Chile Plastic Market Size

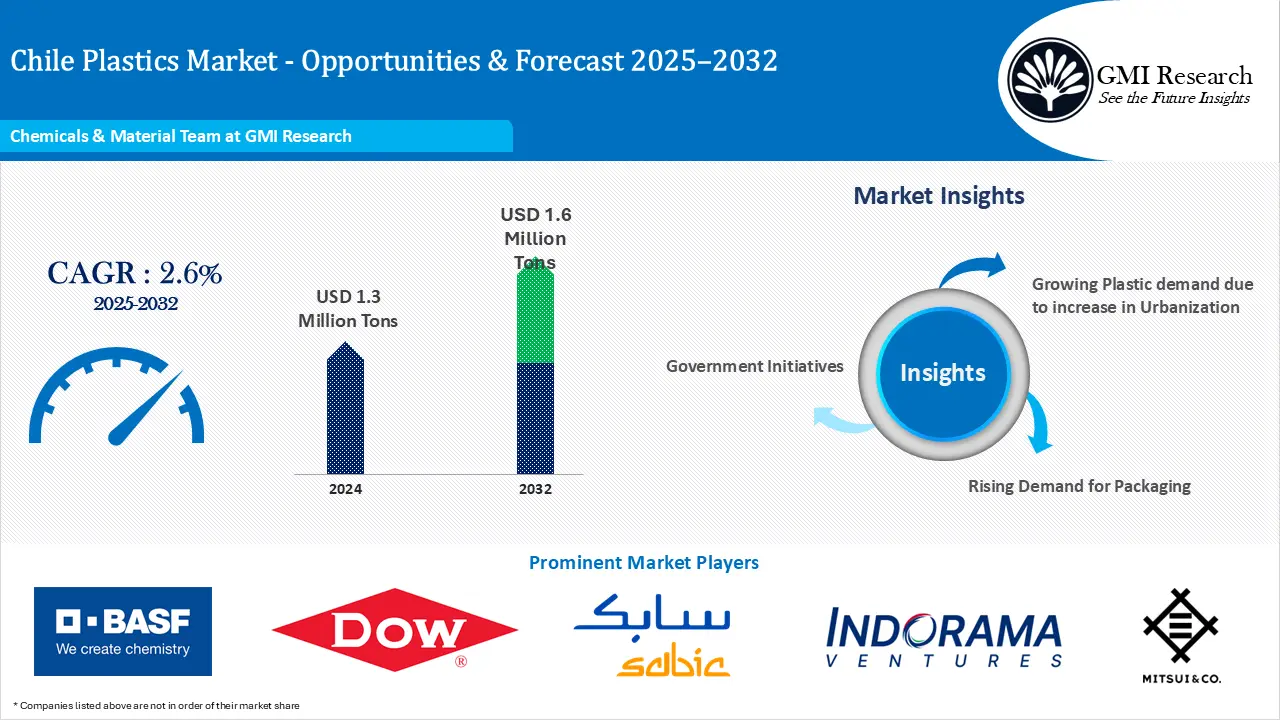

Chile Plastic Market size stood at 1.3 million tonnes in 2024 and is estimated to reach USD 1.6 million tonnes in 2032 with an estimated CAGR of 2.6% from 2025-2032 owing to growing plastic demand due to increase in urbanization, rising demand for packaging and government initiatives.

Key Market Insights

Market Size:

-

- 2024 – 1.3 Million Tonnes

- 2032 – 1.6 Million Tonnes

- Market Forecast – CAGR of 2.6% from 2025-2032

Segment Insights

-

- Product Type Insights: Polyethylene (PE) plastic type holds the largest revenue share

- Application Type Insights: Packaging application segment captures the largest market share

Chile Plastic Market Drivers

Growing Plastic demand due to increase in Urbanization

Chile plastic market size is experiencing growth driven by the rise in plastic consumption. In 2019 the total consumption reached nearly one million tons or 56 kilograms per person with the food service industry generating 23,240 tons of disposable plastics annually.

Rising Demand for Packaging

The majority of the demand is driven by packaging and bottle sectors which make up around 50% of the total demand. While mining, agriculture, fisheries, and retail contribute while collectively accounting for more than a third of the total demand.

Government Initiatives

Chile plastic market trends are being influenced by new government regulations aimed at enhancing plastic recycling efforts. Chile generates almost one million tons of plastic waste annually but only 8.5% is recycled. Plastic waste is a pressing environmental concern in Chile and globally. Chilean President Gabriel Borich has committed to a strong agenda prioritizing environmental preservation alongside the promotion of sustainable and inclusive economic development.

The Chilean Plastics Pact which is spearheaded by the Environment Ministry seeks to transform plastic production and disposal to mitigate environmental pollution. Among its targets is the implementation of a regulation banning single use plastics. Another key objective is to ensure that one-third of non-delivery and delivery plastic packaging is recyclable or reusable and made from 25% recycled content. This law is expected to reduce single use plastic waste by approximately 23,000 tons each year.

The law seeks to cut down on waste by focusing on three main objectives. That includes removing single use items from the food and beverage sector along with certifying plastic products. It also sets regulations for disposable plastic containers regarding the composition and use. The plastic products under regulation are typically non-recyclable and often contaminated with food residues while having minimal commercial value because of its small size. These include items such as plates, cups and other single-use plastics covered by law.

With the implementation of the EPR law, plastic recycling is transitioning from a voluntary effort driven mainly by entrepreneurs and the cost advantages of recycled resins to a mandatory responsibility. Under the law, business owners and consumer goods sellers will be held accountable for recovering the waste generated by their product packaging. The EPR scheme mandates that 80 percent among households within the country will gain access to curbside pickup for recyclable materials which is a significant increase from the current coverage that barely serves ten percent within households.

Chile Plastic Market Segment Analysis

Plastic Type Market Insights: Polyethylene (PE) plastic type captured the highest revenue share

Based on type Polyethylene is the most commonly used owing to its ability to be produced in various densities. Its varying densities give the final plastic distinct physical characteristics which makes it suitable for a broad range of products. HDPE is durable and resistant to chemicals or moisture which makes it perfect for applications such as containers along with various construction materials.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Polypropylene is a highly durable plastic known for its superior heat resistance which makes it ideal for applications like food packaging and storage especially for hot items or products that need to be heated. It offers flexibility for light bending while retaining its strength and shape for extended use.

Polyethylene Terephthalate is highly resistant to chemicals including water and organic materials while also easily recyclable. Known for its remarkable shatterproof nature, PET is widely used in products like clothing fibers, food containers and many everyday items.

Application Market Insights: Packaging application segment holds the largest market share

The packaging segment leads the market based on end-use industry as plastic packaging offers a versatile solution for protecting and transporting products in various forms. Many products that consumer purchase rely on plastic packaging to ensure they survive the journey to stores or homes and remain in good condition for consumption or use. Their durability and waterproof qualities are what make them very versatile and valuable for packaging. However, Chile has recently approved a bill designed to urgently address plastic pollution by prohibiting and restricting the disposable plastics in food sales and delivery services. It also mandates that 30% of bottled beverages in supermarkets must be in reusable packaging.

Chile Plastic Market Major Players & Competitive Landscape

Several leading companies operating in the market are BASF, DOW, Sabic, Indorama Ventures, Mitsui & Co and many more.

There are opportunities for international companies in various areas. That includes technology to enhance plastic packaging recycling and compostable alternatives to plastic packaging. Companies can also offer materials that serve as substitutes for plastic.

Chile Plastic Market Scope of the Report

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 1.3 Million |

| Market Revenue Forecast in 2032 |

USD 1.6 Million |

| CAGR |

2.6% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By End-Use Industry |

| Regional Coverage | Chile |

| Companies Profiled | BASF, DOW, Sabic, Indorama Ventures, Mitsui & Co, among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Chile Plastic Market Research Report Segmentation

The Chile Plastic Market has been segmented on the basis of type and end-use industry. Based on the type, the market is segmented into polypropylene, polyethylene, polyvinyl chloride, polyethylene terephthalate, polycarbonate, polyamide, polystyrene, polyurethane and others. Based on the end-use industry, the market is segmented into automotive & transportation, packaging, consumer goods, infrastructure & construction, healthcare & pharmaceuticals, electrical & electronics, others.

Chile Plastic Market by Type

-

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Polyamide

- Polycarbonate

- Polyurethane

- Polystyrene

- Others

Chile Plastic Market by End-Use Industry

-

- Packaging

- Automotive & Transportation

- Infrastructure & Construction

- Consumer Goods

- Healthcare & Pharmaceuticals

- Electrical & Electronics

- Others

Chile Plastic Market Leading players

-

- BASF

- DOW

- Sabic

- Indorama Ventures

- Mitsui & Co

Frequently Asked Question About This Report

Chile Plastic Market

Chile Plastic Market size was estimated at 1.3 Million Tonnes in 2024

The market growth is driven by growing plastic demand due to increase in urbanization, rising demand for packaging and government initiatives.

Chile Plastic Market estimated to reach USD 1.6 million tonnes in 2032 with an estimated CAGR of 2.6% from 2025-2032.

Some of the major players operating in the market are BASF, DOW, Sabic, Indorama Ventures, Mitsui & Co and many more.

Packaging application segment holds the largest market share.

Polyethylene (PE) plastic type captured the highest revenue share.

Related Reports

- Published Date: Sep-2025

- Report Format: Excel/PPT

- Report Code: GR24AB-01-00350

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Chile Plastic Market and Analysis Report – Opportunities and Forecast 2025-2032

Why GMI Research