No products in the cart.

Press Release

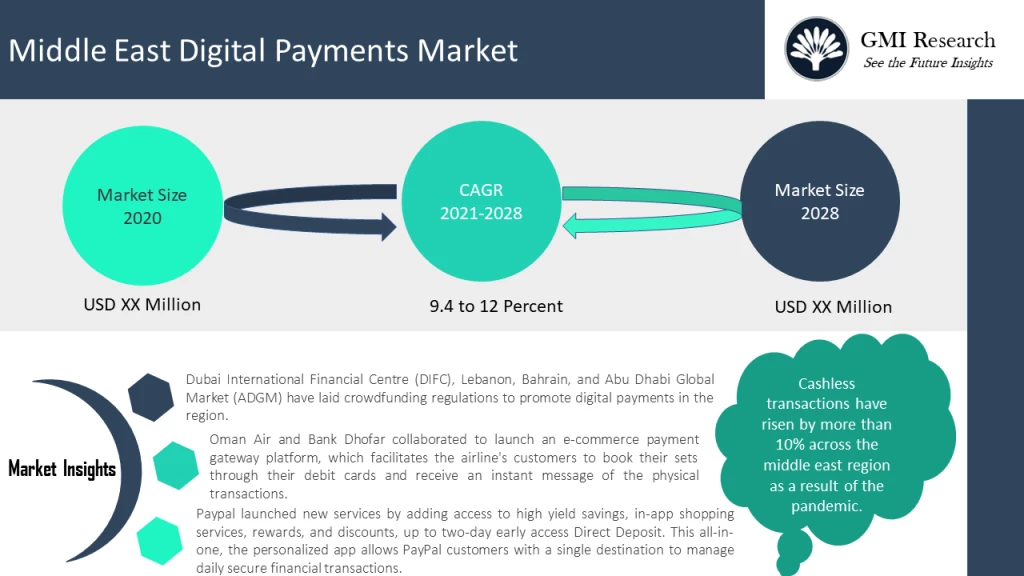

As per the GMI Research forecasts, the rising government initiatives to promote cashless transactions and the growing penetration of smartphones and the internet are the two significant drivers that are contributing to the growth of the Middle East Digital Payments Market. The market was estimated to be USD xx Million in 2020 and is predicted to reach USD xx million by the end of 2028 while growing at a CAGR of 9.4%-12% during the forecast period (2021-2028).

The Middle East Digital Payments Market is likely to experience an upsurge in demand over the forecast period. The increasing number of smartphone users owing to the rising internet penetration is the major factor that is surging the market growth. For instance, according to GSMA, the global mobile connections in 2019 stood at 8.98 billion and increased even significantly with prominent growth rates in the Middle East region. Furthermore, the increasing collaboration between the banks to promote digital payments is another significant factor driving the market’s growth in the middle east countries. For instance, in 2020, Oman Air and Bank Dhofar collaborated to launch an e-commerce payment gateway platform, which facilitates the airline’s customers to book their sets through their debit cards and receive an instant message of the physical transactions.

To have an edge over the competition by knowing the market dynamics and current trends of “Middle East Digital Payments Market”, request for Sample Report here

Moreover, the COVID-19 pandemic has accelerated digital adoption and a shift from cash, similar to other regions of the world. Cashless transactions have risen by more than 10% across the middle east region as a result of the pandemic. Also, according to a survey by Visa. and Dubai Economic, around 43 percent of consumers in the UAE will continue using digital payments more in stores, and 48 percent will increase their use of online payments with cards or digital wallets for future e-commerce transactions.

In addition to this, the rise in the number of fin-tech startups in the middle east region is another key factor contributing to the growth of the middle east digital payments market. The UAE is the leader in the fintech ecosystem, consisting of approximately 24% of the fin-techs in the region. The central banks of Egypt, UAE, and Bahrain have adopted regulations for online payment services. In addition, the Dubai International Financial Centre (DIFC), Lebanon, Bahrain, and Abu Dhabi Global Market (ADGM) have laid crowdfunding regulations to promote digital payments in the region.

On the basis of Mode of Payment, the Digital Wallets segment is expected to lead the Middle East Digital Payments Market during the forecast period. The adoption of digital wallets in middle east countries such as UAE, Saudi Arabia, and Bahrain has been expanding steadily in the past few years. This has been accelerated by the positive impact of the COVID-19 pandemic. The adoption of digital wallets is witnessed maximum in UAE among the middle east regions. The pay apps such as Samsung Pay, Apple Pay, and Google Pay allow saving of debit or credit card information and making payments by tapping a mobile phone on point-of-sale (POS) terminals using near-field communication (NFC) or by simply making online payments.

Key Developments:

- In 2021, Paypal launched new services by adding access to high yield savings, in-app shopping services, rewards, and discounts, up to two-day early access Direct Deposit. This all-in-one, the personalized app allows PayPal customers with a single destination to manage daily secure financial transactions.

- In 2021, Apple Inc. was working on its new upcoming service, “Apple Pay Later,” which allows its customers to pay for any Apple Pay purchase in installments over time.

- In 2019, Fiserv collaborated with two of the biggest technology and digital payments companies, Samsung and Visa, for software that will allow businesses to accept payments with the wave of a smartphone or tablet.

The Middle East Digital Payments Market is segmented into Mode of Payment and End-Users. Based on the Mode of Payment, the market has been segmented into Digital wallets, Debit/Credit cards, and Online Banking. Based on the End-Users, the market has been segmented into BFSI, Telecommunication, Transportation, Retail & E-commerce, Utility bills, and Others.