No products in the cart.

Contactless Biometrics Technology Market by Slope By Component (Hardware, Software, and Service), By Application (Face, Hand Geometry, Voice, Fingerprint, Iris, Others), By End-Use (Government, Banking & Finance, Consumer Electronics, Healthcare, Transport & Logistics, Defence & Security, Others), and By Region – Global Opportunities & Forecast, 2022-2029

Report Description

Table Of Content

Sample Request

Request For Customization

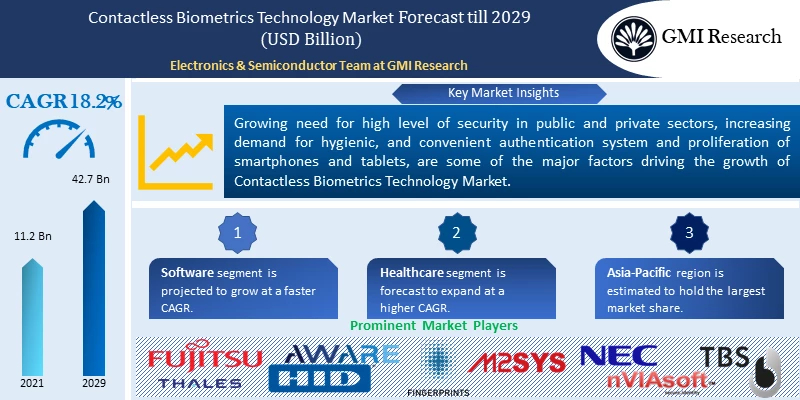

Contactless Biometrics Technology Market size reached USD 11.2 billion in 2021 and is estimated to reach USD 42.7 billion in 2029 and the market is estimated to grow at a very high CAGR 18.2%.

To have an edge over the competition by knowing the market dynamics and current trends of “Contactless Biometrics Technology Market”, request for Sample Report here

Key Drivers

Rising demand for secure, hygienic, and convenient authentication system and growing need for high level of security in public and private sectors are the prominent factors that are expected to drive the market growth for contactless biometrics technology. Growing usage of identification and data capture technology for security purpose in a wide range of areas including e-commerce and retail industry, BFSI sector, border control applications, government offices, corporate sector, airports, and others are further encouraging the use of touchless authentication technology, thereby, driving the market growth. Rising penetration of smartphones and tablets, coupled with increasing focus of manufacturers on incorporating facial recognition software for smartphones as verification to unlock their smartphones, provides secure access to apps and authenticates payments is further expected to stimulate market growth.

Technological advancement in the field of biometric sensors, computing power, and artificial intelligence are further leveraging contactless biometric to be a very powerful technology for identifying or authenticating users. The outbreak of COVID 19 and the use of the contactless biometric authentication to reduce the number of things people need to touch while providing physically access to secured locations and conducting transactions on public devices such as ATMs, kiosks, and payment systems. This factor is expected to propel the market growth during the forecast period. However, the high cost of contactless biometrics solutions and high risk of data theft or identity theft are some of the factors that are anticipated to restraint the market growth of contactless biometrics technology during the forecast period.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Component – Segment Analysis

Based on the component, the market is segmented into hardware, software, and service. The software segment is expected to grow at a higher CAGR during the forecast period. Rising adoption of new advanced technologies including cloud-based services, Artificial Intelligence (AI), and Machine Learning (ML) for contactless biometrics solutions is expected to drive the demand for associated software for ensuring the compatibility of devices and operating systems for different applications In addition to this, software allows users to integrate the latest add-on features by just updating the software of the application. Growing demand for fast identification of individuals and secure access controls in various sectors, including e-commerce, border controls, airport, and other, is further accelerating the growth of the segment.

Application– Segment Analysis

Based on the application, the market is segmented into face, hand geometry, voice, fingerprint, iris, and others. Iris identification segment is anticipated to grow at a faster CAGR during the forecast period owing to the increasing adoption of iris technology by state and local agencies for border security, hospitals, financial institutes, and several sensitive projects. Moreover, various benefits offered by iris authentication system such as higher accuracy, security, scalability, hygiene, stability, liveness detection, faster matching, and easy to use feature are escalating the growth of the segment.

End-use – Segment Analysis

Based on end-use, the market is segmented into government, banking & finance, consumer electronics, healthcare, transport & logistics, defence & security, and others. The healthcare segment is projected to grow at a faster CAGR during the forecast period. This is primarily attributed to the increasing incidences of healthcare data breaches and medical identity theft. Additionally, high demand for hygiene, along with the recent outbreak of contagious diseases including SARS and COVID 19 is propelling the demand for contactless security and authentication system in hospitals, diagnostic centres, pathology, and other healthcare facilities. Moreover, patients can use contactless biometrics system equipped with facial recognition, iris, and other biometrics to pre-register and check-in for appointments at hospitals, which help in improving patient and healthcare provider safety and quality of care while maintaining social distancing, epecially during the COVID-19 pandemic

In case, any of your pain points areas are not covered in the current scope of this report, Request for Free Customization here

Regional – Segment Analysis

Based on the region, Asia-Pacific region is anticipated to dominate the contactless biometrics technology market during the forecast period primarily due to the outbreak of the COVID 19 pandemic in China and rising demand for touch less technology for safety and security system. Additionally, increasing adoption of contactless biometrics systems in various sectors including transport & Logistics, commercial, consumer electronics, banking & finance, and others, along with the surging number of educational institutes, factories, corporate offices, power plants, banks and other facilities in developing countries including China, Japan, India, and South Korea, are further propelling the demand of contactless biometrics technology market.

Top Market Players

Various notable players operating in the global contactless biometrics technology market include Aware Inc., Fingerprint Cards AB, Fujitsu Limited, Thales Group, HID Global Corporation, IDEMIA Group S.A.S., M2SYS Technology, NEC Corporation, nViaSoft, and Touchless Biometric Systems AG, among other companies.

Key Developments:

-

- In 2020, IDEMIA Group S.A.S., France-based technology company, launched an advanced contact-less facial recognition access control device titled as VisionPass for the India market. VisionPass offers working in all light conditions, with all face types and with various vertical and horizontal angles to identify users of different heights. Additionally, VisionPass can also counter spoofing attempts by image, video or 3D masks for access control and security application.

- In 2018, Precise Biometrics AB partnered with NXP Semiconductors N.V. for the development of a smart card solution. In this collaboration, BioMatch Card software of Precise Biometrics AB will be integrated into NXP’s contactless biometric smart cards. This combined solution is expected to significantly improve convenience for consumers while increasing the security of payments.

- In 2018, Fingerprint Cards AB, one of the leading biometrics company, partnered with FEITIAN, one of the leading providers of user authentication and transaction security in China. This partnership was aimed for developing contactless payment cards by FEITIAN using Biometrics by Fingerprints. The card is integrated with the T-Shape(TM) module which is part of the 1300-series from Fingerprints Cards AB company and also offers ultra-low power consumption.

The global Contactless Biometrics Technology market has been segmented on the basis of component, application, end-use, and region. Based on the component, the market is segmented into hardware, software, and service. Based on application, the market is segmented into face, hand geometry, voice, fingerprint, iris, and others. Iris. Based on end-use, the market is segmented into government, banking & finance, consumer electronics, healthcare, transport & logistics, defence & security, and others.

For detailed scope of the “Contactless Biometrics Technology Market” report request a Sample Copy of the report

Key questions answered in this research report:

-

- At what pace is global Contactless Biometrics Technology market growing? What will be the growth trend in the future?

- What are the key drivers and restraints in Contactless Biometrics Technology market? What will be the impact of drivers and restraints in the future?

- What are the regional revenues and forecast breakdowns? Which are the major regional revenue pockets for growth in the global Contactless Biometrics Technology market?

- Which component generated maximum revenues in 2021 and identify the most promising component during the forecast period?

- What are the various applications of global Contactless Biometrics Technology market and how they are poised to grow?

- What companies are the major participants in this market and their business strategies, how does the competitive landscape look like?

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD 11.2 Billion |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Component, By Application, By End-Use, and By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | Aware Inc., Fingerprint Cards AB, Fujitsu Limited, Thales Group, HID Global Corporation, IDEMIA Group S.A.S., M2SYS Technology, NEC Corporation, nViaSoft, and Touchless Biometric Systems AG among others; a total of 10 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global Contactless Biometrics Technology Market by Component

-

- Hardware

- Software

- Service

- Professional Services

- Managed Services

Global Contactless Biometrics Technology Market by Application

-

- Face

- Hand Geometry

- Voice

- Fingerprint

- Iris

- Others

Global Contactless Biometrics Technology Market by End-Use

-

- Government

- Banking & Finance

- Consumer Electronics

- Healthcare

- Transport & Logistics

- Defence & Security

- Others

Global Contactless Biometrics Technology Market by Region

-

- North America Contactless Biometrics Technology Market (Option 1: As a part of the free 25% customization)

- By Component

- By Application

- By End-Use

- US Market All-Up

- Canada Market All-Up

- Europe Contactless Biometrics Technology Market (Option 2: As a part of the free 25% customization)

- By Component

- By Application

- By End-Use

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Contactless Biometrics Technology Market (Option 3: As a part of the free 25% customization)

- By Component

- By Application

- By End-Use

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Contactless Biometrics Technology Market (Option 4: As a part of the free 25% customization)

- By Component

- By Application

- By End-Use

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Contactless Biometrics Technology Market (Option 1: As a part of the free 25% customization)

Global Contactless Biometrics Technology Market Players (Option 5: As a part of the Free 25% Customization – Profiles of 5 Additional Companies of your Choice)

-

- Aware Inc.

- Fingerprint Cards AB

- Fujitsu Limited

- Thales Group

- HID Global Corporation

- IDEMIA Group S.A.S

- M2SYS Technology

- NEC Corporation

- nViaSoft

- Touchless Biometric Systems AG

- Published Date: Oct-2021

- Report Format: Excel/PPT

- Report Code: UP1120A-00-0620

Get Free 25% Customization in this Report

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Contactless Biometrics Technology Market by Slope By Component (Hardware, Software, and Service), By Application (Face, Hand Geometry, Voice, Fingerprint, Iris, Others), By End-Use (Government, Banking & Finance, Consumer Electronics, Healthcare, Transport & Logistics, Defence & Security, Others), and By Region – Global Opportunities & Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

SKU: UP1120A-00-0620

Categories: Electronics & Semiconductor, Published, Report Store

Tags: Contactless Biometrics Technology Market, Contactless Biometrics Technology Market Dynamics, Contactless Biometrics Technology Market Growth, Contactless Biometrics Technology Market Key players, Contactless Biometrics Technology Market Opportunity, Contactless Biometrics Technology Market Size, Contactless Biometrics Technology Market Trends

Why GMI Research