Thailand Paints and Coatings Market Overview

Thailand Paints and Coatings Market size valued at USD 1.1 billion in 2024 and is estimated to reach USD 1.5 billion in 2032 and the market is estimated to grow at a CAGR of 4.1% from 2025-2032 primarily driven by robust growth in construction and infrastructure projects, thriving automotive industry, rise in urbanization and increase in disposable income and decreasing household sizes and small family sizes are becoming increasingly common.

Market Size, Forecast & Key Segment Insights

Market Size & Forecast:

-

- 2024 – USD 1.1 Billion

- 2032 – USD 1.5 Billion

- Market Forecast – CAGR of 4.1% from 2025-2032

Segment Insights:

-

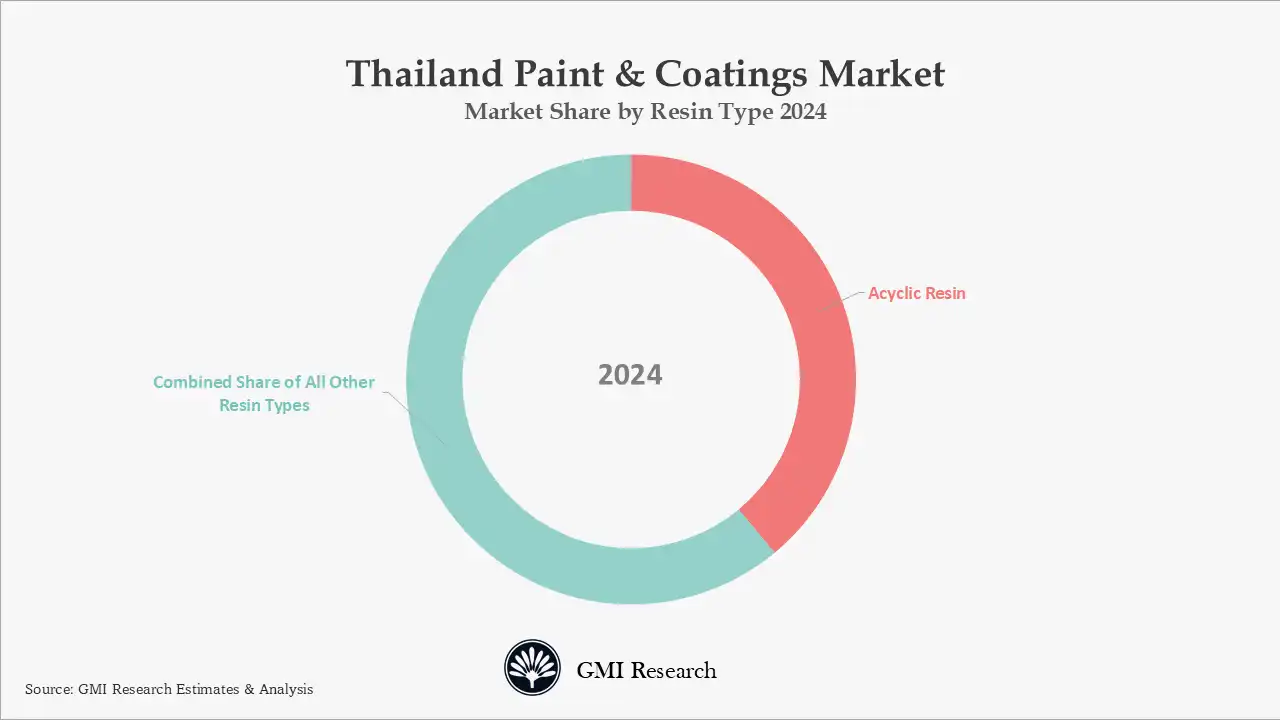

- Resin Type Market Insights: Acrylic resin type accounted for the largest market shar in 2024

- Technology Type Market Insights: Waterborne segment hold the largest market share and is forecast to grow at a robust rate during the forecast period

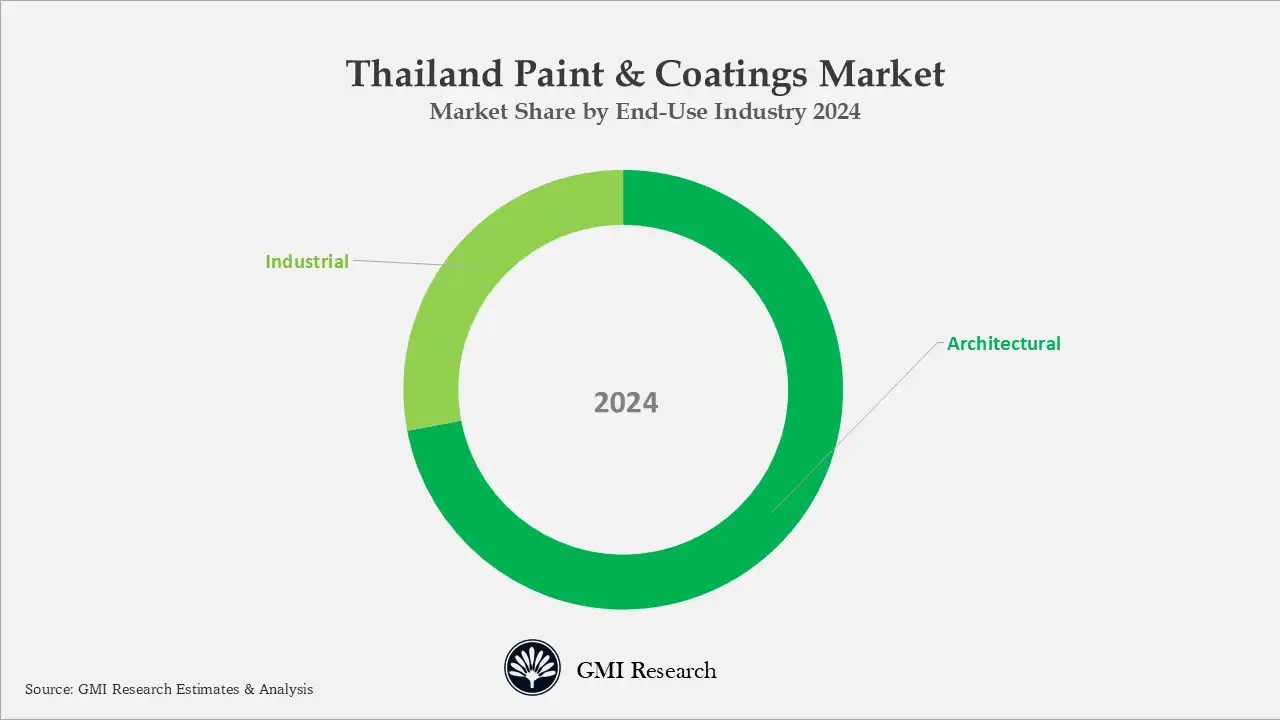

- End-Use Industry Market Insights: Architectural paints dominated the market revenues in 2024

Thailand Paints and Coatings Market Growth Drivers

Robust Growth in Construction and Infrastructure Projects

Market growth is being driven by the rise in infrastructure projects across the country with the construction sector is forecast to grow at CAGR of 4.1% between 2025 and 2028. Construction projects in Thailand are categorized into public and private sectors with infrastructure representing more than 80% in public sector efforts. The public sector also includes various infrastructure projects and housing for government officials. Meanwhile in the private sector over half of construction activities are residential with the remaining projects focused on industrial and commercial developments.

The booming real estate and construction sectors in Thailand are further fueling the need for paints and coatings in residential or infrastructure projects. The Ministry of Transport started fourteen major infrastructure projects in 2024 which collectively valued at USD 16 billion. Key infrastructure developments include major rail projects such as the Khon Kaen-Nong Khai railroad and the Red Line extension phases.

The Cabinet has also given approval for the Homes for Thai People initiative which will be built on SRT land within Bangkok and surrounding areas with plans to expand nationwide which drive additional need for paints and coatings in construction. This project is a priority as it aligns with the government’s plan to enhance living standards along with fostering social and economic stability through improved housing across the country.

Thriving Automotive Industry

Thailand has become a key automotive industry hub in the ASEAN region which drives substantial need for automotive refinishes and coatings in the country. Automobile production capacity in Thailand hit 1.83 million units in 2023 which is primarily driven by the passenger cars production. The growing urbanization along with rising income levels are further fueling the demand for automotive products thereby driving the need for paints and coatings.

Thailand is a key car exporter in the region with more than half of its automotive manufacturing annually sent to countries including Australia and China. The Thai government has recently removed import duties on essential electrical parts utilized in automotive manufacturing to foster the growth of local EV production. Thailand produced around 76,000 EVs in 2023 with paints and coatings offering key benefits like color retention and UV protection which further drive its demand. A broad range of exterior vehicle shades and coating technologies has unlocked significant growth prospects for the market. The growing consumer preference for appealing textures and better aesthetics in vehicles is also driving the automotive paints and coatings market growth.

Challenges Faced by Thailand Paints and Coatings Companies

Paints and coatings companies operating in Thailand are facing volatile raw material prices, stringent environmental and regulatory compliance, growing competition etc.

Thailand Paints and Coatings Market Segment Analysis

Resin Type Market Insights: Acrylic resin type accounted for the largest market share in 2024

Acyclic resin type dominated the market share and is increasingly popular due to its numerous advantages that includes quick drying time and eco-friendliness. The acrylic segment is benefiting from infrastructural growth as new construction projects need extensive use of paint for interior decoration. Growing urbanization is also boosting industrial or residential construction which in turn drives the need for acrylic paints in both business and private sector projects. Alkyd resin is utilized in producing paints and varnishes for the construction and manufacturing industries as it helps optimize product performance while achieving a flawless finish. The construction industry also relies on polyester resin for waterproofing applications that includes flat roofs and storage tanks. Its capacity to form a continuous and waterproof barrier makes it perfect for these applications as it provides long-lasting protection from water penetration.

Technology Type Market Insights: Waterborne segment hold the largest market share and is forecast to grow at a robust rate during the forecast period

Based on technology, the waterborne segment is expanding rapidly due to its environmentally friendly characteristics along with reduced VOC output and compliance with environmental standards. These coatings are commonly used in the automotive and construction or industrial sectors as they become a favored choice over traditional solvent-based options. With a growing focus on sustainability and environmental protection, waterborne coatings are anticipated to see consistent demand growth in the coming years.

End-Use Industry Market Insights: Architectural paints dominated the market revenues in 2024

Based on end-use industry, the market can be categorized into architectural and industrial segments. The architectural segment dominated the market and is experiencing growth due to the rapid expansion in construction and a shift in consumer preferences. There is also a rising awareness of safety concerns along with VOC emissions in coatings. The industrial segment is also expanding rapidly as the growing industrial sector in the country creates a surge in need for machinery and infrastructure protective coatings. With stricter environmental regulations in place, manufacturers are increasingly turning to eco-friendly coatings which is fueling innovation along with market growth. Industrial coatings are also essential in the aerospace and automotive sectors where technological innovations improve durability and boost performance.

Thailand Paints and Coatings Market Major Players & Competitive Landscape

Several leading companies operating in the market are TOA Paint, Jotun, Nippon Paint, AkzoNobel, Berger, Kansai Paints among others. These companies lead the market by providing the industry with various products including decorative and non-decorative coatings or for waterproofing.

Key Thailand Paints and Coatings Market Developments

-

- In 2024 Nippon Paint set its sights on becoming the leading company in Thailand market. The company has initiated the Inspired by You campaign to build a unique brand that resonates with consumers and stands out in the market.

- In 2023 NP Auto Refinishes successfully acquired D-ACT Co. This acquisition allows NP Auto Refinishes to expand its presence and strengthen its dominant position in automotive coatings market in Thailand.

Thailand Paints and Coatings Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 1.1 billion |

| Market Revenue Forecast in 2032 |

USD 1.5 billion |

| CAGR |

4.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Resin Type, By Technology, By End-Use Industry |

| Regional Coverage | Thailand |

| Companies Profiled | TOA Paint, Jotun, Nippon Paint, AkzoNobel, Berger, Kansai Paints, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Thailand Paints and Coatings Market Research Report Segmentation

Thailand paints and coatings market has been segmented on the basis of Resin Type, Technology, and End-use Industry. Based on the Resin Type, the market is segmented into Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, and Others. Based on the Technology, the market is segmented into Water-borne Coatings, Solvent-borne Coatings, Powder-based, and Others. Based on the End-use Industry, the market is segmented into Architectural and Industrial. The Architectural segment is further segmented into Residential and Non-Residential. The Industrial segment is further segmented into General Industrial, Protective, Automotive, Wood, Marine, Packaging, and Others.

Thailand Paints and Coatings Market by resin type

-

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

Thailand Paints and Coatings Market by technology

-

- Water-borne Coatings

- Solvent-borne Coatings

- Powder-based

- Others

Thailand Paints and Coatings Market by end-use industry

-

- Architectural

- Residential

- Non-Residential

- Industrial

- General Industrial

- Protective

- Automotive

- Wood

- Marine

- Packaging

- Others

- Architectural

Thailand Paints and Coatings Market Leading players

-

-

TOA Paint

-

Jotun

-

Nippon Paint

-

AkzoNobel

-

Berger

-

Kansai Paints

-

Frequently Asked Question About This Report

Thailand Paints and Coatings Market [GR24AB-01-00386]

Thailand Paints and Coatings Market size was estimated at USD 1.1 billion in 2024.

Thailand Paints and Coatings is growing owing to robust growth in construction and infrastructure development, a well-established automotive sector, accelerating urbanization, and rising disposable incomes are driving demand, alongside a shift toward smaller households and nuclear family structures.

Thailand Paints and Coatings Market has the potential for growth and the market is forecast to reach USD 1.5 billion in 2032 growing at a steady CAGR of 4.1% from 2025-2032.

Major Paints & coating companies operating in Thailand are TOA Paint, Jotun, Nippon Paint, AkzoNobel, Berger, Kansai Paints among others.

Architectural paints end-use industry hold the largest market share in 2024

Acrylic resin type hold the largest market share in 2024

Waterborne segment dominates the market share and is forecast to grow at a robust rate during the forecast period.

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00386

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Thailand Paints and Coatings Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research