Saudi Arabia Fertilizer Market Overview

Saudi Arabia fertilizer market size forecast to grow at robust CAGR of 6.2% between 2025 and 2032 due to the government emphasis on food security, surge in agriculture production, increasing adoption of modern fertilizer manufacturing techniques which will improve the soil fertility and enhance the plant growth coupled with increasing population growth, growing demand for food production.

Market Size, Forecast & Key Segment Insights

Market Size & Forecast:

-

- 2024 – USD XX Billion

- 2032 – USD XX Billion

- Market Forecast – CAGR of 6.2% from 2025-2032

Segment Insights:

-

- Fertilizer Type Insights: Nitrogenous Fertilizer estimated to hold the largest market share in 2024.

Saudi Arabia Fertilizer Market Drivers

Government Growing Emphasis on Food Security

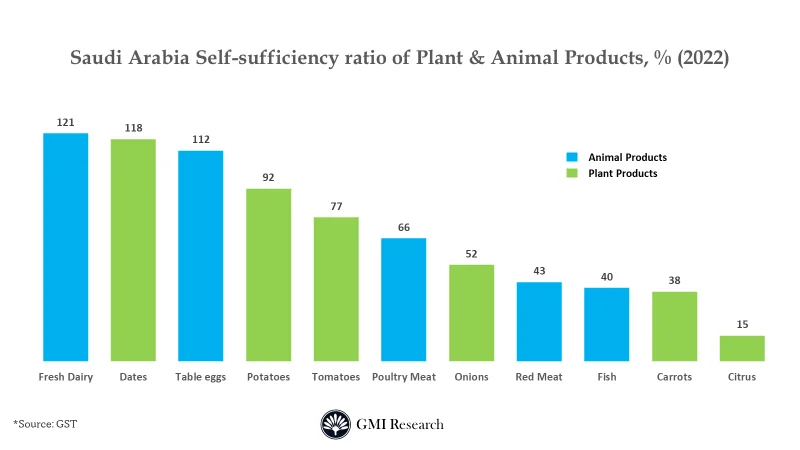

The government of Saudi Arabia has two pronged approach to address the issue of food security, one by improving and developing the local food production and second through improving supply chains to make sure that access to food is guaranteed for crops can’t be cultivated locally. Currently around 80% of the food requirements in the country is met through food imports.

Growing population in KSA which is projected to touch 50 million by 2060 is forecast to surge the requirements of food in the country drastically. Saudi government plans is to increase local production and the government is providing incentives and support to local farmers.

In 2023, the Agricultural Development Fund announced 1.5 billion SAR funding to support farmers to grow vegetables etc. Saudi government targeted to improve the fertilizer consumption and encouraging farmers to produce crops by using water-saving methods.

Under Saudi Vision 2030, the country planned to encourage and educate farmers to use modern technology and to promote sustainable agriculture. Moreover, the demand for organic fertilizers is expected to drive the Saudi Arabia fertilizers market.

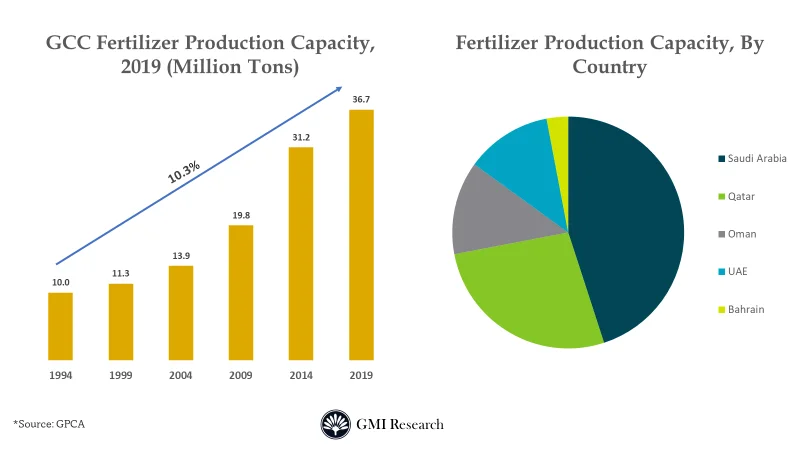

Saudi Arabia captured more than 45% of share in terms of production in the GCC fertilizer market. As per the Gulf Petrochemicals and Chemicals Association, 36.7 million tons of fertilizers were produced in GCC countries. Due to the rise in the population size and income of the consumers, the need for fertilizers to promote crop yields will increases. Moreover, people are shifting towards urban areas which resulted in reduction of availability of arable land is supporting the demand for fertilizer across KSA. In addition, change in the dietary pattern along with the high demand for the good quality food among people is anticipated to boost the market growth in near future.

Surge in agriculture production

Under the Vision 2030, the government goal is to double the local agriculture production in the country. In 2024, the KSA’s agricultural GDP touched a whopping USD 30 billion with a YoY growth of 8.2 vs 2023, continuing the upward growth momentum. The application of fertilizer are fruits and vegetables, cereals, pulses, cereals, among others is further supporting the Saudi Arabia fertilizer industry. Increasing use of fertilizers for better nutrient management, proper utilization of resources and improves crop quality.

Rising use of modern agriculture techniques

The Kingdom has embraced modern agriculture technologies and practices as faster route to food security and sustainability to support innovation, entrepreneurship and start-ups in the sector. Modern irrigation methods such as drip irrigation is widely used across kingdom’s farms to conserve water as the country has limited fresh water.

Saudi Arabia Fertilizer Market Segment Analysis

KSA Fertilizer Market by Type Insights: Nitrogenous Fertilizer estimated to hold the largest market share

Nitrogenous Fertilizer estimated to hold the largest market share due to the increasing demand for ammonium sulfate and ammonium nitrate for cultivation of vegetable crops. As per the GPCA, Saudi Arabia ammonia captured 40% and Urea holds 28% of market share across GCC region in 2020. Saudi government aimed to reduce dependency on vegetable imports and to become self-sufficient in terms of vegetable production to cater to the increasing demand of food. For instance, self-sufficiency ratio of tomato is 77% and potato is 92% in 2021. This is expected to boost the fertilizer market in Saudi Arabia.

Saudi Arabia Fertilizer Market Major Players & Competitive Landscape

Several leading companies are Maaden Phosphate Co., Saudi Basic Industries Corporation, Al-Jubail Fertilizer Company, Al-Tayseer Chemical Industry, Jas Global Industries, Arabian Agricultural Services Co., Saudi United Fertilizer Company among others.

Saudi Arabian Fertilizers Market covers detailed analysis of Saudi Arabia fertilizer market size and trends, domestic and international players expansion and government initiatives. The key players in the Saudi Arabia market are adopting various strategies like product launches, partnerships, investment in R&D to increase their market share in the fertilizer market.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

Saudi Arabia Fertilizer Market News

-

- In 2022, Krishak Bharati Cooperative in India signed a long term fertilizers deal with Saudi Arabia, to export 1 million tons of phosphatic fertilizers to India. In addition, agreement were signed with 3 Indian companies to explore more products and technology development in phosphatic fertilizers. Both the countries planned to boost their long term relationship by providing double phosphate fertilizer and ammonia to India.

Saudi Arabia Fertilizer Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| CAGR |

6.2% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By Application |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | Maaden Phosphate Co., Saudi Basic Industries Corporation, Al-Jubail Fertilizer Company, Al-Tayseer Chemical Industry, Jas Global Industries, Arabian Agricultural Services Co., Saudi United Fertilizer Company, among others; a total of 7 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia Fertilizer Market Research Report Segmentation

The Saudi Arabia fertilizer Market has been segmented on the basis of Type and Application. Based on the Type, the market is segmented into Nitrogenous Fertilizers, Phosphatic Fertilizers, Potassic Fertilizers, Secondary Macronutrient Fertilizers, Micronutrient Fertilizers. Based on the Application, the market is segmented into Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others. The Nitrogenous Fertilizers segment is further segmented into Urea, Calcium Ammonium Nitrate, Ammonium Nitrate, Ammonium Sulfate, Anhydrous Ammonia, Others. The Phosphatic Fertilizers segment is further segmented into Mono-ammonium Phosphate (MAP), Di-ammonium Phosphate (DAP), Single Super Phosphate (SSP), Triple Super Phosphate (TSP), Others. The Potassic Fertilizers segment is further segmented into Muriate of Potash (MOP), Sulfate of Potash (SOP).

Saudi Arabia fertilizer Market by Type

-

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate

- Ammonium Nitrate

- Ammonium Sulfate

- Anhydrous Ammonia

- Others

- Phosphatic Fertilizers

- Mono-ammonium Phosphate (MAP)

- Di-ammonium Phosphate (DAP)

- Single Super Phosphate (SSP)

- Triple Super Phosphate (TSP)

- Others

- Potassic Fertilizers

- Muriate of Potash (MOP)

- Sulfate of Potash (SOP)

- Secondary Macronutrient Fertilizers

- Micronutrient Fertilizers

- Nitrogenous Fertilizers

Saudi Arabia fertilizer Market by Application

-

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Major Players Operating in the Saudi Arabia fertilizer Market

-

-

Maaden Phosphate Co.

-

Saudi Basic Industries Corporation

-

Al-Jubail Fertilizer Company

-

Al-Tayseer Chemical Industry

-

Jas Global Industries

-

Arabian Agricultural Services Co.

-

Saudi United Fertilizer Company

-

Frequently Asked Question About This Report

Saudi Arabia fertilizer market [UP3587-001001]

Saudi Arabia Fertilizer Market size was estimated at USD XX billion in 2024

The market growth is due to the government emphasis on food security, surge in agriculture production, increasing adoption of modern fertilizer manufacturing techniques which will improve the soil fertility and enhance the plant growth coupled with increasing population growth, growing demand for food production.

Saudi Arabia fertilizer market size forecast to grow at robust CAGR of 6.2% between 2025 and 2032.

Maaden Phosphate Co., Saudi Basic Industries Corporation, Al-Jubail Fertilizer Company, Al-Tayseer Chemical Industry, Jas Global Industries, Arabian Agricultural Services Co., Saudi United Fertilizer Company among others.

Nitrogenous Fertilizer estimated to hold the largest market share

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: UP3587-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia fertilizer Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research