Mexico Automotive Aftermarket Market Size & Insights

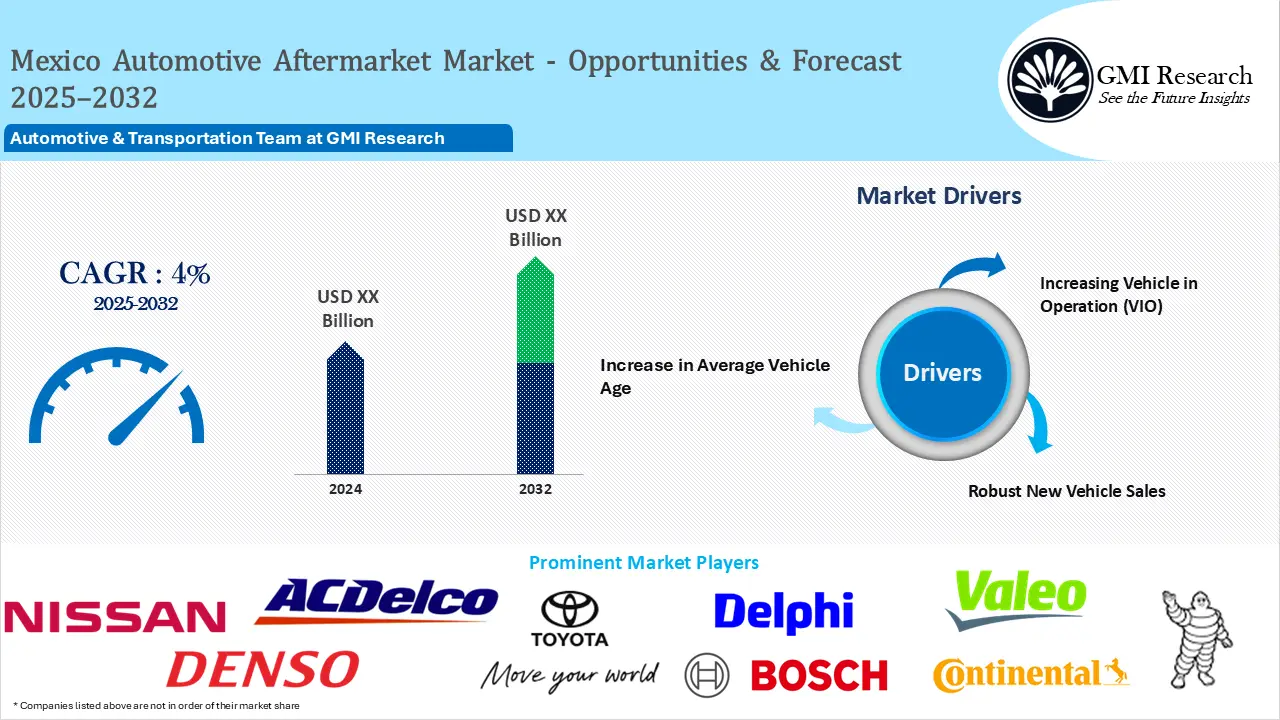

Mexico Automotive Aftermarket size is forecast to grow at a steady rate of 4% between 2025 and 2032 primarily driven by robust new vehicle sales, increase in number of registered vehicles (VIO), increase in vehicle age, and with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Key Market Insights

Market Size:

-

- Market Forecast – CAGR of 4% from 2025-2032

Segment Insights

-

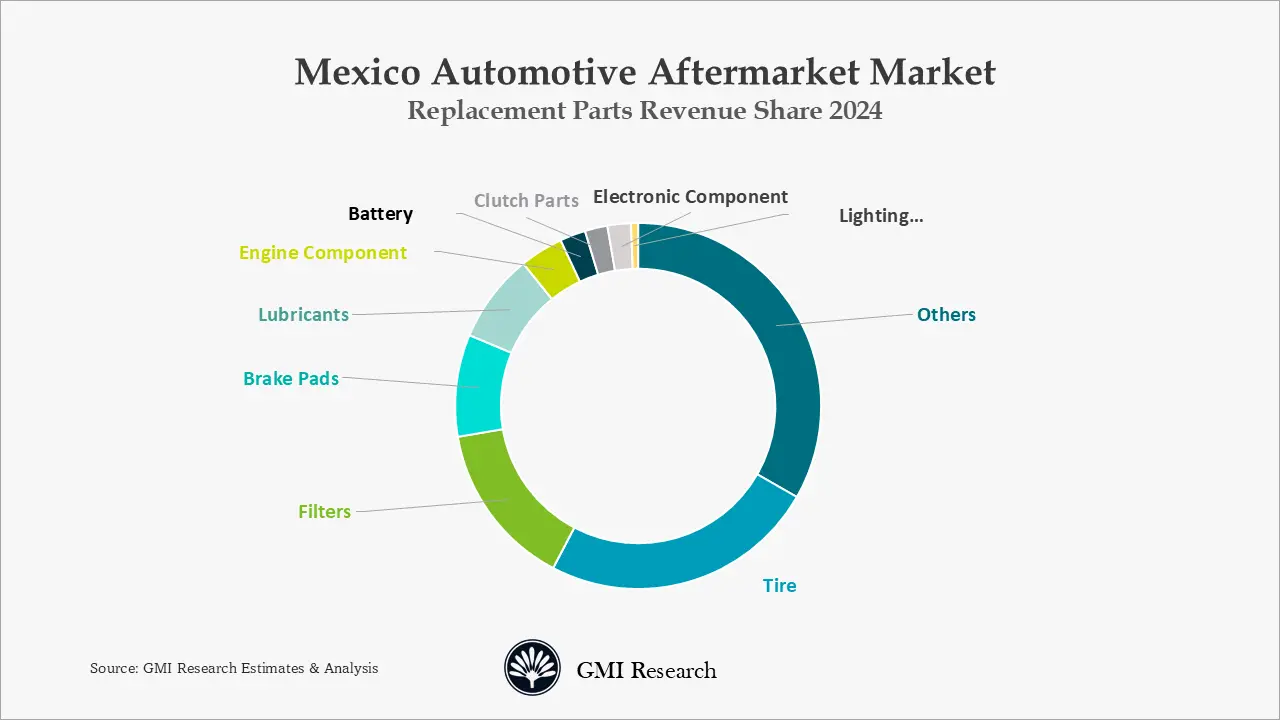

- Replacement Parts Type Insights: In Mexico, tire holds the largest market revenues in 2024.

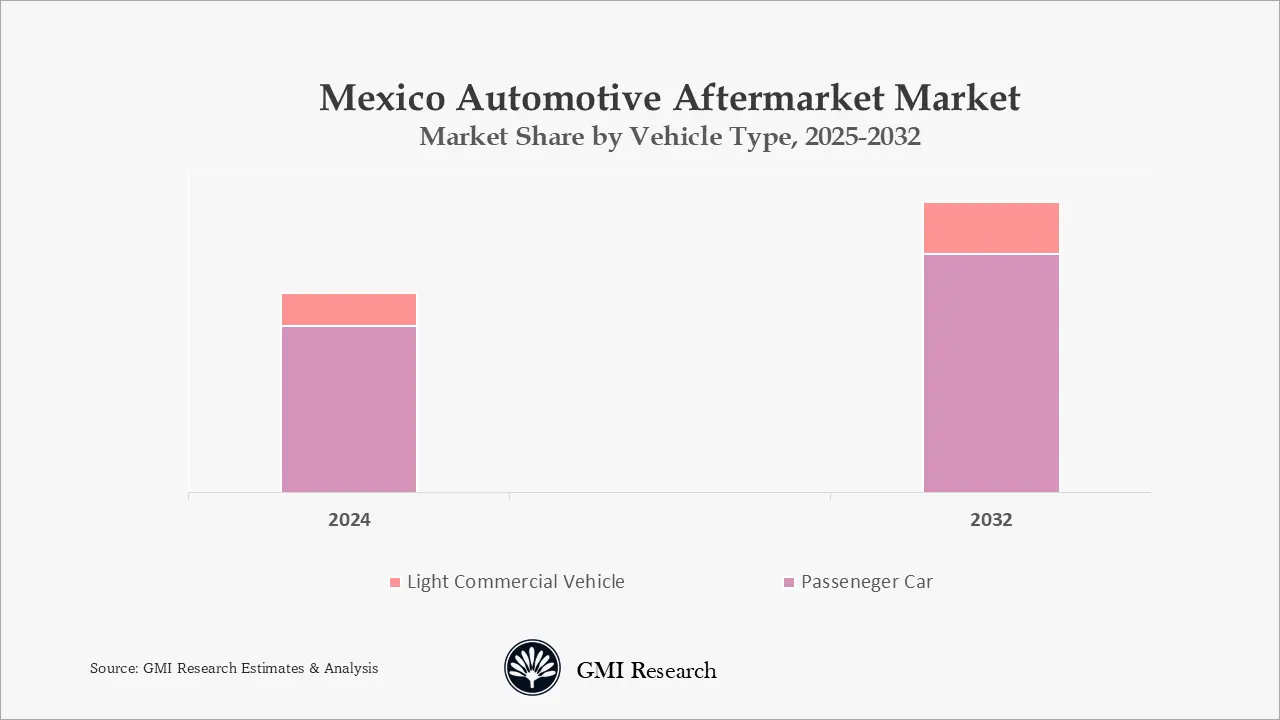

- Vehicle Type Insights: Passenger cars and light vehicle capture the largest market share of aftermarket market revenues in Mexico.

Mexico Automotive Aftermarket Market Drivers

Growth in New Vehicle Sales

The passenger vehicle sales in Mexico reached 635 thousand in 2024 an increased by 6.3% over 2023, however the commercial vehicle sales touched 919 thousand vehicles in 2024 with a growth rate of 12.3% over 2024 and the total vehicle units sales reached 1.55 million vehicle in 2024. The vehicle sales is driven by growing household spending and easy vehicle financing in the country, are driving the growth of the automotive aftermarket market in Mexico. Several popular car manufacturers, including Ford, GM, Chrysler, Nissan, Volkswagen, Toyota, and Honda, have established assembly plants in Mexico, which will drive the growth of Mexico’s automotive aftermarket market. In addition, this international existence highlights Mexico’s significance as a critical hub for automotive production, fascinating both Japanese and American automakers to leverage the country’s manufacturing capabilities and strategic location. These factors is further paving way for the Mexico Automotive Aftermarket. Moreover, favorable government initiatives such as Center for the Development of the Mexican Automotive Industry is introduced to provide training, consulting, technological R&D services to promote auto industry in Mexico.

Increasing Vehicle in Operation (VIO)

Mexico has huge vehicle in operations and the VIO is growing owing to robust new vehicle sales, the number of registered vehicle in Mexico reached 37 million vehicles. Robust economic growth driving rise in disposable income is forecast to increase the total number of cars registered in Mexico during the forecast period.

Rise in Out of Warranty Vehicles

In Mexico, the average vehicle age is on the rise reaching over 10 years, the rise in the average vehicle is driving demand for automotive aftermarket during the forecast period as older vehicle goes through more wear and tear and require major and frequent maintenance.

Mexico Automotive Aftermarket Market Segment Analysis

Vehicle Type Aftermarket Insights: Passenger cars and light vehicle dominate the market revenues

Considering the VIO, at present and in coming years, passenger cars will continue to dominate the VIO, and since passenger cars along with light trucks comprises of the maximum share of the VIO, thus passenger cars held maximum unit share. The market for light commercial vehicle aftermarket parts is expected to expand at a steady rate.

Replacement Parts Insights: Tire captured the largest revenue share

There is an increased demand for tire sales as compared to other replacement parts since the tires wear more. The need for tires is created by consistent demand from cars and light trucks. Replacement part demand also has been expected to rise because of the aging vehicle population, growing vehicle in operation (VIO) trend and other factors.

Mexico Automotive Aftermarket Market Overview

Mexico has established itself as a popular player in the global automotive market, positioning as the 7th largest passenger vehicle manufacturer in the world. In addition, the various initiatives taken by the Mexican Government to foster the automotive industry will benefit the aftermarket companies in Mexico Automotive Aftermarket Market. As per OICA in 2024, Mexico’s vehicle production reached 4.2 million units, the production increased by 5% over 2023. because of a growing number of sales of vehicles, setting its position as the 7th largest vehicle producing nation that year. For instance, the automotive aftermarket industry in Mexico is witnessing the fastest growth, primarily driven by robust demand, growing concern of customers concerning safety and comfort, advancement in distribution channels, and speedy economic development.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

As per the AMIA, 1.23 million vehicles were produced, accompanied by a large workforce. The growing demand for spare parts for vehicle modification, increase in the sale of new automobiles, growing concerns about vehicle safety, high investments by market players in research and development activities, and advancement in distribution channels are the expected key factors to drive the growth of the Automotive Aftermarket Market in Mexico. In 2024, the total FDI in auto parts industry reached USD 2.4 billion.

As per the Mexican Automobile Industry Association (AMIA), the significant impact of the North American Free Trade Agreement (NAFTA) on Mexico’s automotive industry. Over a period of more than 2 decades, from 1994 to 2016, Mexico’s light vehicle production saw valuable growth, increasing from 1.1 million units to approx. 3.5 million units. As the production of light vehicles rises, the demand for light automobiles increases which further creates the demand in Mexican Automotive Aftermarket Market. On the contrary, the counterfeit auto components is hindering the market growth.

Mexico Automotive Aftermarket Market Major Players & Competitive Landscape

Several leading companies are Nissan, Toyota, ACDelco, Volkswagen, Denso, Delphi, Bosch, Continental, Michelin, Valeo, Bridgestone, Hella, Continental and many more.

Mexico Automotive Aftermarket Market News

-

- In 2024, Yokohama laid the foundation of a new tire plant with an annual production capacity of 5 million tires, the Mexico plant is projected to start operations in the first quarter of 2027.

- In 2022, German auto parts producer Continental AG has announced a huge investment in the Mexican state of Guanajuato. The company planned to invest USD 209.48 million to open new factory and to expand its existing plant capacity in Mexico.

Mexico Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR |

4% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | Mexico |

| Companies Profiled | Nissan, Toyota, ACDelco, Volkswagen, Denso, Delphi, Bosch, Continental, Michelin, Valeo, Bridgestone, Hella, Continental among others; a total of 12 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Mexico Automotive Aftermarket Market Research Report Segmentation

The Mexico Automotive Aftermarket has been segmented on the basis of vehicle type, replacement parts, certification. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. By replacement parts, the market is segmented into tire, battery, brake parts, filters, Lighting Components, Electronic components, Lubricants, Clutch Parts, Engine Components and others. Based on certification, the market has been segmented into Genuine Parts, Certified Parts, Counterfeit Parts, Others.

Mexico Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Mexico Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electronic components

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

Mexico Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Mexico Automotive Aftermarket Leading players

-

- Nissan

- Toyota

- ACDelco

- Volkswagen

- Denso

- Delphi

- Bosch

- Continental

- Michelin

- Valeo

- Bridgestone

- Hella

Frequently Asked Question About This Report

Mexico Automotive Aftermarket [UP3495-001001]

How big is the Mexico Aftermarket Automotive Industry?

Mexico Automotive Aftermarket market growth is driven by robust new vehicle sales, increase in number of registered vehicles (VIO), and with over millions of passenger vehicles are currently out of warranty in 2024, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032.

Tire dominates the Mexico automotive aftermarket revenue and is continue to dominate during the forecast period till 2032.

The Mexico automotive aftermarket is projected to grow at a steady CAGR of 4% from 2025-2032.

Mexico automotive aftermarket is dominated by Nissan, Toyota, ACDelco, Volkswagen, Denso, Delphi, Bosch, Continental, Michelin Valeo, Bridgestone, Hella, Continental and many more.

Related Reports

- Published Date: Jan-2025

- Report Format: Excel/PPT

- Report Code: UP3495-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Mexico Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00

Why GMI Research