No products in the cart.

Automotive Sensors Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

Report Description

Table Of Content

Sample Request

Request For Customization

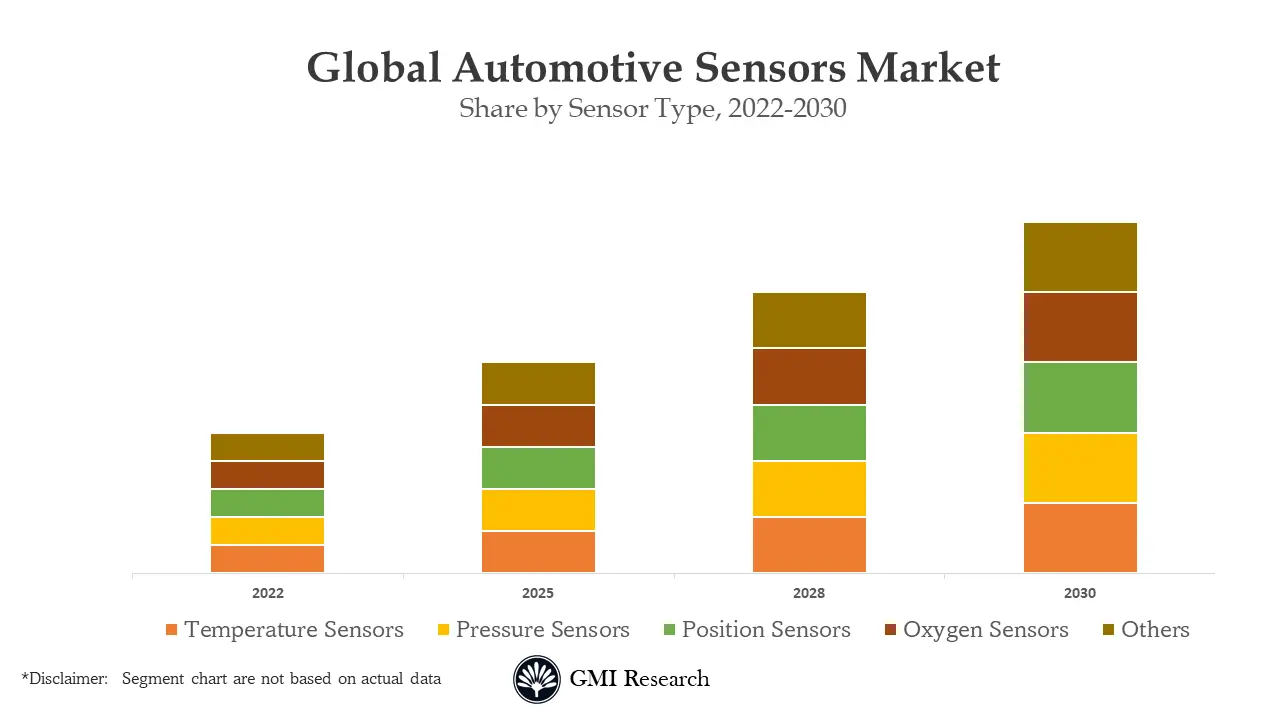

Automotive Sensors Market size reached USD 31.6 billion in 2022 and is forecast to touch USD 74.4 billion in 2030, and the market is expected to grow at a whopping CAGR 11.3% over the forecast period attributed to growing demand for connected cars worldwide.

To have an edge over the competition by knowing the market dynamics and current trends of “Automotive Sensors Market”, request for Sample Report here

To have an edge over the competition by knowing the market dynamics and current trends of “Automotive Sensors Market”, request for Sample Report here

Key Automotive Sensors Market Drivers

Automotive Sensors Market is primarily driven by rising adoption of autonomous vehicles around the world, growing need to reduce greenhouse gas emissions and increasing demand for high quality security and tracking systems in vehicles. Nowadays, a lot of people rely on cars for commuting to work, as per our estimates approximately 75% Americans use their own cars to travel between home to work. However, in recent years number of road accidents have significantly increased due to rising urbanization in cities coupled with increasing population growth rates and lack of safety features in cars, which are pushing the demand for Autonomous Vehicles. It is estimated that around 58 million units of autonomous vehicles to be sold globally by 2030, which will increase growth opportunities for Automotive Sensors Market in upcoming years.

Strict regulations imposed by governments to reduce to carbon emission levels and surge in the adoption of Advanced Driver Assistance Systems (ADAS) in vehicles, are supplementing the Automotive Sensor Market share in the overall Automotive Market. For Instance, during the COP 26 Summit 24 countries including top 6 Automobile Markets such as India, United States and China, pledged to end the sales and production of production which runs on combustion engines, to tackle problems related to global warming and carbon emissions. Such initiatives are promoting electrification in vehicles, which will push the demand for automotive sensors in the forthcoming years. However, aftermarket for automotive sensors is underdeveloped in developing countries, which is restricting the growth of Automotive Sensors Market.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Based on Sales Channel, Original Equipment Manufacturer (OEM) segment is projected to dominate the market

Surge in the demand for automobiles worldwide along with technological advancements in sensor connectivity, have pushed the sales of automotive sensors through Original Equipment Manufacturers (OEMs). Moreover, addition of new features such as clear surrounding visuals and vehicle location tracking in automotive sensors, is projected to have a positive impact on segment’s growth.

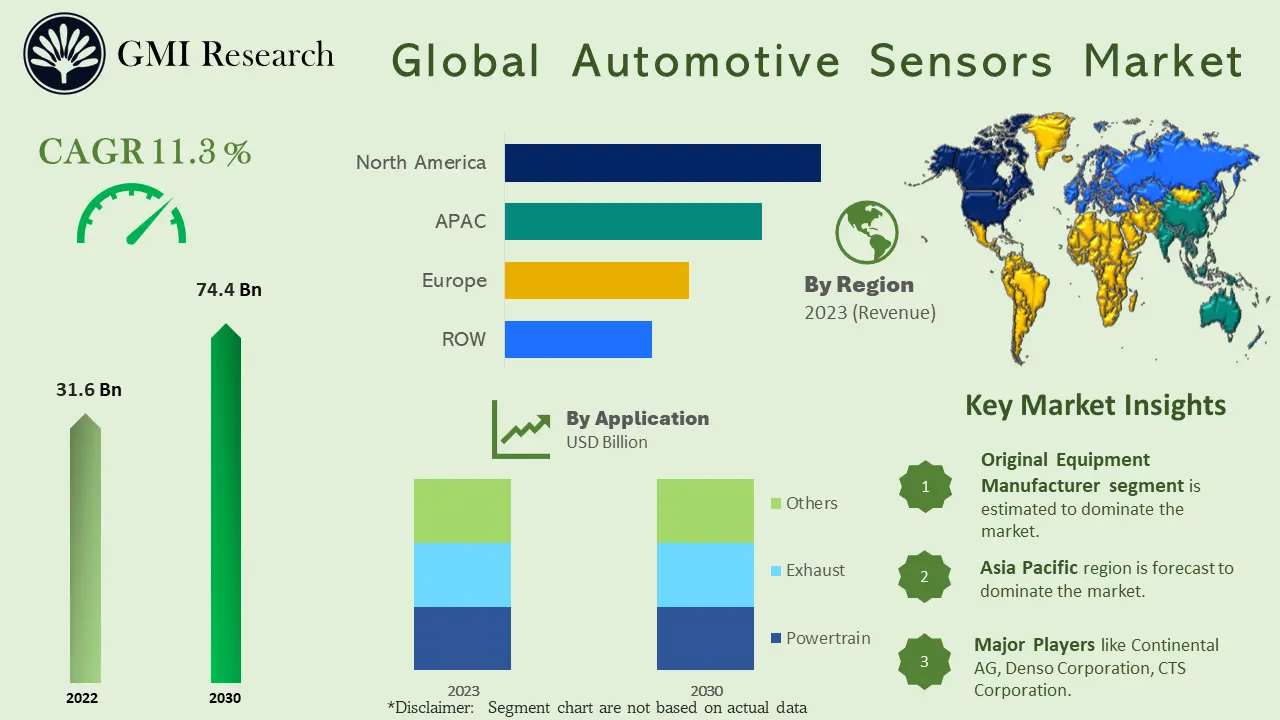

Position Sensors segment is estimated to lead the market due to increasing demand for connected cars

Position Sensors segment is estimated to lead the market due to increasing demand for connected cars

Automotive position sensors market is driven by increasing focus of manufacturers on incorporating advanced technologies in passenger and commercial vehicles due to increasing consumers preference for cars with enhanced safety features. In addition, sensors are increasingly used in areas such as vehicle seat and gear shifters to ensure, all components of vehicles are working properly functioning.

Passenger Cars segment is forecast to hold the largest Automotive Sensor Market size

OEMs are increasingly using automotive Sensors in passenger cars to enhance passenger’s safety, improve safety and reduce carbon emissions. In addition, government initiatives to improve road infrastructure and rise in disposable incomes of consumers in developing countries such as India and Brazil, are pushing the demand for passenger vehicles.

Automotive Powertrain Sensors Market is projected to lead the Automotive Sensors Market

Increasing usage of position, gas and temperature in powertrain and safety control systems along with strict regulations imposed by governments to reduce emissions, are some of the factors augmenting segment’s growth.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

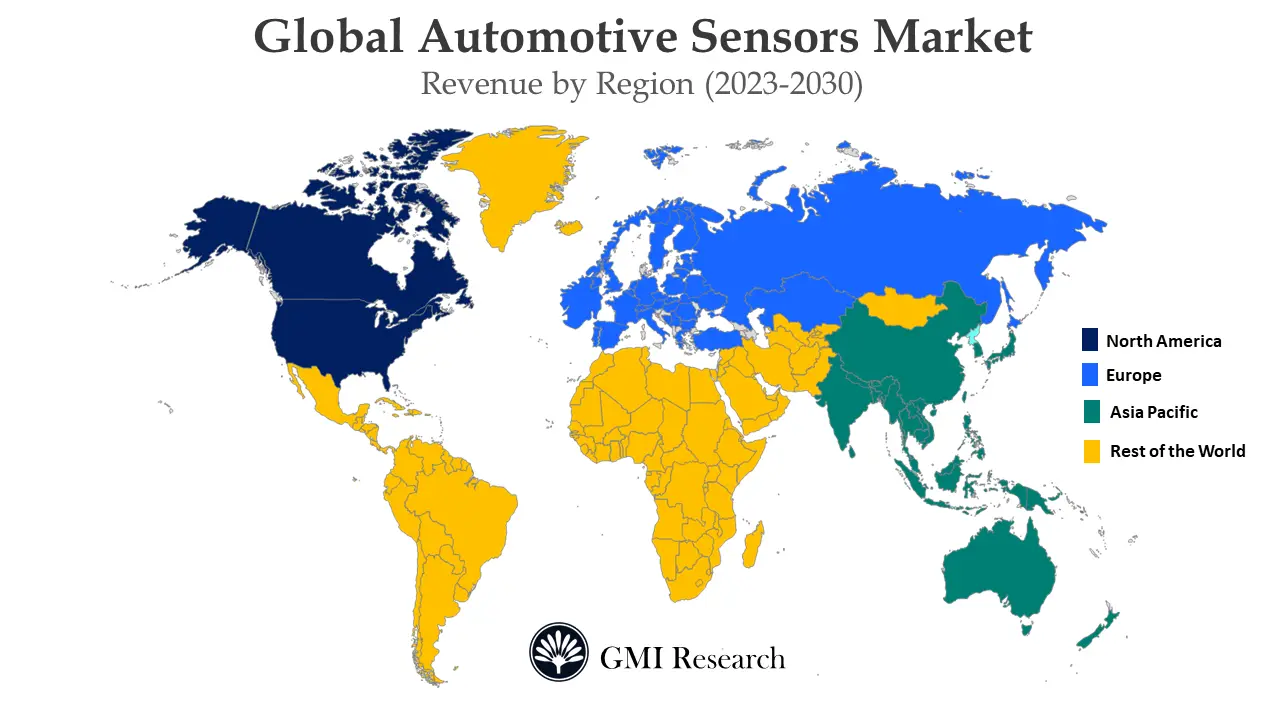

Based on Region, Asia-Pacific region is forecast to hold the largest market share

Asia-Pacific Automotive Sensors Market is propelled by growing demand for electric vehicles, Government regulations mandating the usage of advanced technologies to increase safety in vehicles and growing popularity of autonomous vehicles. Electric vehicles industry in India is growing at a rapid pace. Retail sales of Electric vehicles in India is projected to account for 4.7% of the total automobile sales during the calendar year. As per the data available at government’s Vahan website, more than 9,89,000 EVs are already registered with regional transport offices, such trends are creating growth opportunities for automotive sensors in the region. In addition, increasing investments in infrastructure development of Automotive sector and rising per capita incomes of consumers, are pushing the market growth in Asia-Pacific.

Top Automotive Sensor Manufacturers:

Various notable players operating in the global Automotive Sensors market include Robert Bosch GmbH, Continental AG, BorgWarner Inc., Denso Corporation, Infineon Technologies AG, Sensata Technologies, Inc., Allegro MicroSystem, LLC, Analog Devices, Inc., Elmos Semiconductor SE, and CTS Corporation among other companies.

Key Developments:

-

- In June 2022, Allegro MicroSystems, Inc., during the Sensors Coverage Conference in San Jose, CA, launched its A33110 and A33115 magnetic position sensors. These sensors are designed for ADAS applications which required high levels of accuracy and heterogenous signal redundancy.

- In November 2021, Robert Bosch GmbH announced the launch of its advanced driver-assistance system for city rail transportation. This system uses signal to warn the driver in case of collision.

- In October 2021, Infineon Technologies AG announced the launch of its automotive current sensor— XENSIV TLE4972, which makes use of Infineon’s well-proven Hall technology for precise current measurements.

- In April 2021, Honda launches its modern Advanced Driver Assistance System (ADAS) for a range of vehicles available in Japan.

- In 2021, Melexis, a leading microelectronics engineering company, launched two new non-contact position sensors. This product launch helped the company to expand its portfolio and complement the existing MLX90364/5/6/7 products.

- In September 2020, Aeva Inc., entered into a partnership with auto supplier ZF Friedrichshafen AG to manufacture major self-driving sensors for the company.

- In April 2020, Infineon Technologies AG announced that it has acquired Cypress Semiconductor Corporation. Through this acquisition, Cypress will add a differentiated portfolio of microcontrollers, connectivity components, software ecosystems and high-performance memories.

Segments Covered in the Report:

The global automotive sensors market has been segmented on the sales channel, sensor type, vehicle type, application, and region. On the basis of sales channel, the market is segmented into OEM and aftermarket. On the basis of sensor type, the market is segmented into temperature, pressure, position, oxygen, nitrogen oxide, speed, inertial, image, and others. On the basis of vehicle type, the market is segmented into passenger cars, LCVs, and HCVs. On the basis of application, the market is segmented into powertrain, chassis, exhaust, safety & control, body electronics, telematics, and others.

For detailed scope of the “Automotive Sensors Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2022) |

USD 31.6 Billion |

| Market Base Year |

2022 |

| Market Forecast Period |

2023-2030 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Sales Channel, By Sensor Type, By vehicle Type, by Application, and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Robert Bosch GmbH, Continental AG, BorgWarner Inc., Denso Corporation, Infineon Technologies AG, Sensata Technologies, Inc., Allegro MicroSystem, LLC, Analog Devices, Inc., Elmos Semiconductor SE, and CTS Corporation among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Automotive Sensors Market by Sales Channel

-

- Original Equipment Manufacturer (OEM)

- Aftermarket

Global Automotive Sensors Market by Sensor Type

-

- Temperature Sensors

- Pressure Sensors

- Position Sensors

- Oxygen Sensors

- Nitrogen Oxide Sensors

- Speed Sensors

- Inertial Sensors

- Image Sensors

- Other Sensors

Global Automotive Sensors Market by Vehicle Type

-

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

Global Automotive Sensors Market by Application

-

- Powertrain

- Chassis

- Exhaust

- Safety & Control

- Body Electronics

- Telematics

- Others

Global Automotive Sensors Market by Region

-

-

North America Automotive Sensors Market (Option 1: As a part of the free 25% customization)

- By Sales Channel

- By Sensor Type

- By Vehicle Type

- By Application

- US Market All-Up

- Canada Market All-Up

-

Europe Automotive Sensors Market (Option 2: As a part of the free 25% customization)

- By Sales Channel

- By Sensor Type

- By Vehicle Type

- By Application

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

-

Asia-Pacific Automotive Sensors Market (Option 3: As a part of the free 25% customization)

- By Sales Channel

- By Sensor Type

- By Vehicle Type

- By Application

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

-

RoW Automotive Sensors Market (Option 4: As a part of the free 25% customization)

- By Sales Channel

- By Sensor Type

- By Vehicle Type

- By Application

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

-

Global Automotive Sensors Market Players (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Robert Bosch GmbH

- Continental AG

- BorgWarner Inc.

- Denso Corporation

- Infineon Technologies AG

- Sensata Technologies, Inc.

- Allegro MicroSystem, LLC

- Analog Devices, Inc.

- Elmos Semiconductor SE

- CTS Corporation

Frequently Asked Question About This Report

Automotive Sensors Market

Automotive Sensors Market touched USD 31.6 billion in 2022 and is anticipated to reach USD 74.4 billion in 2030.

Robert Bosch GmbH, Continental AG, BorgWarner Inc., Denso Corporation, among others.

Asia-Pacific region is forecast to grow at the fastest rate.

- Published Date: Aug - 2022

- Report Format: Excel/PPT

- Report Code: UP1312A-00-0620

Get Free 25% Customization in this Report

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Automotive Sensors Market Size, Share, Trends and Growth Report – Global Opportunities & Forecast, 2023-2030

$ 4,499.00 – $ 6,649.00

SKU: UP1312A-00-0620

Categories: Electronics & Semiconductor, Published, Report Store

Tags: Automotive Sensors Market, Automotive Sensors Market Dynamics, Automotive Sensors Market Growth, Automotive Sensors Market Key players, Automotive Sensors Market Opportunity, Automotive Sensors Market Size, Automotive Sensors Market Trends

Why GMI Research