Indonesia Cloud Computing Market Size

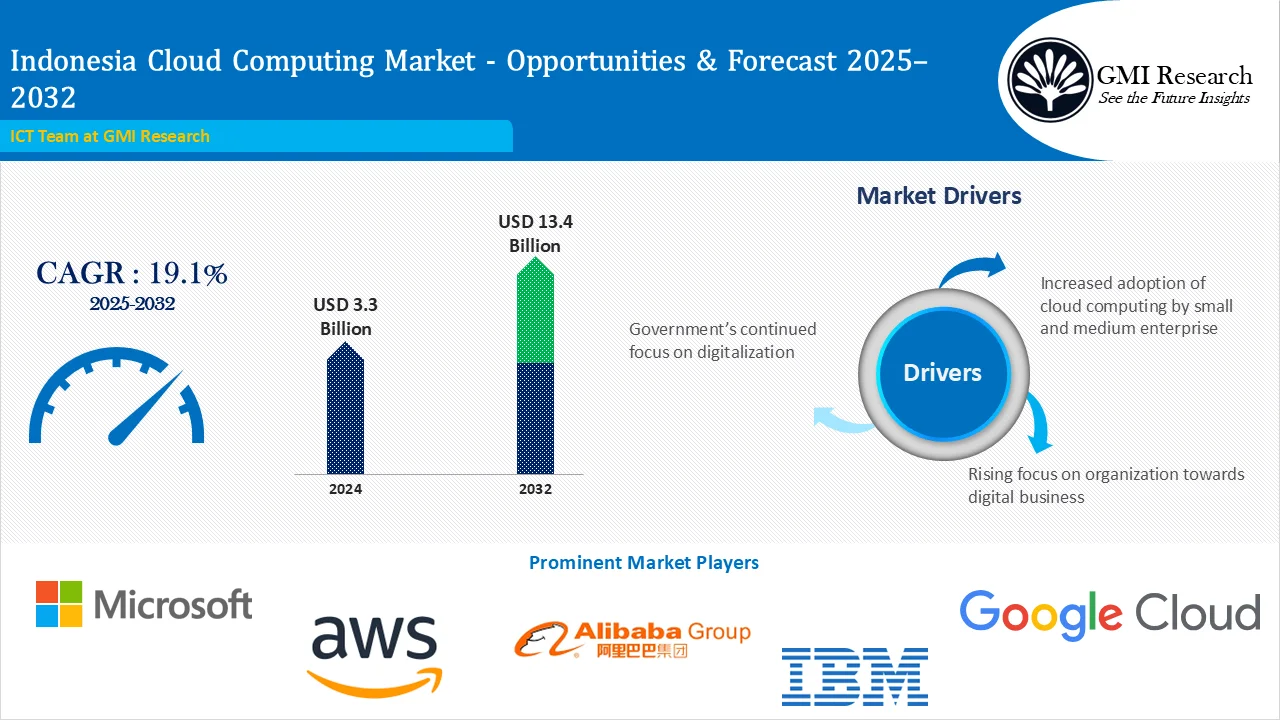

Indonesia Cloud Computing Market size reached USD 3.3 billion in 2024 and is estimated to reach USD 13.4 billion in 2032 and the market is estimated to grow at a very high CAGR of 19.1% from 2025-2032 primarily driven by rapid growth of digital economy, surging e-commerce and digital payments, growing adoption of cloud across large, medium and small businesses, government supports for cloud, rising internet & smartphone penetration etc.

Key Market Forecast & Insights

Market Size:

-

- 2024 – USD 3.3 Billion

- 2032 – USD 13.4 Billion

- Market Forecast – CAGR of 19.1% from 2025-2032

Segment Insights

-

- Service Model Type Insights: SaaS service model holds the largest market share

- Deployment Model Type Insights: Public Cloud segment captured the highest revenue share

- Industry Vertical Type Insights: BFSI industry vertical dominates the Indonesia Cloud market in 2024

Indonesia Cloud Computing Market Dynamics

Indonesia Cloud Computing Market Growth Drivers

Rapid Growth of Digital Economy

Indonesia’s digital economy is experiencing rapid expansion, driven primarily by E-commerce. The country’s E-commerce gross merchandise volume (GMV) represents 76% of the digital economy, amounting to USD 82 billion. Nearly 90% of Internet users aged 16 to 64 have made online purchases. E-commerce market is projected to reach USD 160 billion by 2030, with the rapid development of daily services such as online shopping and digital payments enabled by cloud computing.

Growing Adoption of Cloud across Large, Medium and Small Businesses

There has been increased adoption of cloud computing by small and medium enterprise across Indonesia. More than 90% of the companies operating in Indonesia fall into this category and are increasingly focusing towards reducing their Capital Expenditure (CAPEX) and Operational Expenditure (OPEX).

Small and medium businesses are investing substantially on cloud deployments as it will facilitate rapid business analytics and artificial intelligence. For instance, the demand for software as a service such as Microsoft 365 is gaining prominence among the small and medium businesses.

Organizations across Indonesia are moving towards cloud wherein cloud is the major enabler and platform supporting digital technologies. Indonesia being the fourth largest populated country in the world, the country smartphone adoption rate is projected to reach 89% by 2025 from 71% in 2018, smart as per GSM Intelligence. In Indonesia people spend more time on mobile phones when it compares to its peer countries driving demand for cloud storage and other cloud services. In Indonesia, the internet penetration touched 79% in 2024 as per World Economic Forum reflects the swift adoption of online platforms by Indonesian

Organisations are increasingly deploying cloud owing to its various benefits such as enhanced security, increased flexibility, among others. According to Telekom, by 2025 Indonesia digital economy will achieve USD 133 bn and in 2030 top 10 digital economy.

Challenges Faced by Market Players

The cloud computing market presents numerous security issues and challenges. In the cloud, the data is stored with a third-party provider and is accessed over the internet. This factor has increased complexity related to the security of data and following compliance while securing the same information. Additionally, the rapid growth and implementation of the cloud computing in the companies has given rise to issues related to account hijacking. All these factors are likely to hamper the growing demand of the Indonesia cloud computing market.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Indonesia Cloud Computing Market Segment Analysis

Indonesia Cloud Computing Market by Service Model Insights: SaaS service model holds the largest market share

Based on Service Model, the Software as a Service segment accounted for the highest revenue share in 2024 owing to the increasing emphasis of the Indonesia government on supporting the adoption of SaaS in the country. Moreover, growing adoption of Software as a Service by the small and medium enterprises in the country is fuelling the market growth. Currently, the SMEs accounts for more than 90% of the market in Indonesia and are increasingly opting for SaaS products in order to avoid large-up front licensing fees and huge capital costs. The SaaS offers beneficial cost saving as it usually resides in a shared or multi-tenant environment, wherein the license cost of hardware and software is comparatively low to the traditional model. Moreover, SaaS offerings are easy to use, reduces the time spend on installation, and provides scalability.

Indonesia Cloud Computing Market by Deployment Model Insights: Public Cloud segment captured the highest revenue share

Based on deployment, the public cloud segment accounted for the highest revenue share in 2021. This is majorly due to the increasing demand for the public cloud by industries such as telecommunications, manufacturing, retail among others. Leading organizations in Indonesia are shifting their applications and workloads to the public cloud platforms due to the rising concerns related to security. The public cloud services are being increasingly used by SMEs and other businesses due to its lower cost as compared to the traditional data center and private clouds services. This factor is expected to attract a large customer base into the Indonesia public cloud market during the forecast period.

Indonesia Cloud Computing Market Industry Vertical Insights: BFSI industry vertical dominates the Indonesia Cloud market in 2024

BFSI industry vertical generates the largest cloud market revenue in 2024. Indonesia’s Financial Services Authority has laid out a roadmap for finance companies to adopt cloud technologies through its Digital Finance Innovation Roadmap and Action Plan, and has established specific digital transformation targets in the Financial Services Sector Master Plan 2021–2025.

The Indonesian government is also encouraging the education sector to move toward cloud adoption. In response, both traditional institutions—such as Pasundan University (UNPAS)—and online education providers, including sekolah.mu and IKIP PGRI Bojonegoro are partnering with global cloud providers to develop online learning platforms that support students in remote communities and low-income households.

Cloud-based healthcare investment is projected to grow significantly during the forecast period, though it still lags behind sectors like financial services. Despite this growth, healthcare represented only about 3.1% of total cloud spending in the region in 2024.

Indonesia Cloud Computing Market Major Players & Competitive Landscape

Major players operating in the Indonesia Cloud Computing market, includes Microsoft, AWS, Google, Huawei, Intel, IBM, Oracle, Salesforce, Adobe, VMware, Alibaba among others.

Microsoft has a strong presence in the Indonesian cloud market owing to its opening of first cloud region in Indonesia. Microsoft has more than 100 organizations are using Microsoft cloud from Indonesia, some of the major organizations, including Adaro, BCA, Binus University, Pertamina, Telkom Indonesia, and Manulife have adopted the Indonesia Central cloud region to leverage Microsoft’s hyperscale infrastructure locally. AWS also have a strong presence with a list of reputed business as its customers such as Tokopedia, Traveloka.com, Lion Air and many more.

Are you Looking for a Partner for your Indonesia Market Entry and Business Expansion plans? GMI Research with decades of experience tracking Indonesia market is the right choice for you

Indonesia Cloud Computing Market News

-

- In May 2025, Microsoft announced the opening of its first cloud region in Indonesia, named Indonesia Central, further expanding its global network to more than 70 Azure regions, the largest footprint among cloud providers. The new AI-ready hyperscale cloud infrastructure delivers in-country data residency, enhanced security, and reduced latency. Indonesia Central will offer a comprehensive suite of advanced services spanning productivity, data analytics, cybersecurity, computing, and storage.

- In April 2024, Throughout the next four years, Microsoft will invest USD 1.7 billion in cloud infrastructure and Artificial Intelligence (AI) in Indonesia. For 29-year history of the company in Indonesia, this will mark as its largest single investment.

- In 2021, AWS strategically announced the launch of Amazon CloudFront, in Indonesia, which is a network offered by the company and is expected to improve 30% in first-byte latency.

- In 2021, Microsoft announced to launch its first data centers in Indonesia, which is a strategic plan to enter the Indonesian cloud market, as the country is the leading cloud market in the South-East Asia. This is mutually beneficial for both, the company and the country, in the context of cloud expansion.

- In 2021, Alibaba Cloud announced that the company planned to invest USD 1 billion for cloud across the Asia-Pacific which includes Indonesia as well. This strategic investment will also boost the Southeast Asia cloud computing market.

Indonesia Cloud Computing Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 3.3 Billion |

| Market Revenue Forecast in 2032 |

USD 13.4 Billion |

| CAGR |

19.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Service Model, By Deployment Model, By Organisation Size, By Industry Vertical |

| Regional Coverage | Indonesia |

| Companies Profiled | Microsoft, AWS, Google, Huawei, Intel, IBM, Oracle, Salesforce, Adobe, VMware, Alibaba, among others; a total of 11 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Indonesia Cloud Computing Market Research Report Segmentation

The Indonesia Cloud Computing market has been segmented on the basis of Service Model, Deployment Model, Organization Size and Industry Vertical. Based on the service model, the market has been segmented into Infrastructure as a Service, Platform as a Service, Software as a Service. Based on the deployment model, the market has been segmented into Public Cloud, Private Cloud and Hybrid Cloud. Based on the organization size, the market has been segmented into Small and Medium Enterprises and Large Enterprises. Based on industry vertical, the market has been segmented into Manufacturing, Healthcare and Life Sciences, IT & Telecom, Retail and Consumer Goods, Energy and Utilities, Media and Entertainment, BFSI, Government and Public Sector and Others

Indonesia Cloud Computing Market by Service Model

-

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

Indonesia Cloud Computing Market by Deployment Model

-

- Public Cloud

- Private Cloud

- Hybrid Cloud

Indonesia Cloud Computing Market by Organisation Size

-

- Small and Medium Enterprises

- Large Enterprises

Indonesia Cloud Computing Market by Industry Vertical

-

- Manufacturing

- Healthcare and Life Sciences

- IT & Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Media and Entertainment

- BFSI

- Government and Public Sector

- Others

Indonesia Cloud Computing Market Leading players

-

- Microsoft

- AWS

- Huawei

- Intel

- IBM

- Oracle

- Salesforce

- Adobe

- VMware

- Alibaba

Frequently Asked Question About This Report

Indonesia Cloud Computing Market [UP2084-001001]

Indonesia Cloud Computing Market was worth USD 3.3 billion in 2024 and forecast to reach USD 13.4 billion in 2032.

The Indonesian Cloud computing market is driven by rapid growth of digital economy, surging e-commerce and digital payments, growing adoption of cloud across large, medium and small businesses, government supports for cloud, rising internet & smartphone penetration etc.

Indonesia Cloud Computing market looks very promising and the market is forecast to grow at a very high CAGR of 19.1% from 2025-2032.

Major players operating in the market are Microsoft, AWS Google, Huawei, Intel, IBM, , Oracle, Salesforce, Adobe, VMware, Alibaba among others.

Software as a Service segment accounted for the highest revenue share in 2024.

BFSI industry vertical dominates the Indonesia Cloud market in 2024.

Related Reports

- Published Date: Dec-2025

- Report Format: Excel/PPT

- Report Code: UP2084-001001

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Indonesia Cloud Computing Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research