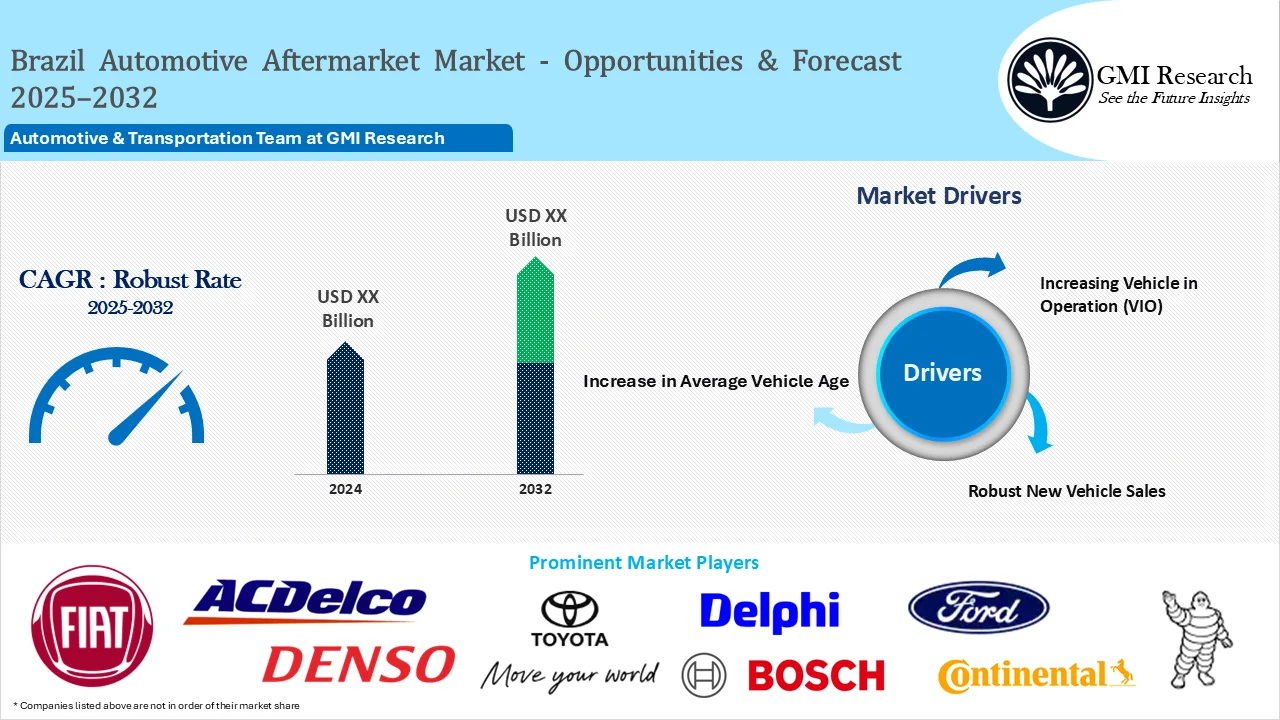

Brazil Automotive Aftermarket Market size is forecast to grow at a steady CAGR between 2025 and 2032 primarily driven by increasing VIO, robust new vehicle sales coupled with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Brazil Automotive Aftermarket Overview

Brazil Automotive Industry has been constantly expanding and developing in terms of production and sales. The Brazil automotive industry is one of the largest vehicle producers across the globe. This is driven by the increasing investment by the international companies such as BMW, Fiat, Kia, Suzuki, Land Rover, Mercedes-Benz, Volkswagen, Audi, among others. In addition, favourable environment has further increased the domestic demand. The Brazilian government is focussing on improving the business environment, incentives for the technological advancement and rising foreign investment in the Brazil automotive industry. The government is further promoting vehicle export and facilitating new trade agreements with other Latin America countries.

Brazil Automotive Aftermarket Parts and Component Market Drivers

Increasing Vehicle in Operation (VIO)

Brazil has one of the largest vehicle in operation globally, as per WHO the country has more than 93 million vehicle registered in 2016, As the sales of new vehicle is growing at robust rate the VIO is forecast to increase at a steady growth rate. In Brazil, the average vehicle age is on the rise and currently more than one third of the vehicles in operation are between the age of 10 to 15 years, and the share of vehicle less than 4 years old is decline to one fourth. This change is VIO is owing to slowdown in vehicle sales in last couple of years. The ageing vehicle fleet is providing impetus for Brazil auto parts market growth during the forecast period as they go through more wear and tear.

Robust New Vehicle Sales

Brazil new passenger vehicle sales reached 1.9 million units in 2024 and the sales surged by 13.2% compared to 2023 and 2024 is the best year for car sales since 2007. The market is forecast to continue this positive growth momentum in 2025 with sales projections at 8.4% growth over 2025. The vehicles sales in Brazil is primarily driven by growing domestic demand improving employment opportunities and growing disposable income.

Brazil Auto Parts Market Segment Analysis

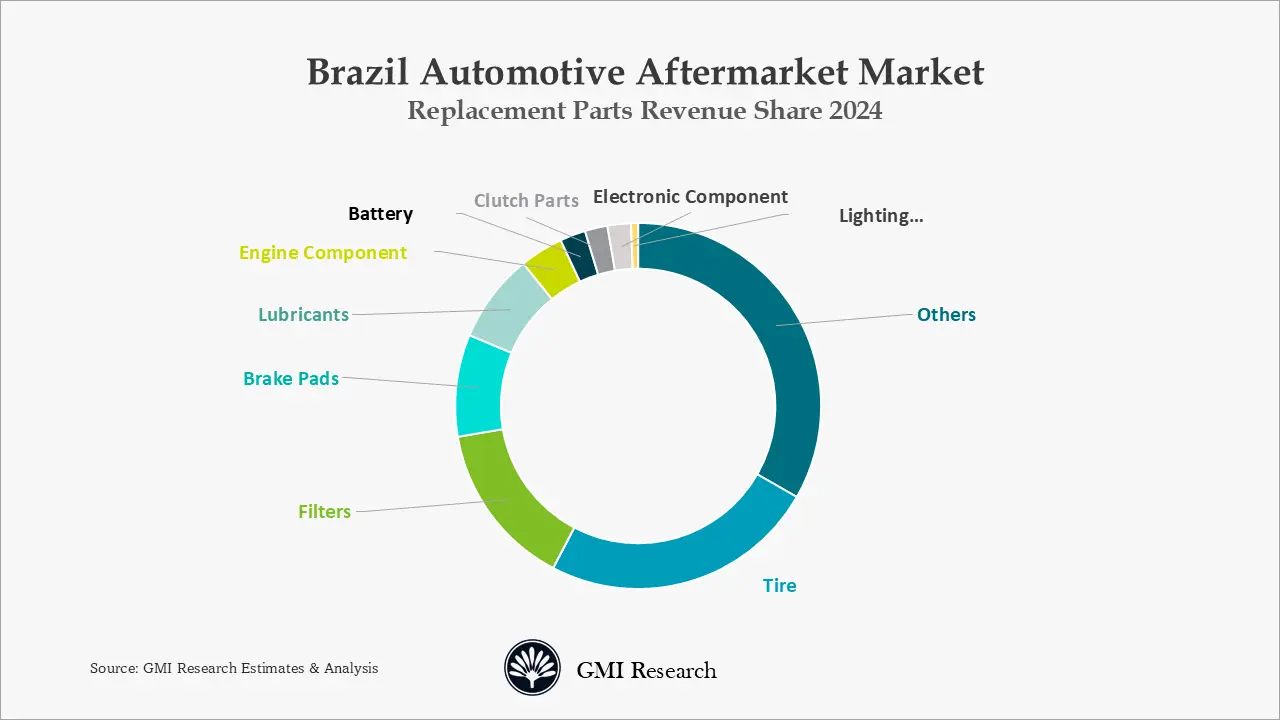

Brazil Automotive Aftermarket Market Replacement Parts Insights: Tire dominated the market share

Tires captures the largest market share of Brazil auto parts market, increase in tire sales relative to other replacement parts since tires undergo greater wear and require frequent replacing. The demand for tires is caused by steady demand from cars and light trucks. The need for replacement parts has also been anticipated to soar due to the growing age of vehicles, increasing vehicle off the road (VIO) trends, among others.

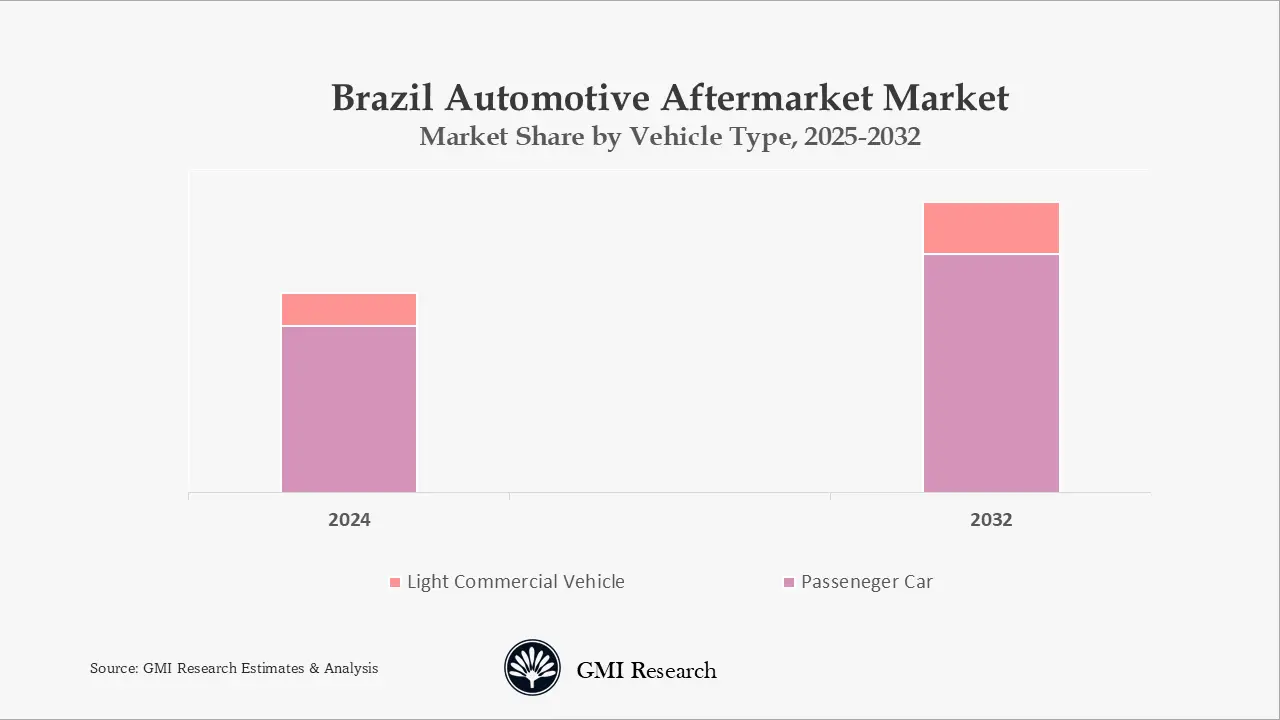

Brazil Automotive Aftermarket Market Vehicle Type Insights: Passenger vehicles is forecast to grow at the faster CAGR.

Passenger vehicles captured the largest market share owing to as passenger cars forms the largest share in the total VIO and passenger cars will dominate the VIO in the years to come. The demand for aftermarket parts for light commercial vehicles are projected to grow at a steady rate.

Brazil Automotive Aftermarket Market Certification Type Insights: Genuine parts to grow at a robust rate

The demand of genuine parts are driven by customer’s inclination towards parts quality, reliability and also to go for the best fitment as these parts are manufactured by car manufacturers with the same level of parts quality when the car was manufactured. Although genuine parts the parts with highest price tag compared to OEM and aftermarket parts. The demand for OEM and aftermarket parts is also projected to grow at a robust rate as these parts are preferred for the lower price compared to genuine parts.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

The quality of aftermarket parts varies greatly among different manufacturers. However, demand remains consistent because cost is lower than OEM and OES parts. In fact, some aftermarket parts exceed the quality of certified parts quality procedures yet come at a much lower price.

Brazil Automotive Aftermarket Industry Major Players & Competitive Landscape

Several leading companies are FCA Brazil, Volkswagen, ACDelco, Toyota, Ford, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

Brazil Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | Brazil |

| Companies Profiled | FCA Brazil, Volkswagen, ACDelco, Toyota, Ford, Denso, Robert Bosch, Delphi, Champion, Valeo, Bridgestone, Hella, Continental among others; a total of 13 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Brazil Automotive Aftermarket Market Research Report Segmentation

Brazil Automotive Aftermarket has been segmented on the basis of vehicle type, certification, replacement part. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

Brazil Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Brazil Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

Brazil Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Brazil Automotive Aftermarket Leading players

-

- FCA Brazil

- Volkswagen

- ACDelco

- Toyota

- Ford

- Denso

- Robert Bosch

- Delphi

- Champion

- Valeo

- Bridgestone

- Hella

- Continental

Frequently Asked Question About This Report

Brazil Automotive Aftermarket Market [UP3496-001001]

Brazil automotive aftermarket size was USD XX billion in 2024.

Brazil Automotive Aftermarket market growth is driven by increasing VIO, robust new vehicle sales coupled with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust growth rate between 2025-2032.

Tire dominates the Brazil automotive aftermarket revenue.

The Brazil automotive aftermarket is projected to grow at a steady CAGR from 2025-2032.

Brazil automotive aftermarket is dominated by FCA Brazil, Volkswagen, ACDelco, Toyota, Ford, Denso, Robert Bosch, Hyundai, Delphi, Champion, Valeo, Bridgestone, Hella, Continental and many more.

Related Reports

- Published Date: Mar-2025

- Report Format: Excel/PPT

- Report Code: UP3496-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Brazil Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research