Big Data Security Market Size, Share, Growth Opportunities, Outlook, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2023-2030

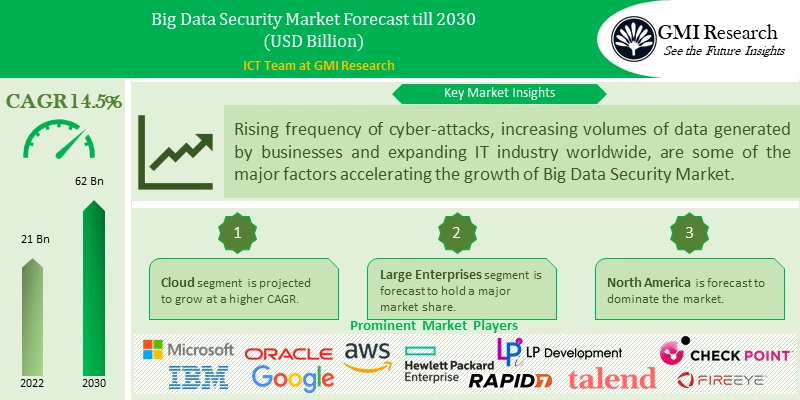

Big Data Security Market registered a revenue of USD 21 billion in 2022 and is projected to reach USD 62 billion in 2030, growing at a very high CAGR of 14.5% during the forecast period from 2023-2030 attributed to increasing adoption of advanced technologies by companies and rising concerns related to data security and privacy.

To have an edge over the competition by knowing the market dynamics and current trends of “Big Data Security Market”, request for Sample Report here

Major Big Data Security Market

Big Data Security Market is primarily driven by increasing frequency of target based cyber-attacks on businesses, huge amounts of data generated by companies from multiple sources and rapid growth in the Information Technology (IT) sector. Over the years, significant increase in targeted attacks has been observed worldwide. Big corporations are the prime target for attackers who are planning to cause data breaches, because these corporations offer large pay load which includes personal identifiable information phone number, name, address, license number and social security numbers. This results in data breaches and, such incidences are increasing the demand for big data security solutions. For instance, over 4100 publicly disclosed data breaches were reported, which disclosed 22 billion records in 2021, as per Risk based security and flashpoint report, this figure is projected to exceed by 5% in 2022.

Moreover, integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) with big data security solutions and increasing investments by major players on research and development, are some of the additional factors supplementing the Big Data Security Market size. Companies are focusing on adopting cloud-based solutions for big data security because it can be accessed from anywhere as per convenience, requires minimal hardware, simplifies the process of managing data and is cost-effective, which is further creating growth opportunities for Big Data Security Market. However, high installation cost of bid data security solutions and low-cybersecurity budgets in emerging start-ups are restricting the market growth.

Enterprises have significantly increased the use of big data to improve their business processes, as a result they are facing problems related to effective handling, processing, maintaining privacy and managing transaction logs. This continuous growth in big data is not only confined to efficient use of such data, but hackers are also developing effective solutions, which are capable of penetrating security walls of such data. Traditional security systems cannot sustain cyber-attacks from hackers, which is increasing demand for effective cyber-security products.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Cloud segment is projected to grow at a higher CAGR attributed to increasing demand for cloud-based big data security solutions by SMEs and large enterprises.

Cloud deployment of big data security is gaining popularity in market because it provides speed, increases scalability and improve IT security of organizations, which is one of the major factors boosting the segment’s growth. While on-premises deployment offer organizations more control over big data security solutions such as next-generation intrusion prevention systems and next-generation firewalls.

Large Enterprises segment is forecast to hold a major market share

Large Enterprises segment is forecast to hold a major market share

Large organizations are increasingly deploying big data security solutions to protect their critical assets such as endpoints, data centres, network, and applications from unauthorized from malicious ransomware, which is one of the major factors propelling growth of the segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

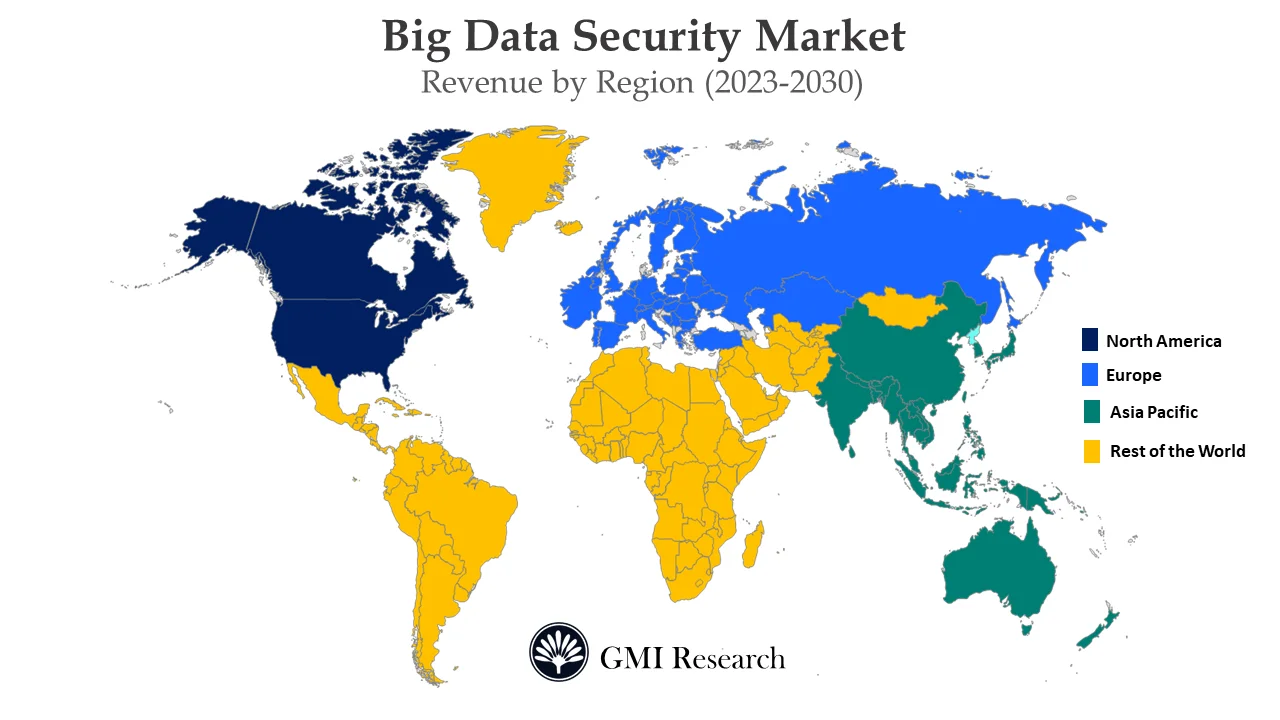

Based on Region, North America is estimated to dominate the market

Big Data Security Market in North America is driven by presence of the leading players such as Microsoft Corporation, IBM and Oracle, increasing adoption of IoT based devices and increasing frequency of cyber-attacks. Additionally, various industries in North American region are adopting big data security solutions for enhancing risk management and customer marketing skills, which is further propelling the market growth.

Top Market Players

Top Market Players

Various notable players operating in the market, include Microsoft Corporation, IBM, Oracle, Google, Amazon Web Services (AWS), Hewlett Packard Enterprise Development LP, Talend, Check Point Software Technologies Ltd., FireEye, Inc., and Rapid7, among others.

Key Developments:

-

- In August 2022, Anaconda announced its partnership with Oracle to offer secure open-source Python and R tools and packages by embedding Anaconda’s repository across OCI Artificial Intelligence and Machine Learning Services.

- In August 2022, Barclays Bank PLC (Barclays) and Microsoft Corporation signed a multi-year agreement under which Barclays will streamline its existing communications and collaboration solutions with team and will replace several point solutions, which were previously used by the company.

- In July 2022, IBM acquired Databand.ai, a key vendor of data observability software that helps enterprises to solve problems with their data, which includes errors, pipeline failures, and inferior quality before they influence their bottom line. This acquisition will IBM’s software portfolio across data, AI, and Automation.

- In May 2022, Oracle announced expansion of its built-in security services and capabilities for Oracle Cloud Infrastructure (OCI), which will help protect cloud applications and data of customers from emerging threats.

- In October 2020, IBM announced to expand its Cloud Pak for Security, which includes new data sources, integrations, and services, thus allowing security operations teams to manage full threat lifecycle from a single console.

- In February 2020, Oracle announced its expansion of cloud interoperability partnership with Microsoft with interconnect, which will allow businesses to operate between Microsoft Azure and Oracle cloud regions within the European Union data district.

- In July 2020, Google introduced announced two new security offerings, Confidential VMs and Assured Workloads, to simplify security operations and strengthen data protection.

Segments Covered in the Report:

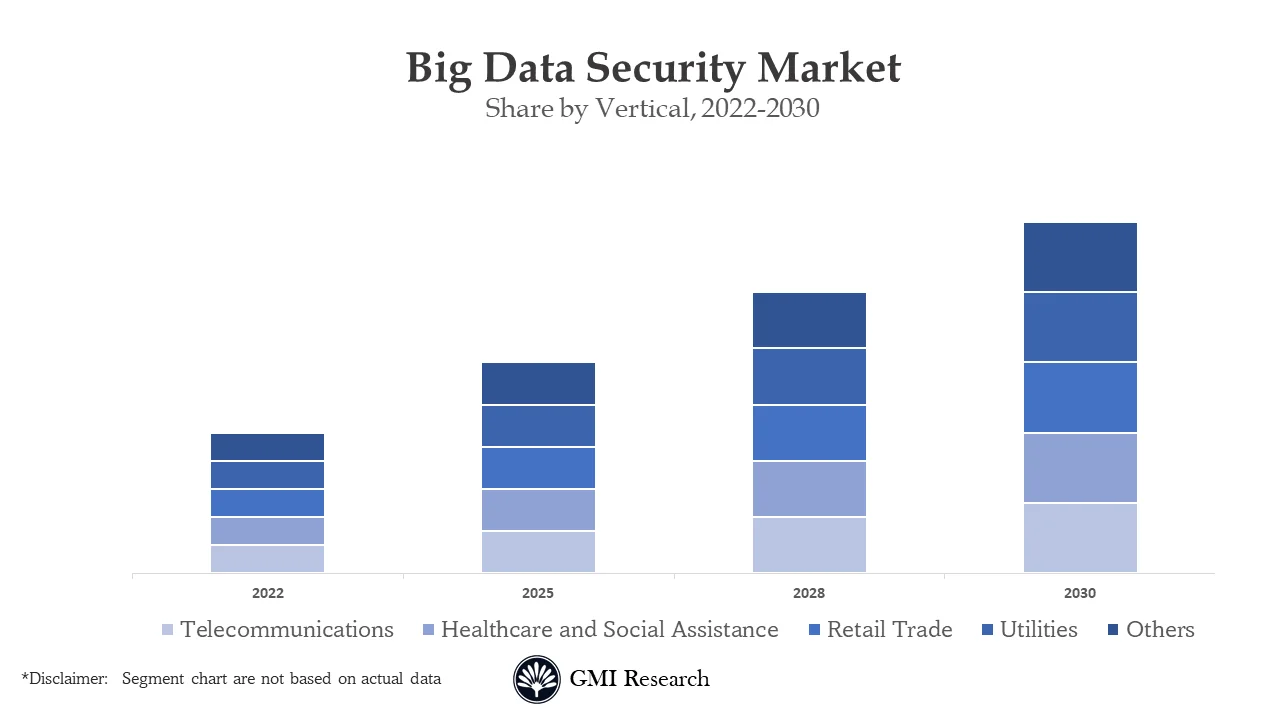

The Global Big Data Security Market has been segmented on the basis of Component, Deployment Mode, Organization Size, Vertical and Region. Based on Component, the market is segmented into Software and Services. Based on Deployment Mode, the market is segmented into Cloud and On-Premises. Based on Organization Size, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises. Based on Vertical the market is segmented into Information Technology and Information Technology-Enables Services, Telecommunications, Healthcare and Social Assistance, Retail Trade, Utilities, and Others.

For detailed scope of the “Big Data Security Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 21 billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Component, By Deployment Mode, By Organization Size, By Vertical, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Microsoft Corporation, IBM, Oracle, Google, Amazon Web Services (AWS), Hewlett Packard Enterprise Development LP, Talend, Check Point Software Technologies Ltd., FireEye, Inc., and Rapid7, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Big Data Security Market by Component

-

- Software

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption

- Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

- Services

- Software

Global Big Data Security Market by Deployment Mode

-

- Cloud

- On-Premises

Global Big Data Security Market by Organization Size

-

- Large Enterprises

- Small and Medium-sized Enterprises

Global Big Data Security Market by Vertical

-

- Information Technology and Information Technology-Enables Services

- Telecommunications

- Healthcare and Social Assistance

- Retail Trade

- Utilities

- Others

Global Big Data Security Market by Region

-

-

North America Big Data Security Market (Option 1: As a part of the free 25% customization)

- By Component

- By Deployment Mode

- By Organization Size

- By Vertical

- US Market All-Up

- Canada Market All-Up

-

Europe Big Data Security Market (Option 2: As a part of the free 25% customization)

- By Component

- By Deployment Mode

- By Organization Size

- By Vertical

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Big Data Security Market (Option 3: As a part of the free 25% customization)

- By Component

- By Deployment Mode

- By Organization Size

- By Vertical

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Big Data Security Market (Option 4: As a part of the free 25% customization)

- By Component

- By Deployment Mode

- By Organization Size

- By Vertical

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Major Players Operating in the Big Data Security (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Microsoft Corporation

- IBM

- Oracle

- Amazon Web Services (AWS)

- Hewlett Packard Enterprise Development LP

- Talend

- Check Point Software Technologies Ltd.

- FireEye, Inc.

- Rapid7

Frequently Asked Question About This Report

Big Data Security Market [UP2139-001001]

North America region is expected to dominate the market during the forecast period. Various organizations in this region such as Intel, are focusing on embracing their big data environment.

Big Data Security Market is projected to grow at a CAGR of 14.5% over the forecast period.

The top key players in this market include Microsoft Corporation, IBM, Oracle, Google, Amazon Web Services (AWS), Hewlett Packard Enterprise Development LP, Talend, Check Point Software Technologies Ltd., FireEye, Inc., and Rapid7, among others.

Cloud segment is projected to grow at a higher CAGR during the forecast period. Cloud based deployment of big data security solutions offers, speed, scalability and improved IT security.

- Published Date: Apr - 2023

- Report Format: Excel/PPT

- Report Code: UP2139-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Big Data Security Market Size, Share, Growth Opportunities, Outlook, Statistics, Market Scope, Revenue, Research, Trends Analysis & Global Industry Forecast Report, 2023-2030

$ 4,499.00 – $ 6,649.00

Why GMI Research