Saudi Arabia E-Commerce Market Size & Forecast

Saudi Arabia E-Commerce was valued at USD 16.1 billion in 2024 and is forecast to touch USD 41.3 billion in 2032, and the market is expected to grow at a robust CAGR of 12.5% from 2025-2032, primarily driven by high internet & smartphone penetration, changing consumer behaviour, proliferation of digital payments & improvement in logistics, access to a larger product assortment, and government initiatives to diversify Saudi economy under Vision 2030.

Key Market Insights

Market Size:

-

- 2024 – USD 16.1 Billion

- 2032 – USD 41.3 Billion

- Market Forecast – CAGR of 12.5% from 2025-2032

Segment Insights

-

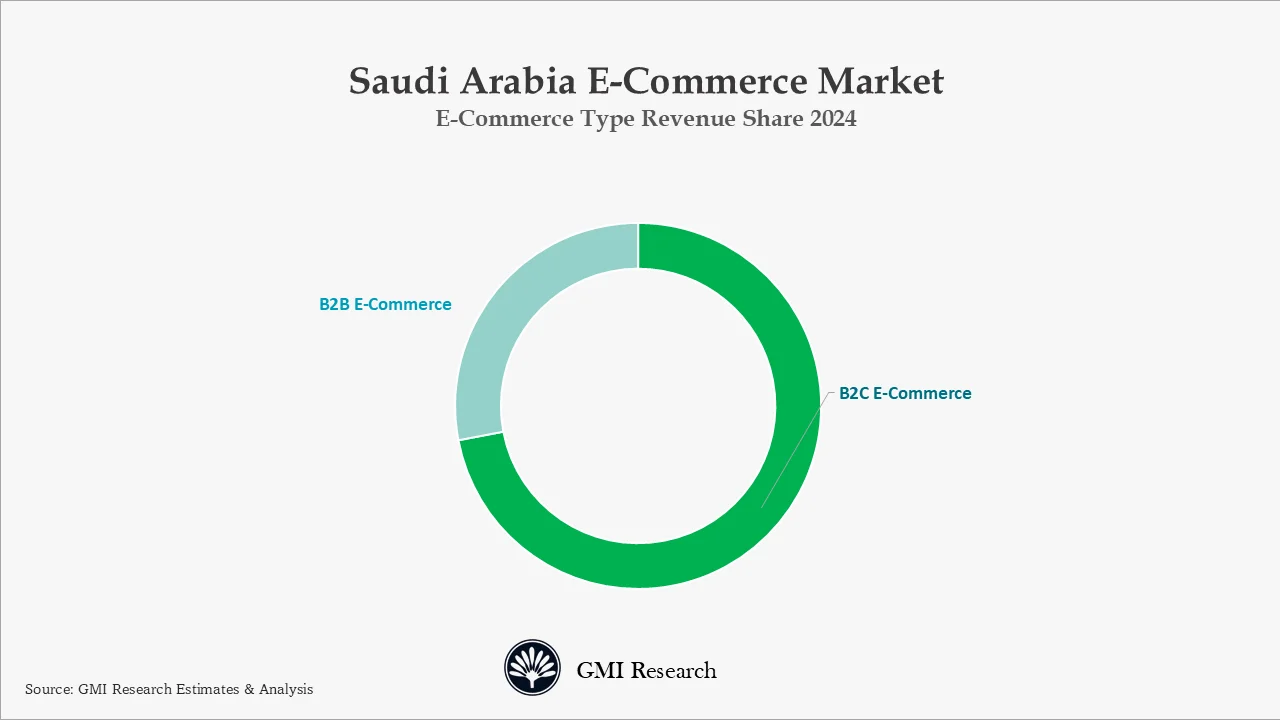

- E-commerce Type Insights: B2C e-commerce spending in Saudi Arabia has witnessed significant growth in recent years and the B2C segment captured 76% market share in 2024.

- E-commerce Category Insights: Consumer Electronics & Appliance dominates the E-commerce market revenue

Saudi Arabia E-Commerce Market Demand Drivers

High Internet & Smartphone Penetration

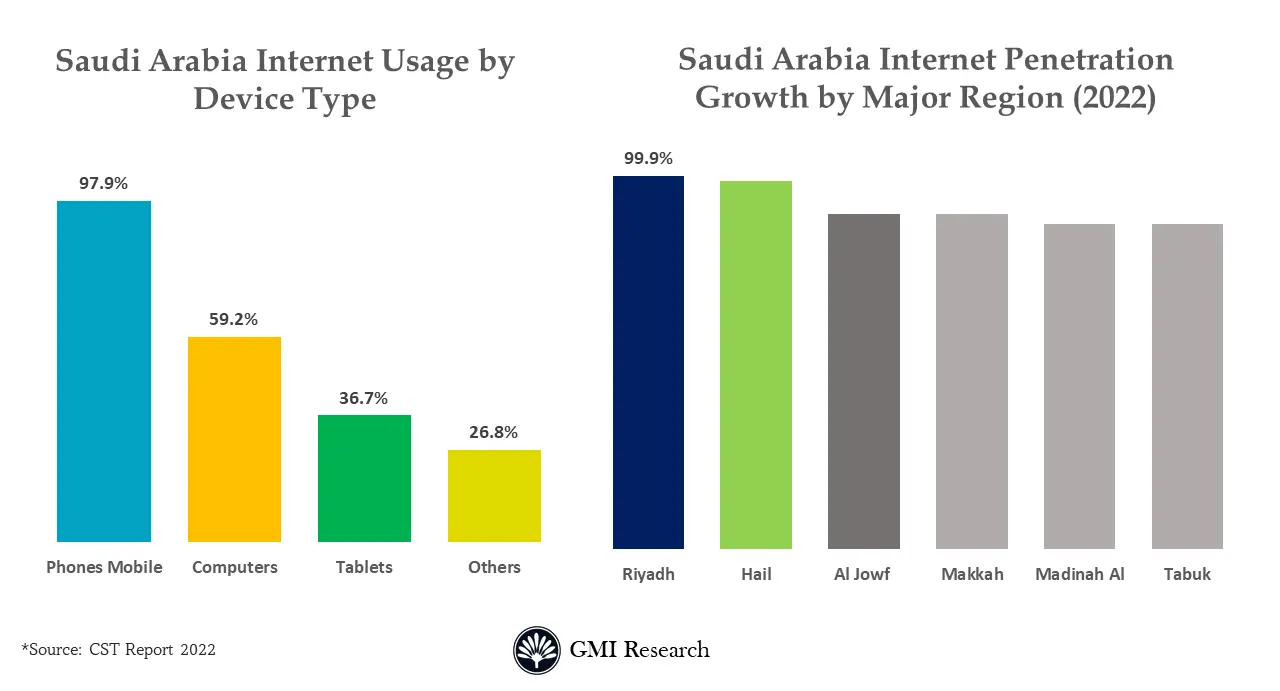

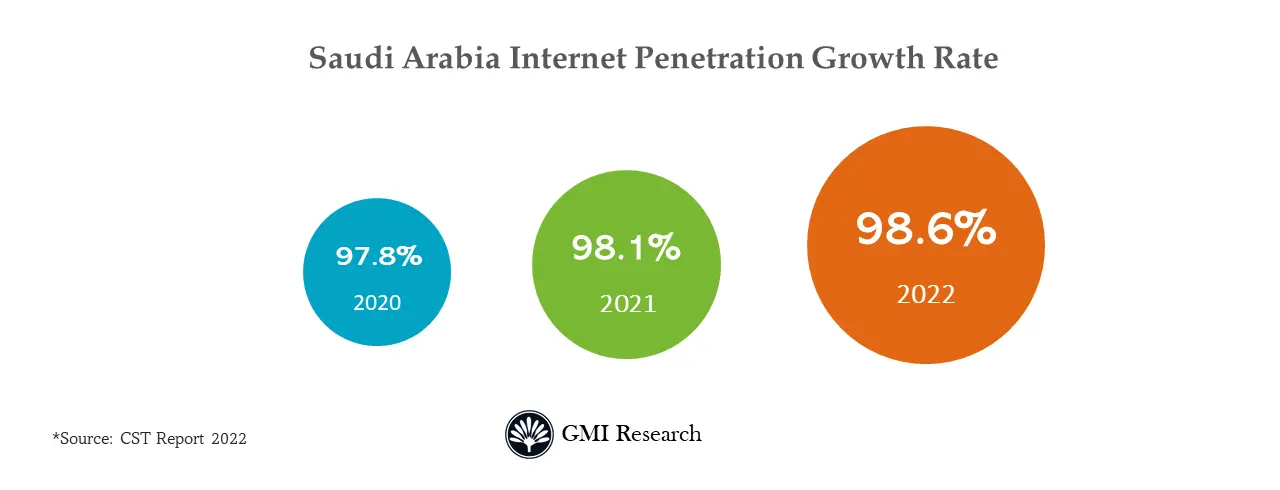

Increased smartphone usage coupled with the high internet penetration rate is expanding the e-commerce market in Saudi Arabia. For instance, internet traffic has been increased by 17% i.e., 35 million terabytes as compared to 2021 as per the Communications, Space and Technology Commission report 20222. Saudi Arabia Internet penetration growth has been increased to 98.6% in 2022.

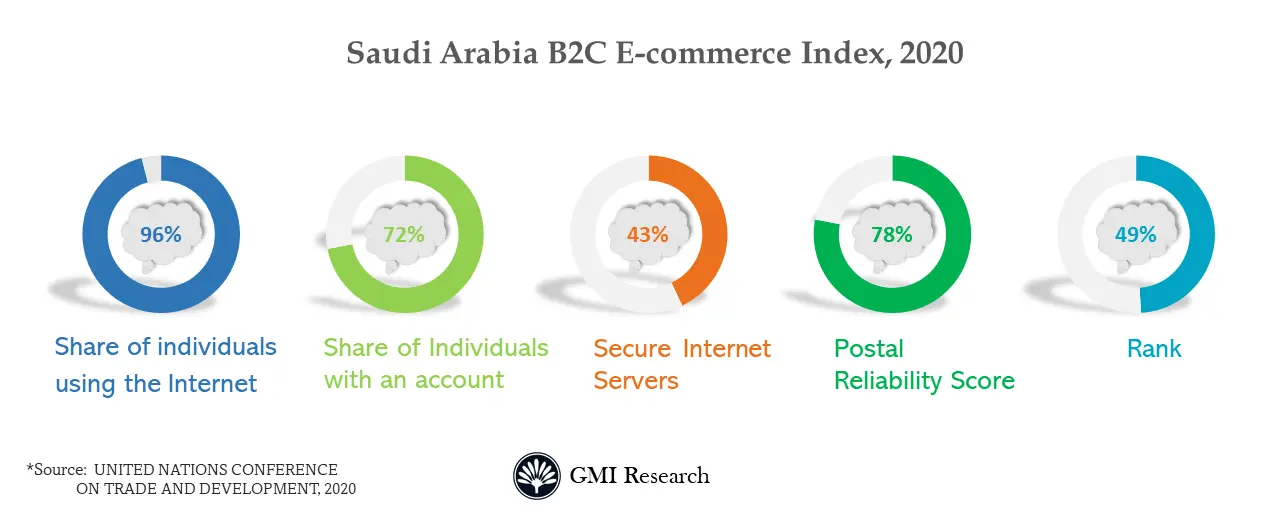

Increasing smartphone and broadband penetration rates are propelling a shift toward online buying in Saudi Arabia. One of the primary factors fostering the growth of Saudi Arabia’s E-commerce market is the government’s growing aim for e-commerce development. Also, significant growth in internet penetration and connected device access to e-commerce platforms and websites present positive growth to the Saudi Arabia E-commerce market. As per UNCTAD report in 2020, the Internet shoppers as percentage of overall internet user stood at 30% and 24.9% of the total population.

E-commerce in Saudi Arabia enables local online sellers, regional and international market players, startups, and home-based businesses to conduct business without building any additional infrastructure and maintaining a physical existence in Saudi Arabia. In addition, conventional businesses varying from FMCG companies to banks are progressively witnessing e-commerce platforms and websites as the fastest-rising complementary channel for their offerings.

Technological awareness along with the implementation of 4G and 5G technology among consumers is anticipate to have positive impact on Saudi Arabian e-commerce market. For example, KSA Ministry of Commerce has introduced 10 initiatives to develop the e-stores in the country. This is expected to propel the Saudi Arabia ecommerce market.

The rising innovations in smartphones, mobile internet, digital technologies, and broadband have fostered the adoption of internet-based services. The growing government assistance in encouraging the usage of digital technologies lines up with the Vision 2030 plan and is predicted to significantly contribute to the growth of Saudi Arabia E-commerce market in the forecast period.

Changing Consumer Behaviour

Customers are getting more comfortable with online transactions as their trust rises in e-commerce platforms, the demand increases for e-commerce shopping. Factors such as reliable delivery services, preventive and authorized payment systems, and supporting return policies have contributed to this trend.

In addition to this, the strategic location of Saudi Arabia and rising trade relations results in different growth opportunities for cross-border e-commerce. For instance, the Saudi Arabian Monetary Authority is dedicated to developing the growth of the Saudi Arabian e-commerce market. They aim to accomplish this by introducing a strong and secure payment ecosystem and developing convenience for customers through different payment channels.

However, these initiatives are predicted to tackle the foremost challenges hampering growth of Saudi Arabia’s e-commerce market. These challenges include the non-existence of an unlimited platform for all stakeholders, restricted and unreliable payment options, and the shortage of high-quality, cost-effective services from logistics providers.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Proliferation of Digital Payments & Improvement in Logistics

Improvement in payment system is one of the corner stone under Vision 2030, KSA is not just transforming payment systems its reforming the complete financial system by Saudi Central Bank (SAMA). The proliferation of digital payment systems such as mobile payment, digital wallets, contactless payments, credit and debit cards are driving E-commerce sales. As per SAMA, the E-payments accounted for 79% of all retail purchase in KSA in 2024.

The significant improvement in logistics has led to improvement in delivery time, the products reach to customer much faster now through advanced distribution systems. The customers also have an option to choose delivery location and time based on their preference.

Access to a larger product assortment

One of the key advantage for customer to purchase products online is the availability of vast product options to choose from, as the E-commerce players are free form physical space restrictions and can showcase entire range of products on an online store providing customer significant products options.

Government Initiatives to Diversify Saudi Economy under Vision 2030

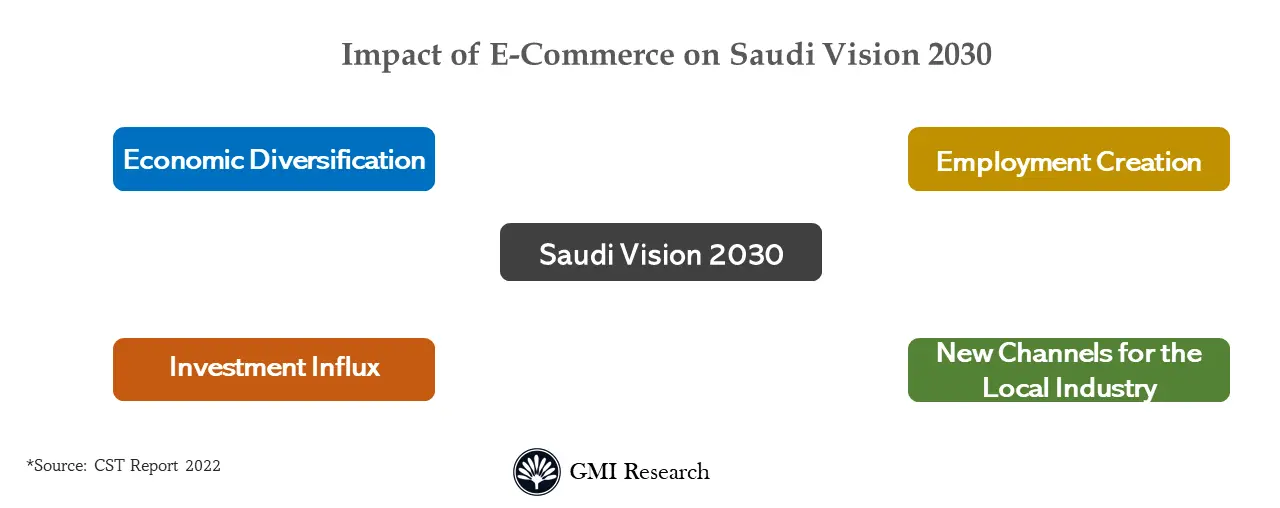

Saudi government planned to diversify its economy to attract more investment under Saudi Vision 2030. E-commerce is the one of the most important aspect of Vision 2030.

The country has launched various initiatives to boost and support the e-commerce such as expanding and promoting e-commerce education programs in academic institution, supporting e-commerce services in cities and introducing guidelines for cyber security in e-commerce.

These initiatives has increased adoption of digital technologies in Saudi Arabia. For instance, Saudi Arabia planned to invest USD 6.4 billion in coming technologies and entrepreneurship to enhance Saudi Arabia digital vision for 2030.

Different government institutions in Saudi Arabian market have initiated different programs to enhance the local e-commerce industry by motivating online buyers to buy more, improving logistics infrastructure, and bringing new opportunities for new local sellers into digital platforms. For example: The Ministry of Commerce and Investment and its affiliated organizations are leading initiatives to establish a favorable environment for online business.

Are you Looking for a Partner for your Saudi Arabia Market Entry and Expansion plans? GMI Research with decades of experience tracking KSA market is the right choice for you.

They are actively involved in shaping regulatory policies, developing customer trust in e-commerce, and helping small and medium enterprises by promoting e-commerce initiatives. Moreover, prioritizing the Saudi Post under the Ministry of Communications and Information Technology will undoubtedly develop competitiveness and simplify the local logistics network and infrastructure of E-commerce Industry in Saudi Arabia.

The Ministry of Commerce has introduced ten initiatives to develop e-stores in Saudi Arabia, following the public’s suggestions to make profitable this sector. Furthermore, renovating the telecommunications infrastructure, establishing a strong digital payment ecosystem, optimizing distribution systems, nurturing local industries, and encouraging innovation and entrepreneurship are all important steps in developing Saudi ecommerce market in the coming period.

Saudi Arabia E-Commerce Market Segment Analysis

E-commerce Type Market Insights: B2C E-commerce Segment is expected to increase in near future.

B2C e-commerce spending in Saudi Arabia has witnessed significant growth in recent years and the B2C segment captured 76% market share in 2024. This growth has been propelled by a widespread transition from offline to online and mobile shopping. Supply-side advancements, advanced quality of service, developed delivery services, and the growing variety of products and services accessible are predicted to propel segment growth.

Growing inclination of customers toward e-commerce purchase, e-commerce market players are predicted to invest more shortly. These investments are predicted to propel organic growth through extended operations and inorganic growth via acquisitions. Growing technological adoption and widespread smartphone availability made e-commerce sector more efficient and reachable.

In addition, rising usage of social networks is further propelling demand for online purchases around a broad variety of products and services. The ecommerce in KSA is anticipated to observe high growth in the coming period due to significant growth in digital dependency and less complexity in shopping on online platforms.

E-commerce Market Category Insights: Consumer Electronics & Appliance dominates the E-commerce market revenue

Consumer electronics dominates the E-commerce market revenues in 2024, however grocery is projected to grow at a significant rate during the forecast period owing to young tech savvy population, rise in comusmer disposable income and lucrative discounts.

Fashion and Apparel segment contributes a substantial share of revenue generated by e-commerce offerings from market vendors across the country. The clothing and fashion industries have a wide variety of outfits including watches, shoes, eyewear, jewelry, bags, and accessories, comprising products for boys, men, girls, and women. Even with the strict social norms dictating dress and appearance, there is a thriving interest and intent among both men and women in the fashion and apparel segment.

The Saudi Arabian Fashion Commission has contributed to developing the nation substantially by nurturing the fashion industry. Their initiatives, such as the 100 Saudi Brands program and the establishment of the Saudi Professional Fashion Association, have significantly contributed to this effort. This initiative focuses on empowering 100 Saudi designers and premium brands, propelling business expansion. It is probably to foster e-commerce demand in the country, as online platforms can efficiently market these products to a wider audience.

In 2022, FSN International, a parent corporation of omnichannel retailer Nykaa, established a strategic partnership with the Middle East Easter Apparel Group to extend its existence into the GCC region, which encompasses Saudi Arabia.

Saudi Arabia E-Commerce Market Major Players & Competitive Landscape

Several leading companies are Amazon.com Inc, Noon Ad Holdings Ltd. (Noon E-Commerce), Jazp.com, Aliexpress., Namshi General Trading L.L.C, Carrefour, IKEA, eXtra.com, Jarir.com among others.

The E-commerce industry in KSA is still in nascent stage and the market is growing at robust growth rate provides ample opportunities for new entrants in grocery, consumer electronics and appliances,

Saudi Arabia E-Commerce Market News

-

- In 2023, Saudi Amazon doubled its storage volume with establishment of a new fulfilment center with a storage facility of 2.7 million cubic feet to support more entrepreneurs and sellers in Saudi Arabia to scale their business online.

- In 2023, Noon A.D. Holding Ltd launched Noon One to help customers save money on their purchases. This effective program offers members limitless free delivery on every app product and prompts them to buy more regularly, delivering a convenient and cost-effective shopping experience.

- In 2023, Noon.com acquired Namshi to expand its digital network of products and services.

- In 2023, Majid AI Futtaim inaugurated its initial carrefour store which is 5000 square meters in AI Kharj to provide more than 20,000 products and enable a seamless and easy shopping experience for consumers.

- In 2022, Noon.com opened a massive 45,000m2 customer fulfilment center in Riyadh, marking its largest warehouse space in the city to deliver products speedily to millions of clients across Saudi Arabia.

- In 2022, Saudi Arabia signed an agreement with Amazon to foster opportunities for SMEs around the Kingdom.

Saudi Arabia E-Commerce Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 16.1 billion |

| Market Revenue Forecast in 2032 |

USD 41.3 billion |

| CAGR |

12.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By application |

| Regional Coverage | Saudi Arabia |

| Companies Profiled | Amazon.com Inc, Noon Ad Holdings Ltd. (Noon E-Commerce), Jazp.com, Aliexpress., Namshi General Trading L.L.C, Carrefour, IKEA, eXtra.com, Jarir.com among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Saudi Arabia E-Commerce Market Research Report Segmentation

The Saudi Arabia E-Commerce Market has been segmented on the basis of Type and application. Based on Type, the market is segmented into B2C E-commerce and B2B E-commerce. Based on Application, the market is segmented into Fashion & Apparel, Beauty & Personal Care, Consumer Electronics, Food & Beverages and Others.

Saudi Arabia E-commerce Market by Type

-

- B2C E-commerce

- B2B E-commerce

Saudi Arabia B2B E-commerce Market by application

-

- Fashion & Apparel

- Beauty & Personal Care

- Consumer Electronics

- Food & Beverages

- Others

Major Players Operating the Saudi Arabia E-Commerce Market

-

- Amazon.com Inc.

- Noon AD Holdings Ltd. (Noon E-Commerce)

- Jazp.com

- AliExpress

- Namshi General Trading L.L.C

- Carrefour

- IKEA

- eXtra.com

- Jarir.com

Frequently Asked Question About This Report

Saudi Arabia E-Commerce Market [UP3541-001001]

Saudi Arabia E-Commerce Market size was estimated at USD 16.1 billion in 2024

Saudi Arabia E-Commerce provides plenty of opportunities for the e-commerce companies and the market size is forecast to touch USD 41.3 billion in 2032, and the market is expected to grow at a robust CAGR of 12.5% from 2025-2032.

The market growth is primarily driven by high internet & smartphone penetration, changing consumer behaviour, proliferation of digital payments & improvement in logistics, access to a larger product assortment, and government initiatives to diversify Saudi economy under Vision 2030.

Major players operating in the KSA E-commerce market are Amazon.com Inc, Noon Ad Holdings Ltd. (Noon E-Commerce), Jazp.com, Aliexpress., Namshi General Trading L.L.C, Carrefour, IKEA, eXtra.com, Jarir.com among others.

Riyadh and Jeddah together dominate the Saudi E-commerce market.

Which is the largest Saudi Arabia E-Commerce type segment?

Consumer Electronics & Appliance dominates the E-commerce market revenue

Related Reports

- Published Date: Nov-2025

- Report Format: Excel/PPT

- Report Code: UP3541-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Saudi Arabia E-Commerce Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research