Press Release

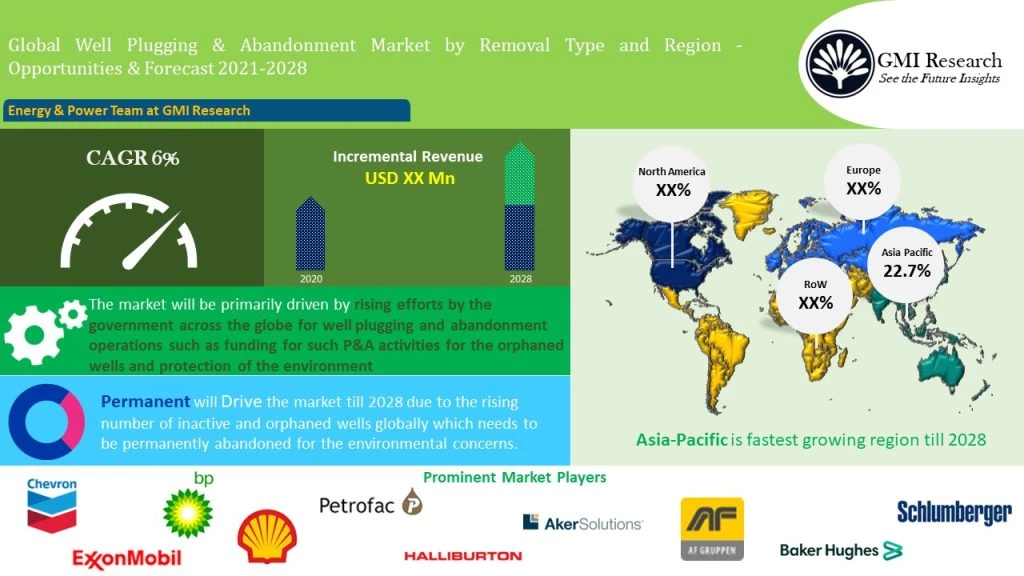

As per the GMI Research forecasts, rising number of maturing oil and gas fields stands to be the primary factor contributing to the growth of the global well plugging and abandonment market. The market was estimated to be USD 2,126 Million in 2020 and is predicted to reach USD xx Million by the end of 2028, while growing at a CAGR of 6.0% during the forecast period (2021-2028).

The majority of today’s oil and gas production comes from mature wells. For instance, 70% of the world production oil and gas comes from the oilfields which are greater than 20 to 30 years old. Aging offshore infrastructure oil fields that are active for 2-3 decades face a decline in production, which increases the liability on the company. For instance, the Ghawar oil field in Saudi Arabia started its production in 1951, which peaked its production in 2005 and currently the rate of the decline in the oil production is reported to be 8% per year.

To have an edge over the competition by knowing the market dynamics and current trends of “Global Well Plugging & Abandonment Market” request for Sample Report here

Similarly, the Burgan field in Kuwait was discovered in 1937 while started its production in 1948, which peaked its production in 2005 and currently reporting the decline in the oil production by 14% per year. Also, rising decommissioning of pipelines is driving the P&A market. For instance, in 2020, The decommissioning programme have been prepared in Norway to allow the decommissioning of the PL301. The Heimdal field was developed in several phases and consists of two platforms and several pipeline systems.

The rising efforts by the government across the globe for well plugging and abandonment operations such as funding for such P&A activities for the orphaned wells and protection of the environment are significant factors contributing to the growth of the global well plugging & Abandonment market. For instance, in April 2021, U.S House of Representatives Democrat introduced a bill authorizing USD 8 billion to plug and clean up abandoned oil wells nationwide, a measure aimed at creating jobs for oil and gas workers and reducing climate-warming emissions. The Department of Environmental Protection has lined up 500 priority and nearby wells that could be bid right away when stimulus funding arrives.

The rising research and innovations for the alternative materials for P&A operations is another major factor driving the growth of the global well plugging & abandonment market. Development and qualification of new alternative materials like Sandaband and ThermaSet are considered as some of the most important technological achievements in P&A. These innovative materials have been used on field for a Temporary P&A by BP in Norway Ula Well. Furthermore, in 2019, Rawwater Engineering Company Limited which invented the Bismuth Plug — are strong, formable and impermeable to withstand the rigors of both onshore and offshore applications, and the plugs can operate effectively from shallow to deep wells.

The presence of improperly abandoned wells which are either plugged incorrectly or are orphaned by their operators is a major restraining factor which is hampering the growth of the well plugging and abandonment market. Moreover, these wells are a major source of air and groundwater pollution, as they continue to leak toxic substances such as arsenic and methane even after they are no longer operational. Among the chemicals that can seep out and contaminate air, soil, or groundwater are hydrogen sulfide, benzene, and arsenic. For instance, in 2018, the orphaned and abandoned wells in the United States were collectively responsible for emitting 281,000 tons of methane into the atmosphere.

On the basis of removal type, permanent removal is expected to witness high market share over the forecast period. The increasing number of inactive or orphan wells globally is a significant factor driving the growth of this segment during the forecast period. For instance, in 2021, Alberta province has more than 80,000 inactive wells which are being planned to be permanently abandoned by the Liability Management Framework.

Based on region, Europe stands to be one of the key markets for well plugging and abandonment during the forecast period. In Europe, over 950,000 tons of topsides are scheduled for removal across the North Sea, out of which more than 605,000 tons will be from UKCS. The UK is expected to spend about EUR 15.3 billion on decommissioning, over the next ten years. Approximately, 2,400 wells are expected to be decommissioned across the whole North Sea and West of the Shetland region by 2027. Hence, such high opportunity for the P&A activities is driving the growth of the market in this region

Key Developments:

-

- In 2021, Baker Hughes officially announced that the company will abandon wells owned by NAM that are permanently being closed all over the Netherlands, which is jointly owned by Royal Dutch Shell and ExxonMobil.

- In 2021, Aker Solutions announced that it has signed a letter of intent with AF Gruppen to merge the two companies’ existing offshore decommissioning operations into a 50:50 owned company. By combining Aker Solutions’ offshore, engineering and project execution capabilities with AF Gruppen’s decommissioning and construction capabilities, the new company is aimed at increasing customer efficiency through the decommissioning process and maximize the recycling potential

The Global Well Plugging & Abandonment Market has been segmented on the basis of Removal Type. Based on the Removal Type, the market is segmented into Temporary and Permanent.