Vietnam Paints and Coatings Market Overview

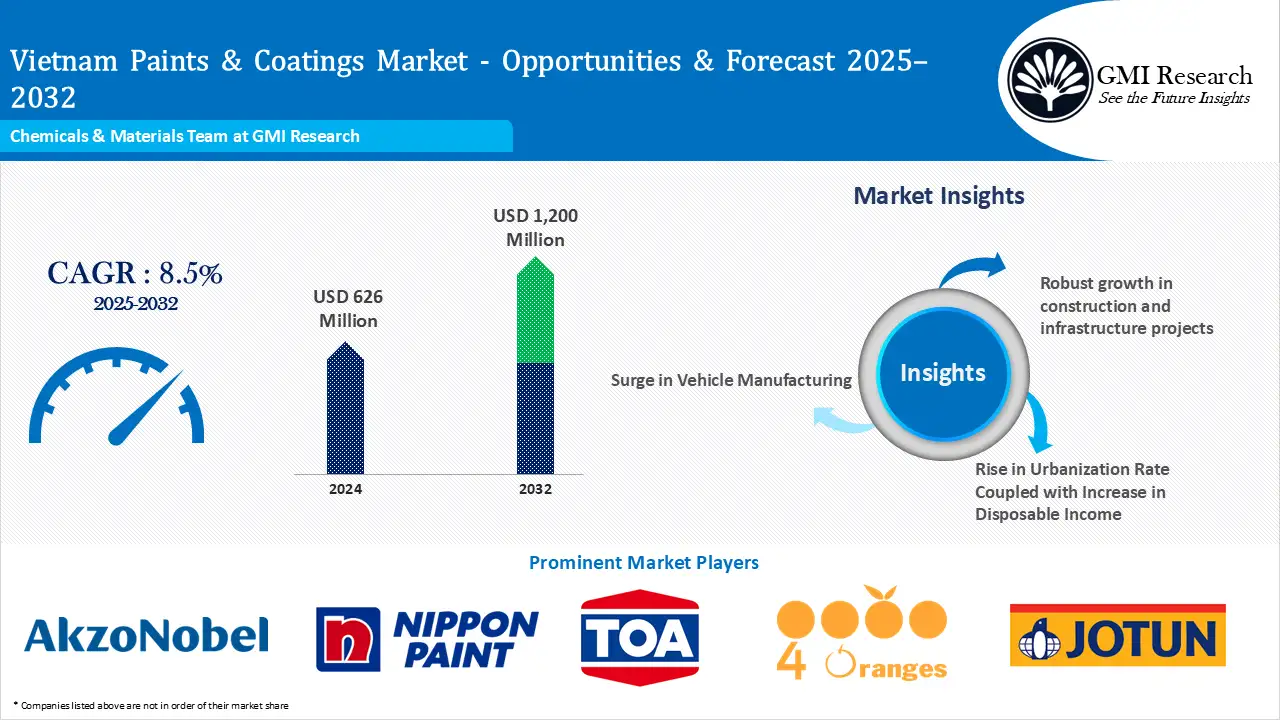

Vietnam Paints and Coatings Market size was valued at USD 626 million in 2024, and forecast to touch USD 1.2 billion in 2032, growing at a CAGR of 8.5% from 2025-2032 owing to robust growth in construction and infrastructure projects, rise in urbanization rate coupled with increase in disposable income, surge in vehicle manufacturing, government support & incentives.

Market Size, Forecast & Key Segment Insights

Market Size & Forecast:

-

- 2024 – USD 626 Million

- 2032 – USD 1.2 Billion

- Market Forecast – CAGR of 8.5% from 2025-2032

Segment Insights:

-

- Resin Type Insights: Acrylic resin type hold the largest market share in 2024

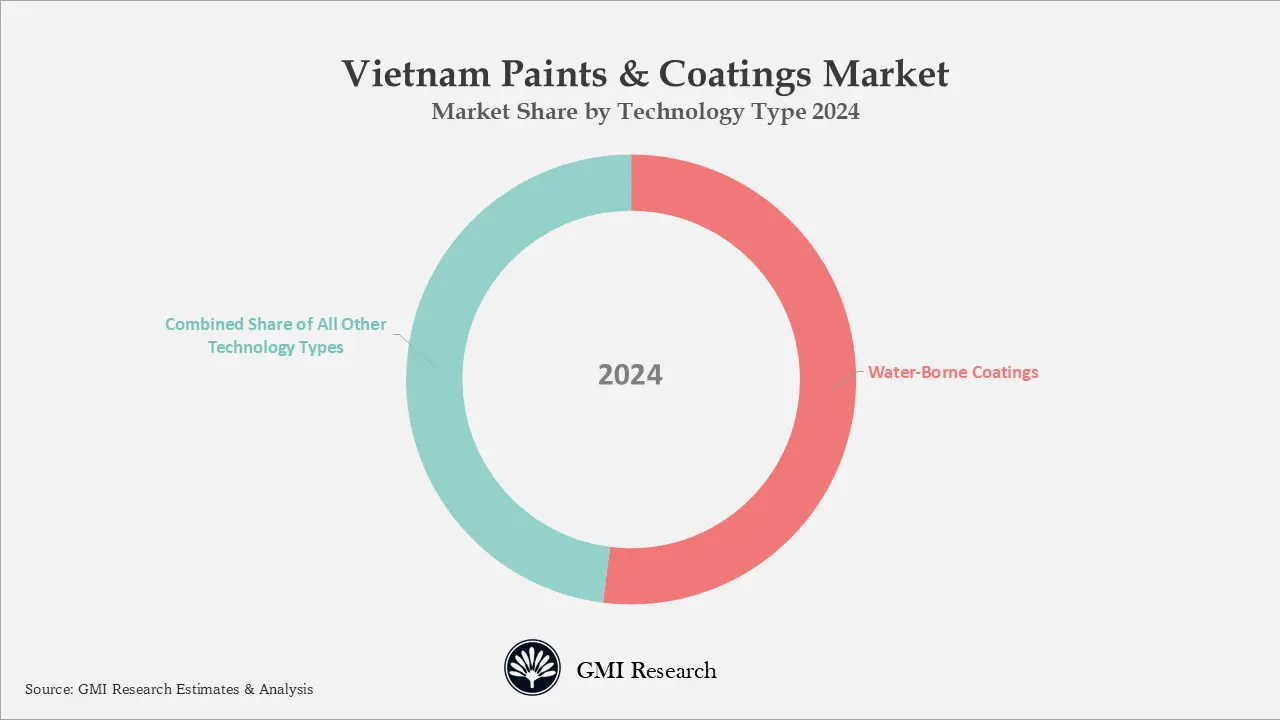

- Technology Type Insights: Waterborne segment hold the largest market share of 55% in 2024 and it is forecast to grow at a robust rate during the forecast period

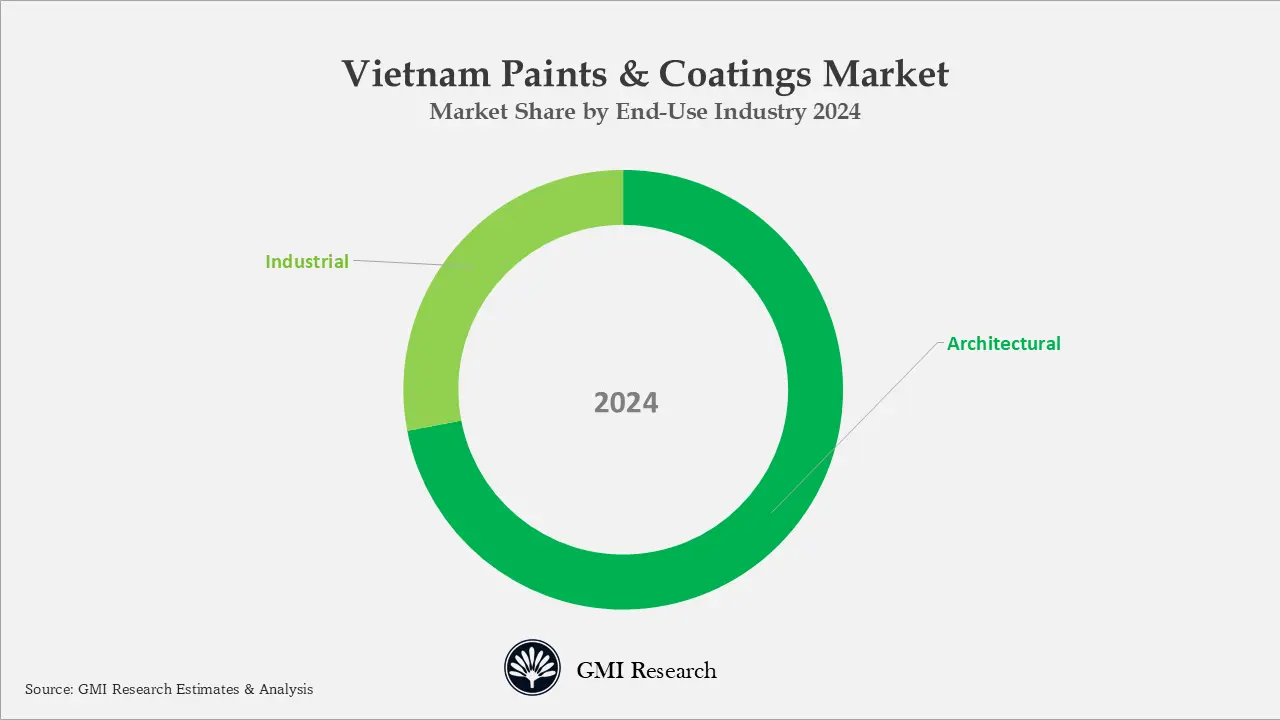

- End-Use Industry Insights: Architectural paints dominated the market revenues in 2024

- Regional Insights: South Vietnam holds the largest market share

Vietnam Paints and Coatings Market Growth Drivers

Robust Growth in Construction and Infrastructure Projects

The demand for paints & coating in Vietnam is largely attributed to the rise in construction projects across commercial and residential sectors that drives demand for architectural coatings. The real estate sector in the country is experiencing substantial growth with an increase in urban housing and commercial developments. The USD 9 billion in investment in urban development in 2024 which covers affordable residential properties or commercial spaces further drives a higher need for paints and coatings in construction projects. The Ministry of Construction reports that Vietnam launched 600,000 newly constructed residential units in 2023 which emphasizes the increased demand for paints and coatings for decorative and protective functions.

Industrial growth and infrastructure expansion also contribute greatly to the increased need for protective coatings. The Ministry of Construction intends to ramp up infrastructure investments by allocating about USD 15 billion in 2024 for new roads and urban expansion. The significant increase in public infrastructure spending drives the need for paints across the commercial and public sectors especially for projects including the North South Expressway which will require high-performance coatings.

Rise in Urbanization Rate Coupled with Increase in Disposable Income

Vietnam paints and coatings market growth is further driven by the increase in per capita income along with urbanization. The growing consumer purchasing power is leading to an increased demand for products like passenger vehicles which further fuels the growth in the automotive sector. The expansion of the automotive sector in the country increases the need for coatings that are essential for enhancing vehicle appearance and providing protection. The government is also focusing on developing the domestic automotive industry and drawing foreign investments thereby boosting the need for advanced automotive coatings in the near future.

Surge in Vehicle Manufacturing

The growth of vehicle manufacturing in the country is driving the demand for paints in Vietnam. In 2024, 175,000 units were manufactured and there are plans to take total vehicle manufacturing to 1.5 million vehicles by 2035, this is projected to drive the demands form paints & coating in the country during the forecast period.

Government Support & Incentives

The government introduced measures in 2023 which offered subsidies and tax reductions to motivate paint and coating manufacturing companies to increase their production capacity in Vietnam. This effort has led to a 15% growth in local output volume among the three leading domestic paint manufacturing companies. These measures aim to reinforce the local industry and stabilize the supply chain thus reducing the need for imports.

Are you Looking for a Partner for your Vietnam Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Vietnam market is the right choice for you.

Vietnam Paints and Coatings Market Segment Analysis

Resin Type Market Insights: Acrylic resin type hold the largest market share in 2024

Based on the resin type, acrylic is the largest segment in the market. Its leading position is driven by its adaptability and broad application across sectors including automotive and construction. Acrylic coatings provide outstanding durability and UV protection which makes them a popular option. The expanding construction sector and infrastructure initiatives in the country are further propelling the need for acrylic paints and coatings.

Technology Type Market Insights: Waterborne segment hold the largest market share of 55% in 2024 and it is forecast to grow at a robust rate during the forecast period

Based on technology, the waterborne coatings category is leading the market. This segment leadership is attributed to the increasing demand for eco-friendly products with low VOCs and better environmental benefits. Environmental concerns have led to a preference for waterborne paints which offer an eco-friendlier option in comparison to traditional solvent-based options. Waterborne coatings are increasingly popular in automotive and architectural sectors due to strict emission controls in these industries. The segment continues to grow owing to technological developments that improve durability and performance which solidify its popularity with consumers and manufacturing companies.

End-Use Industry Market Insights: Architectural paints dominated the market revenues in 2024

Based on end-use industry, architectural paint segment holds the largest share in Vietnam similar to many other countries in Asia fueled by the rapid real estate growth and the growing need for commercial and residential properties. The key factors behind the leading position are the protective and aesthetic benefits of architectural coatings that are crucial for improving and preserving contemporary structures. The extensive high-end housing projects reshaping the urban skylines will require substantial amounts of paint for the apartments within these buildings.

The industrial segment has experienced consistent growth in recent years driven by stable industrial expansion. The automotive industry is anticipated to be a key driver within industrial coatings growth in the country in the foreseeable future. Despite lower automotive production in comparison to neighbouring countries like Indonesia and Thailand, the automotive market in Vietnam is currently among the fastest growth in Southeast Asia. Even though still seen as a costly purchase, cars are becoming a more frequent sight across Vietnamese city roads standing alongside motorcycles as one of the main forms of transportation for urban residents.

Regional Insights: South Vietnam holds the largest market share

Based on region, South Vietnam holds the leading position in the market fueled by its thriving economy, ongoing infrastructure projects along with significant demand for construction. The status of Ho Chi Minh City as a commercial center reinforces the leading position of this region. The North, led by Hanoi’s thriving real estate market ranks second with the West and East areas holding smaller shares yet showing growth potential. The market demand is being led by major cities including Hanoi and Ho Chi Minh City fueled by their robust infrastructure development and industrial growth.

Vietnam Paints and Coatings Market Major Players & Competitive Landscape

Several leading companies operating in the market are AkzoNobel, Nippon Paint, Toa Vietnam, 4 Oranges Co., Ltd, Jotun Paints, KOVA Group, Dong Tam, Alphanam, Hoa Binh among others. International companies dominate the market with major internation players capturing more than two third of the market share and also solidifying their presence through innovative products, extensive distribution channels and a loyal customer base.

Key Vietnam Paints and Coatings Market Developments

In 2023, AkzoNobel introduced a new environmentally responsible paint range in Vietnam designed to minimize environmental harm and enhance air quality. It has raised its local production output to address increasing demand which highlights its dedication to environmental sustainability and its targeted approach in the Vietnamese market.

Vietnam Paints and Coatings Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 626 million |

| Market Revenue Forecast in 2032 |

USD 1.2 billion |

| CAGR |

8.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Resin Type, By Technology, By End-Use Industry |

| Regional Coverage | Vietnam |

| Companies Profiled | AkzoNobel, Nippon Paint, Toa Vietnam, 4 Oranges Co., Ltd, Jotun Paints, KOVA Group, Dong Tam, Alphanam, Hoa Binh , among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Vietnam Paints and Coatings Market Research Report Segmentation

Vietnam Paints and Coatings Market has been segmented on the basis of Resin Type, Technology, and End-use Industry. Based on the Resin Type, the market is segmented into Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others. Based on the Technology, the market is segmented into Water-borne Coatings, Solvent-borne Coatings, Powder-based, and Others. Based on the End-use Industry, the market is segmented into Architectural and Industrial. The Architectural segment is further segmented into Residential and Non-Residential. The Industrial segment is further segmented into General Industrial, Protective, Automotive, Wood, Marine, Packaging, and Others.

Vietnam Paints and Coatings Market by Resin Type

-

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

Vietnam Paints and Coatings Market by Technology

-

- Water-borne Coatings

- Solvent-borne Coatings

- Powder-based

- Others

Vietnam Paints and Coatings Market by End-Use Industry

-

- Architectural

- Residential

- Non-Residential

- Industrial

- General Industrial

- Protective

- Automotive

- Wood

- Marine

- Packaging

- Others

- Architectural

Vietnam Paints and Coatings Market Leading players

-

-

AkzoNobel

-

Nippon Paint

-

Hoa Binh Paint

-

Jotun Paints

-

Frequently Asked Question About This Report

Vietnam Paints and Coatings Market [GR24AB-01-00385]

Vietnam Paints and Coatings Market size was estimated at USD 626 million in 2024.

Vietnam Paints and Coatings is growing due to robust growth in construction and infrastructure projects, rise in urbanization rate coupled with increase in disposable income, surge in vehicle manufacturing, government support & incentives.

Vietnam Paints and Coatings Market has strong opportunity for expansion as the market is forecast to touch USD 1.2 billion in 2032, growing at a CAGR of 8.5% from 2025-2032.

Major Paints & coating companies operating in Vietnam are are AkzoNobel, Nippon Paint, Toa Vietnam, 4 Oranges Co., Ltd, Jotun Paints, KOVA Group, Dong Tam, Alphanam, Hoa Binh among others.

Architectural paints end-use industry accounted for the largest market share in 2024

Acrylic resin type dominated the market share in 2024

Waterborne segment hold the largest market share and is forecast

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00385

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Vietnam Paints and Coatings Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research