China Animal Feed Market Overview

China Animal Feed Market size reached USD 181 billion in 2024 and is estimated to reach USD 238 billion in 2032 and the market is estimated to grow at a CAGR of 3.5% from 2025-2032 owing to the increasing poultry and meat consumption, rising household incomes, as well as growth in population and rapid urbanization and government initiatives to support animal feed industry.

Market Size & Forecast:

-

- 2024 – USD 181 Billion

- 2032 – USD 238 Billion

- Market Forecast – CAGR of 3.5% from 2025-2032

Key Segment Insights:

-

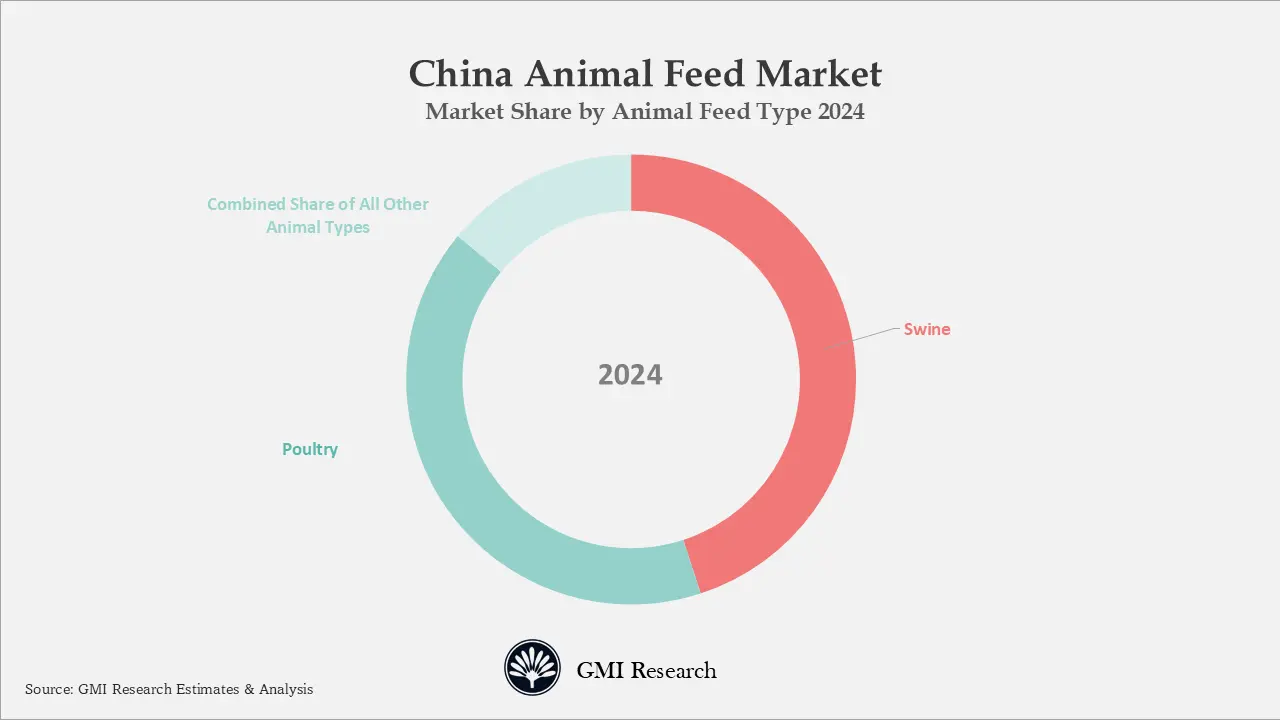

- Animal Type Market Insights: Pig feed hold the largest revenue share in 2024. However, Poultry feed market is the second largest revenue generator in China.

China Animal Feed Market Trends

In China, the government is focussing on reducing reliance on grain and soybean meal by 2030 in an attempt to cut cost, boost efficiency and improve food security. Ministry of Agriculture and Rural Affairs estimates that there will be 7% drop in feed consumption per KG of by 2030. There are also plains to increase usage of alternative protein sources and have plans to increase production capacity of alternative protein sources significantly. The government is also encouraging farms to switch to low-protein diet technologies and use of synthetic amino acids to reduce soybean and grain use.

China Animal Feed Market Growth Drivers

Increasing Meat Consumption

The rising need in China for feed ingredients to sustain its expanding animal protein consumption and production has significant implications for agricultural markets on a global scale China held the position of the largest importer globally for soybeans, barley, rapeseed, and other essential components in both direct and indirect animal feed applications. Corn, primarily utilized in animal feed, has become the nation’s primary crop surpassing both rice and wheat, while China also ranks among the top consumers and producers of feed additives such as lysine. However, over the past forty years China has shifted from a predominantly plant-based diet to increased meat consumption, resulting in its status as the world’s top livestock products producer and the largest animal feed manufacturer.

Population Growth and Rapid Urbanization.

As the population increases and living standards improve, there has been a gradual rise in meat consumption in China and consequently the animal feed production is anticipated to sustain its upward trajectory to meet the growing demand. The production volume of animal feed in China totaled 228.85 million MT in recent years, where the regions of Shandong and Guangdong produced more than 30 million MT each, with additional production exceeding ten million MT in areas such as Jiangsu, Guangxi, Sichuan, Henan, Liaoning, Hebei, Hunan, and Hubei.

The growth of China animal feed market is anticipated to grow in the years ahead as the trend of urbanization and rising living standards will likely lead to higher levels of animal protein consumption. The expansion and modernization of the aquaculture and livestock industries will promote the adoption of commercial feeds, advocated by the Minister of Agriculture in China for a swift move from backyard farming to larger-scale operations closely integrated with processing companies where above-scale farms already dominate the egg industry. Meanwhile, China’s utilization of commercial feed in the sheep and cattle sectors is currently limited, but there is a potential growth as these segments increasingly embrace commercial production models.

Government Initiatives to Support Animal Feed Industry

The other factor contributing to the growth of China animal feed market size is the roles and initiatives from the government, including the five-year strategy for the feed sector which outlines a plan to transition the country from a large-scale producer to a dominant player by modernizing and consolidating smaller mills. The Ministry of Agriculture’s initiative to relicense feed mills in 2014 was ostensibly focused on enhancing feed quality and safety standards, but the campaign was also intended to reduce oversupply by shutting down mills that were not equipped with modern technology, quality control standards, or sufficient testing capabilities.

However, despite the pivotal role of government officials in initiating China animal feed market, its rise as the global leader in feed production largely stems from the growth of privately owned enterprises. In fact, China’s strict environmental regulations have led to the shutdown of many small-scale and outdated farms, creating substantial opportunities for larger players to increase their market share. Given these circumstances, increased concentration in industrial production and overall industrialization levels have boosted demand for animal feed once again. As the Chinese government is reforming the supply side of agriculture, there is a broader implementation of environmental regulations and enhanced food safety measures throughout the country. Consequently, there is an avoidable trend towards increased concentration and larger-scale production across the entire animal feed industrial chain in China, which encompasses the amino acids industry at its source to its utilization in livestock farming downstream.

China animal feed market is forecasted to maintain its growth trajectory in the coming years mainly due to China’s successful efforts in effectively controlling the spread of covid outbreak and saw a 2.3% increase in economic growth, in stark contrast to the negative impact felt in other parts of the world. The significant rise in poultry feed production presents an intriguing sector to monitor in the upcoming years whether it can sustain its high level and maintain to hold the largest share across all feed categories manufactured in the nation. In theory, the substantial rebound in swine product demand particularly for swine feed anticipated to reduce demand for alternative animal feed types or consolidate market share to achieve higher levels than other sectors of animal feed, but contrary to expectations, this trend is not taking place in China. The main reason behind this is the transition to large-scale and structured poultry farming, which involves replacing small backyard farms that have poor hygiene conditions. In addition, proper farm management, which emphasizes operational efficiency and cost control, has stabilized the growing demand for mixed poultry feed.

China Animal Feed Market Segment Analysis

Animal Type Market Insights: Pig feed hold the largest revenue share in 2024. However, Poultry feed market is the second largest revenue generator in China.

Swine feed dominated the market revenues owing to pork is the most eaten meat in China for many decades. The meat consumption in China has significantly increased in the last couple of decades owing to growing income levels. As per United Nations Food & Agriculture Organization, the per capita meat consumption China reached 70 KG in 2022 from merely 45 KG in 2002 increased almost 18 times. Pork dominated the meat consumption with 57% share in 2022. The popularity of pork meat in China is driving the swine feed market in the country during the forecast period.

In the last couple of decades Chinese have started to diversify their meat consumption patterns, before 1980 most of the meat consumed are pork however, in recent decades Chinese consumption of poultry and beef has also witnessed significant increase. Poultry feed market is the second largest revenue generator in China, it is only 13 million less than swine feed in 2024.

China Animal Feed Market Major Players & Competitive Landscape

Several leading companies are New Hope Group, Wen’s Foodstuff Group, CP Group (Charoen Pokphand Group), Haid Group, Twins Group, Tongwei Group, Cargill, China National Cereals, Oils and Foodstuffs Corporation, CJ Tianjin Feed Co., Ltd., TRS Group and many more. China is home to some of the largest animal feed producing companies globally, there are around 1,032 feed production plants in China with a capacity of me than 100k tons per annum.

Challenges Faced by China Animal Feed Market Companies

Furthermore, due to the extensive swine fever outbreak in China and lesser extents in other nations, the global production of animal feed decreased for the first time and the US production of animal feed has exceeded that of China after a decade-long gap. However, expectations suggest that China will reclaim its position as the largest consumer of animal feed in the coming years, surpassing the US once again. Despite China’s above-average pork consumption on a global scale, there is considerable potential for growth in beef and poultry meat. The animal feed sector is seeing opportunities for development, driving consolidation among industry leaders which is expected to drive up the country’s need for oil meals, whether sourced locally through crushing or by means of imports. In addition, the relatively low average beef consumption per capita in China creates a promising opportunity for foreign beef suppliers to extend their market penetration into the country. It is also a chance for palm kernel cake producers to tap into the potential growth in demand for ruminant feed, especially if China promotes domestic breeding among livestock industry participants.

However, one of the main challenges for China animal feed market is the fluctuating prices of feed ingredients, as feed compositions generally combines grains and assorted minerals which prices susceptible to factors like weather and international commodity markets. Additionally, issues with regulatory compliance and maintaining the safety and quality of feed products can pose further challenges for the development of this market.

Key China Animal Feed Market Developments

-

- In Aug 2024, Advent International a private equity investor announced its investment in Seek Pet Food a prominent Chinese pet food producers. Advent will work with Seek’s founder Fang Yuan and other shareholders to speed up sales growth.

China Animal Feed Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 181 billion |

| Market Revenue Forecast in 2032 |

USD 238 billion |

| CAGR |

3.5% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Type, By Product |

| Regional Coverage | China |

| Companies Profiled | New Hope Group, Wen’s Foodstuff Group, CP Group (Charoen Pokphand Group), Haid Group, Twins Group, Tongwei Group, Cargill, China National Cereals, Oils and Foodstuffs Corporation, CJ Tianjin Feed Co., Ltd., TRS Group among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

China Animal Feed Market Research Report Segmentation

The China Animal Feed Market has been segmented on the basis of type and product. Based on the type, the market is segmented into swine, poultry, aquaculture, ruminant and others. Based on the product, the market is segmented into pellets, mash, crumbles.

China Animal Feed Market by Type

-

- Poultry

- Swine

- Ruminant

- Aquaculture

- Others

China Animal Feed Market by Product

-

- Pellets

- Mash

- Crumbles

China Animal Feed Market Leading players

-

-

New Hope Group

-

Wen’s Foodstuff Group

-

CP Group (Charoen Pokphand Group)

-

Haid Group

-

Twins Group

-

Tongwei Group

-

Cargill

-

China National Cereals, Oils and Foodstuffs Corporation

-

CJ Tianjin Feed Co., Ltd.

-

TRS Group

-

Frequently Asked Question About This Report

China Animal Feed Market [GR24AB-01-00279]

China Animal Feed Market size was estimated at USD 181 billion in 2024

China Animal Feed Market is driven by the increasing poultry and meat consumption, rising household incomes, as well as growth in population and rapid urbanization and government initiatives to support animal feed industry.

China Animal Feed Market has the potential for growth and the market size is estimated to reach USD 238 billion in 2032 and the market is estimated to grow at a CAGR of 3.5% from 2025-2032.

Major players are New Hope Group, Wen's Foodstuff Group, CP Group (Charoen Pokphand Group), Haid Group, Twins Group, Tongwei Group, Cargill, China National Cereals, Oils and Foodstuffs Corporation, CJ Tianjin Feed Co., Ltd., TRS Group and many more.

Pig feed accounted for the largest share of revenue in 2024, while the poultry feed segment emerged as the second-largest revenue contributor in China.

Related Reports

- Published Date: Jan-2026

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00279

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

China Animal Feed Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research