Morocco Automotive Aftermarket Market Overview

Morocco Automotive Aftermarket size is forecast to grow at a robust CAGR during the forecast period between 2025 and 2032 primarily driven by increasing number of vehicles on the road & increasing vehicle ownership, growth recovery in new vehicle sales and with millions of passenger vehicles already out of warranty in 2024. This out-of-warranty passenger car base is expected to expand at a healthy CAGR between 2025 and 2032, creating sustained demand for automotive aftermarket parts.

Market Size, Forecast & Key Segment Insights

Market Size & Forecast:

-

- 2024 – USD XX Billion

- 2032 – USD XX Billion

- Market Forecast – CAGR of XX% from 2025-2032

Segment Insights:

-

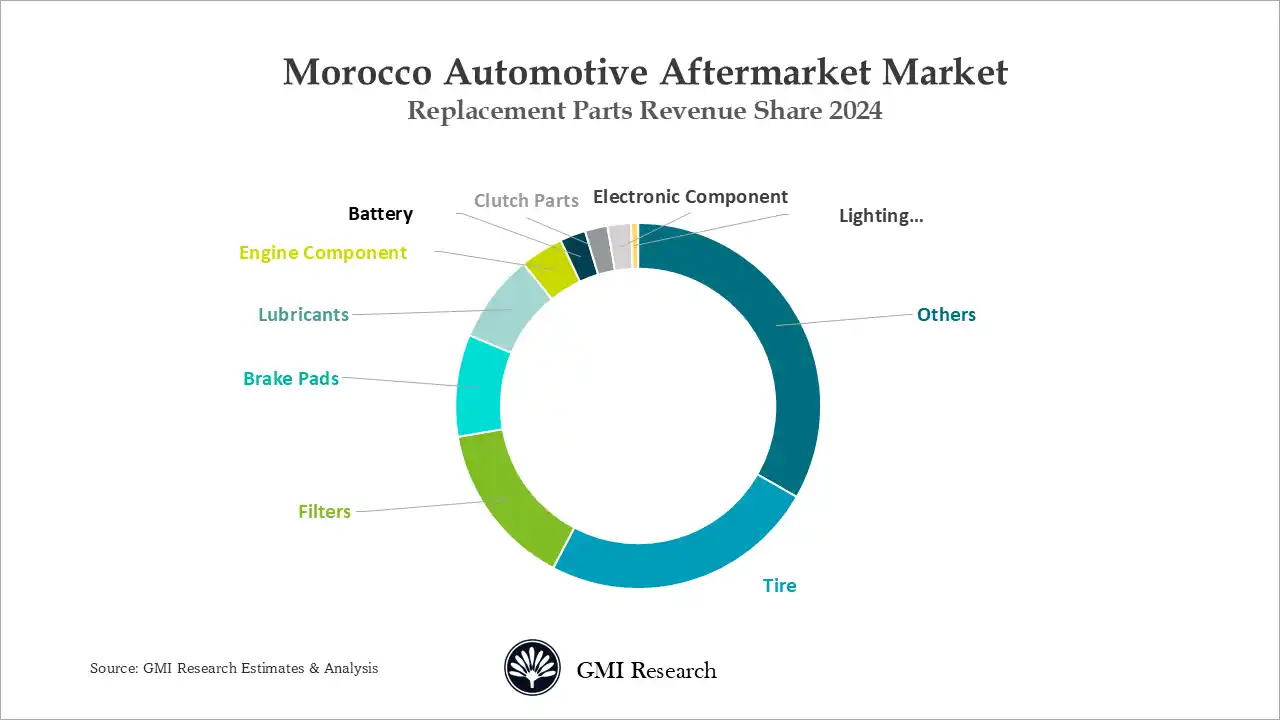

- Replacement Parts Type Insights: Tire generates the largest market revenues in 2024

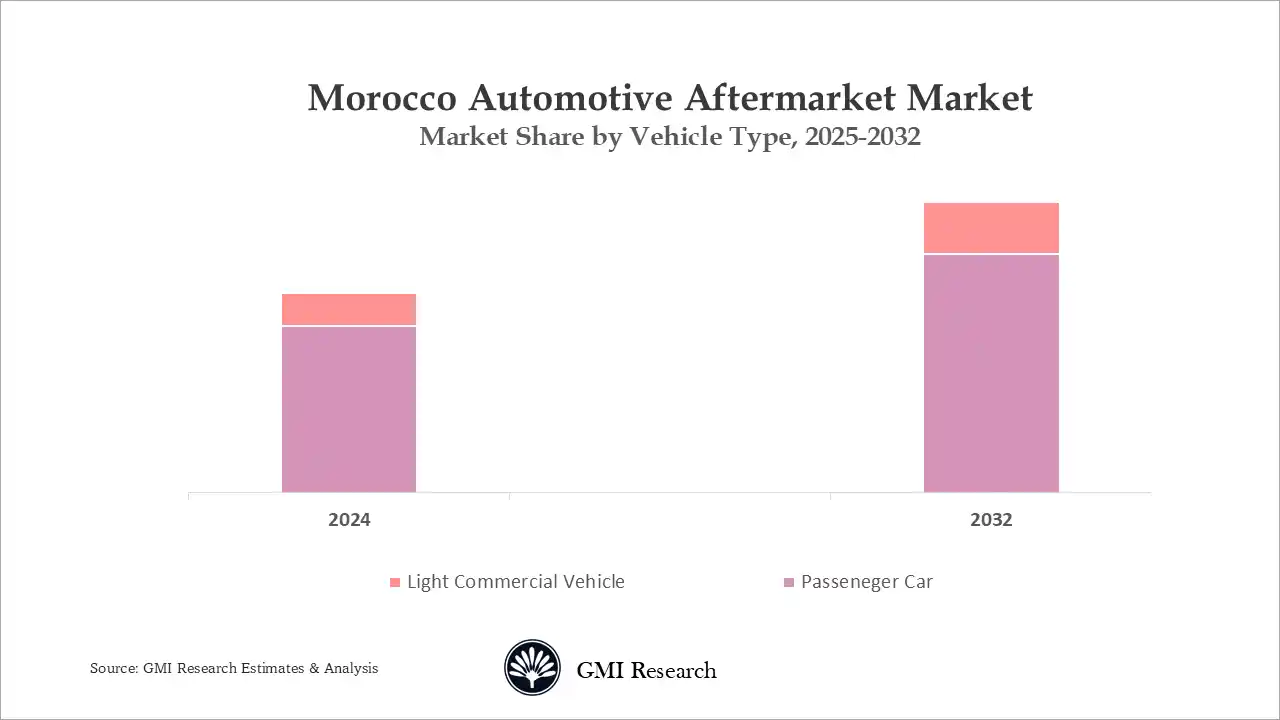

- Vehicle Type Insights: Passenger cars dominates the market revenues in 2024

- Distribution Channel Insights: Currently traditional sales channel dominate the sales channel however, the online sales channel is expected to register the fastest growth rate over the forecast period.

Morocco Automotive Aftermarket Market Growth Drivers

Increasing Number of Vehicles on the Road (VIO) & increasing Vehicle Ownership

Currently the total Vehicle in operation (VIO) in Morocco has over more than 3.5 million light vehicles in 2024 and the VIO in Morocco is on a upward trajectory owing to robust economic growth, growing middle class with increased purchasing power, government support for local manufacturing etc. More than 150 thousand passenger cars are sold in Morocco every year and in the last 6 years around 860 thousand new vehicles are added to the VIO. Despite having a population of 36 million and the country has a vehicle per capita of 112 registered vehicles for every thousand people, this is relatively low compared to developed countries. However, growth in new vehicle sales is raising the ownership rate and this trend is projected to continue during the forecast period till 2032 raising the number of registered eventually creating more and more opportunities for the aftermarket companies. The positive auto industry growth outlook is projected to drive the Morocco Automotive Aftermarket market in coming years.

Growth Recovery in New Vehicle Sales

According to OICA, the sales of new passenger car rebound in 2024 vs 2023 and the new passenger car sales reached 157 thousand units in 2024, the sales grew by 8.2% vs 2023. The growth in new vehicle sales is contributing to rise in vehicle in operation in the country driving demand for aftermarket parts during the forecast period.

Morocco Automotive Aftermarket market is expected to grow during the forecast period due to the favorable government initiatives to boost the overall automotive sector. Morocco government has taken various measures such as tax exemptions, skilled labor force, advanced infrastructure and land purchase subsidy to attract the foreign investment in order to strengthen their position in the vehicle manufacturing. For instance, the country has granted two free zones in Tangier and Kenitra city for car manufacturing. Increased demand for the replacement parts such as gearbox, engine parts, filters, brake parts and others is further boosting the Morocco aftermarket auto parts.

Increasing production and exports along with the advanced manufacturing establishment is paving way to make the country an international automotive hub. As the automotive industry continues to evolve, the automotive aftermarket in Morocco will thrive in next seven years. As per the OICA, Morocco reported 143,265 units new passenger vehicles and 18,144 units new commercial vehicles were sold in 2022. Morocco passenger car sales grew by 1.4% YoY in 2023, the market growth is resilient despite the devastating earthquake due to which 3000 peoples were killed in 2023. The positive auto industry growth outlook is projected to drive the Morocco Automotive Aftermarket market in coming years.

Challenges Faced by Morocco Automotive Aftermarket Companies

Like any other automotive aftermarket, Morocco also faces the challenge of counterfeit parts. Around one sixth of the parts sold in Morocco are counterfeit parts.

Morocco Automotive Aftermarket Market Segment Analysis

Replacement Parts Type Market Insights: Tire generates the largest market revenues in 2024

Tires hold the largest revenue share as tires goes through more wear and tear and also due to large vehicle population is in millions in 2024. Aftermarkets parts associated with the vehicle servicing and maintenance is projected to grow at a robust rate during the forecast period. As currently over millions of passenger vehicles are currently out of warranty in 2023, and the passenger cars with an out of warranty population is projected to grow at a robust CAGR from 2025-2032 is driving demand for mechanical parts as older cars goes through more wear and tears.

Vehicle Type Market Insights: Passenger cars dominates the market revenues in 2024

Passenger cars hold the largest market share of the automotive aftermarket in Morocco as passenger car form the largest chunk of the total registered vehicle in the country. Robust economic growth and growing middle class is driving the vehicle miles travelled due to growing purchasing power and disposable income will further drive the demand for automotive aftermarket parts.

Automotive Vehicle and Parts Manufacturing Industry in Morocco

Automotive industry is the largest exporting industry in Morocco and hold 26th position in terms of vehicle production across the globe. Morocco has production capacity of 700,000 cars in a year and employs more than 220,000 people. In 2020, 250 companies were operating in the automotive industry in Morocco. The country also signed agreements with more than 25 auto parts companies worth USD 1.5 billion to make Morocco as a international hub for automotive industry. This will further create more than 11,500 jobs opportunities.

Morocco Automotive Aftermarket market is expected to grow during the forecast period due to the favorable government initiatives to boost the overall automotive sector. Morocco government has taken various measures such as tax exemptions, skilled labor force, advanced infrastructure and land purchase subsidy to attract the foreign investment in order to strengthen their position in the vehicle manufacturing. For instance, the country has granted two free zones in Tangier and Kenitra city for car manufacturing. Increased demand for the replacement parts such as gearbox, engine parts, filters, brake parts and others is further boosting the Morocco aftermarket auto parts.

Increasing production and exports along with the advanced manufacturing establishment is paving way to make the country an international automotive hub. As the automotive industry continues to evolve, the automotive aftermarket in Morocco will thrive in next seven years.

Morocco Automotive industry is consolidated and dominated by few players like Renault, Dacia, Nissan, Peugeot, Hyundai etc. Dacia Logan and Renault Kangoo Express are two top best selling models in Morocco

Morocco Automotive Aftermarket Market Major Players & Competitive Landscape

Several leading companies operating in Morocco replacement parts industry are Renault, Hyundai Mobis, Peugeot, Volkswagen, Robert Bosch, Valeo, ZF, Delphi, Champion, Federal Mogul, Denso, Mahle, Michelin, Sentury, Bridgestone and many more.

Morocco Automotive Aftermarket Market Scope of the Report

|

Report Coverage |

Details |

| Market Revenues (2024) |

USD Million |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Vehicle Type, By Replacement Parts, By Certification |

| Regional Coverage | Renault, Hyundai Mobis, Peugeot, Volkswagen, Robert Bosch, Valeo, ZF, Delphi, Champion, Federal Mogul, Denso, Mahle, Michelin, Sentury, Bridgestone among others; a total of 10 companies covered. |

| Companies Profiled | Morocco |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Morocco Automotive Aftermarket Market Research Report Segmentation

The Morocco Automotive Aftermarket market has been segmented on the basis of vehicle type, certification and replacement part. By replacement parts, the market is segmented into Clutch Parts, brake parts, tire, filters, Lighting Components, battery, electronic components, Engine Components, Lubricants, and others. Based on the vehicle type, the market has been segmented into commercial vehicles and passenger vehicles. Based on certification, the market has been segmented into Certified Parts, Counterfeit Parts, Genuine Parts, Others.

Morocco Automotive Aftermarket by Vehicle Type

-

- Commercial Vehicles

- Passenger Vehicles

Morocco Automotive Aftermarket by Replacement Parts

-

- Tire

- Battery

- Brake Parts

- Filters

- Air Filter

- Oil Filter

- Others

- Lighting Components

- Electroniccomponents

- Lubricants

- Clutch Parts

- Engine Components

- Timing Belt

- Spark Plugs

- Others

- Others

Morocco Automotive Aftermarket by Certification

-

- Genuine Parts

- Certified Parts

- Counterfeit Parts

- Others

Morocco Automotive Aftermarket Market Leading players

-

-

Renault

-

Hyundai Mobis

-

Peugeot

-

Volkswagen

-

Robert Bosch

-

Valeo

-

ZF

-

Delphi

-

Champion

-

Federal-Mogul

-

Denso

-

Mahle

-

Michelin

-

Sentury

-

Bridgestone

-

Frequently Asked Question About This Report

Morocco Automotive Aftermarket market [UP3585-001001]

Morocco Automotive Aftermarket Market size was estimated at USD XX billion in 2024

The auto aftermarket industry is growing due to increasing number of vehicles on the road & increasing vehicle ownership, growth recovery in new vehicle sales and with millions of passenger vehicles already out of warranty in 2024. This out-of-warranty passenger

Major auto aftermarket players are Renault, Hyundai Mobis, Peugeot, Volkswagen, Robert Bosch, Valeo, ZF, Delphi, Champion, Federal Mogul, Denso, Mahle, Michelin, Sentury, Bridgestone and many more.

Tires hold the largest revenue share in 2024, driven by higher wear and tear and the need for frequent replacement.

Currently traditional sales channel dominate the sales channel however, the online sales channel is expected to register the fastest growth rate over the forecast period.

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: UP3585-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Morocco Automotive Aftermarket Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research