Africa Diesel Generator Market Size

Africa diesel generator market size was estimated at USD 1.2 billion and the market is forecast to reach USD 1.7 billion in 2032 and the market is projected to grow at a CAGR of 4.1% between 2025 and 2032. The market growth is primarily driven by unreliable electricity grids, leading to frequent power outages, rising demand for electricity and the development of the industrial sector in the region.

Market Forecast & Key Insights

Market Size:

-

- 2024 – USD 1.2 Billion

- 2032 – USD 1.7 Billion

- Market Forecast – CAGR of 4.1% from 2025-2032

- In 2024, the diesel generator sales witnesses negative growth in Africa, primarily in Nigeria and South Africa the two major market.

Segment Insights

-

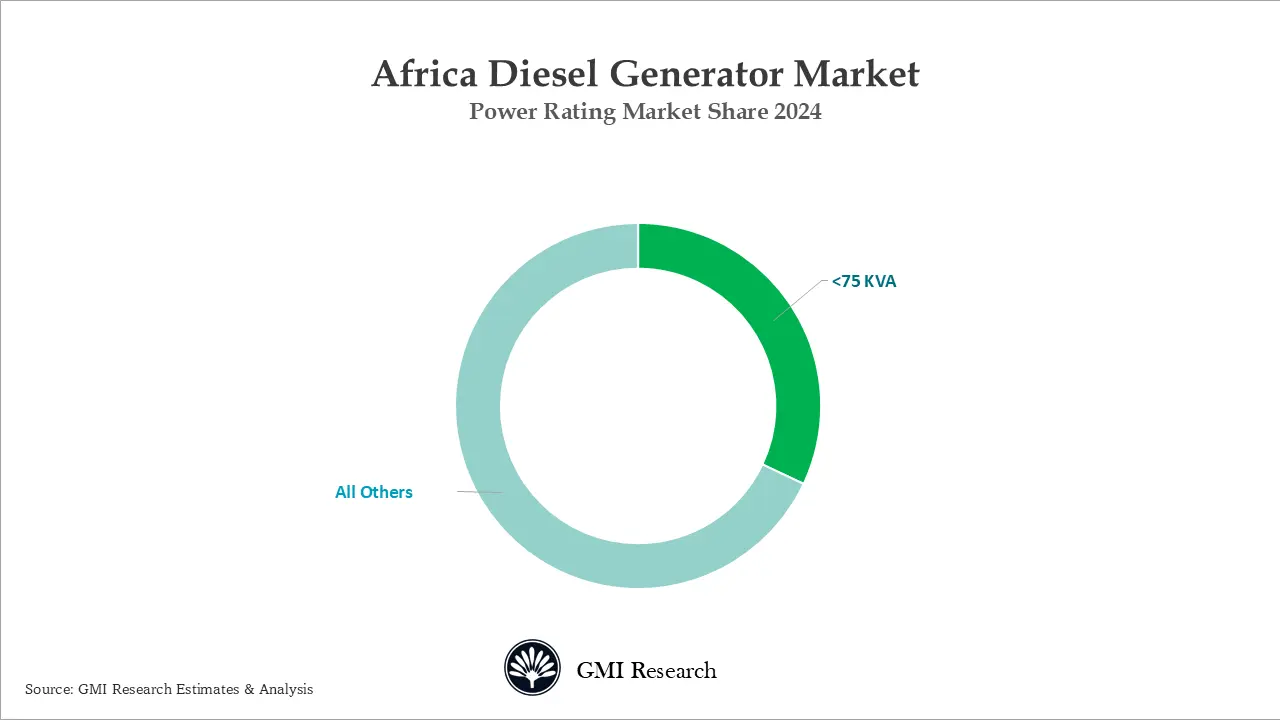

- Power Rating Insights: Generators which have a power rating of less than 75kVA dominates the market revenues

- End-Use Insights: Industrial segment dominates the diesel generator revenues in Africa

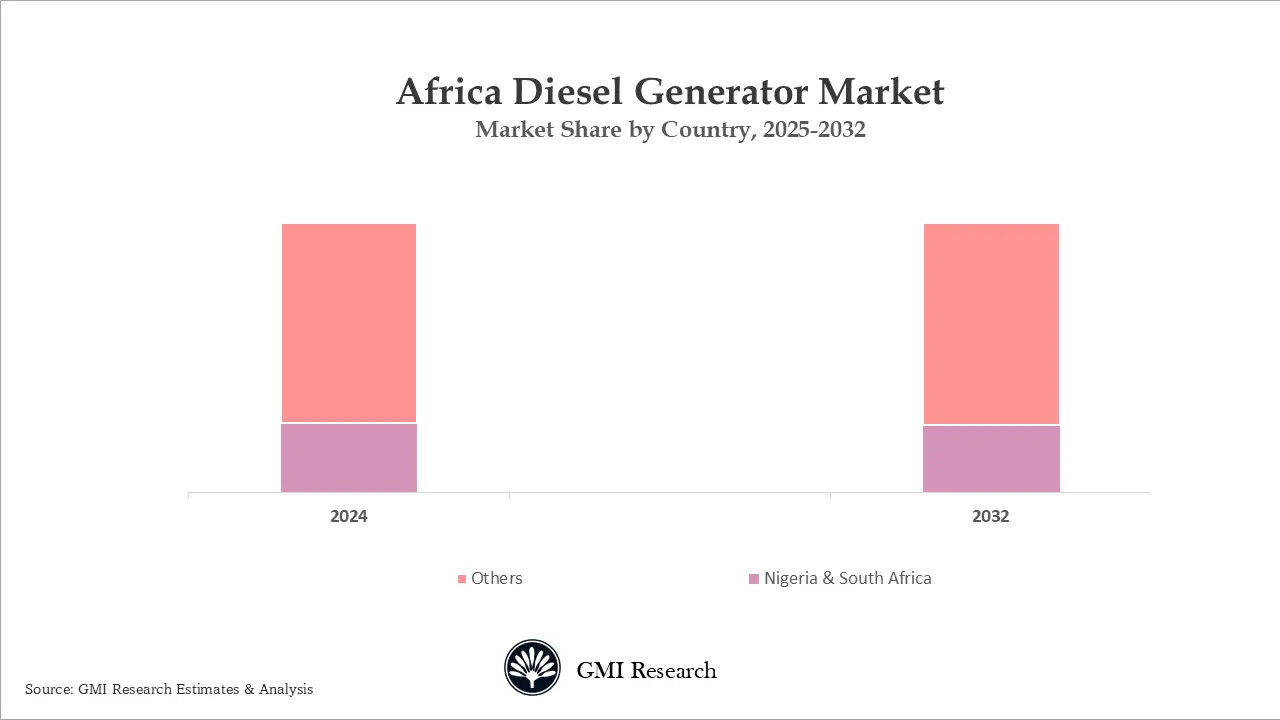

- Country Market Insights: Nigeria and South Africa combined together dominates the market share

Africa Diesel Generator Market Growth Drivers

Unreliable electricity grids, leading to frequent power outages

As per the IEA estimates, currently, there are more than 600 million people living in Africa without reliable electricity access, making Africa with the lowest rate of electricity access globally. This translates into only 56% of African population have electricity and 44% of the population remains without having access to electricity.

The lack of reliable power is intensifying the demand for self-generating power systems and the increasing adoption of gensets in residential, commercial, and industrial sectors will fuel the demand of the market in Africa.

The need for power in the African region is far greater compared to the current electricity supply. The Industrialization and the overall development of the African economies as a whole is driving power demand. The use of diesel generators comes with certain benefits like lower operating expenses and greater fuel efficiency. In many countries across Africa, the diesel generator power generating capacity surpass of the national grid capacity.

Robust Industrial Growth

Africa’s industrialisation efforts are gaining momentum, primarily driven by a combination of strategic investments, favourable government policies, and the expansion of the African Continental Free Trade Area (AfCFTA). Robust industrial growth driving massive electricity demand in Africa, but governments across the continents have limited access to finance owing to low credit rating work as a roadblock to governments to increase massive investments in power generation, drives demand for diesel generator in Africa.

Increasing Adoption of Generators Across Sectors

Power outages are so frequent, in Africa in order to have continuous electricity many companies and households are forced to use alternative power sources, and this applies to even large corporation too.

Continuous growth witnessed across several industries, including mining, oil & gas, is leading to the high adoption of diesel gensets in these industries. For operating without interruptions, the industries across the region have to rely on diesel generators to cope up with frequent power cuts.

Why Purchase a Standard Report When You Can Customize this Report

Please Let us know your Customization Requirements

Challenges Faced by Africa Diesel Generator Market Companies

The high cost of operation and maintenance of diesel gensets along with the rise in demand for the renewable energy are some factors resulting in the hinderance of the Africa diesel gensets market.

Africa Diesel Generator Market Segment Analysis

Market Insights by Power Rating : Generators which have a power rating of less than 75kVA dominates the market revenues

Based on the power rating, generators less than 75kVA dominates the market revenues and is anticipated to grow at a steady growth rate during the forecast period due to its high demand from end users such as residential, telecom sectors, commercial such as shops, clinics, and other sectors. The low cost of these diesel gensets, along with its several applications, is driving the market growth in the region.

Large size generators with a power rating of more than 750 KVA, the demand for such generators comes from mining, manufacturing, oil & gas, data centres. The demand for large size generators is projected to grow during the forecast period owing to as around 47 large size data centres under construction in Africa.

End-Use Market Insights: Industrial segment dominates the diesel generator revenues in Africa

Based on the end-user, the industrial segment dominates the diesel generator revenues in Africa and is expected to grow at a robust CAGR during the forecast period owing to the huge adoption of diesel gensets in oil & gas, telecom, healthcare, real estate, manufacturing, data centres, mining etc. for reliable power backup. In addition, rising industrial activities, which is resulting in increasing demand for the power supply, is boosting the demand for diesel gensets across the globe. The rising demand for diesel gensets among the small and medium scale industries and rapid urbanization will further fuel the demand for diesel gensets in this segment. The growth in data centres across Africa primarily the construction of hyperscale data centres demand huge power requirements relying on diesel generators for power backup.

Country Market Insights: Nigeria and South Africa combined together dominates the market share

Based on the country, Nigeria is one of the major diesel generator market in Africa, primarily due to frequent power cuts, unreliable grid supply, country rich in fossil fuels and government subsidy on fuel. All these factors together creates a strong demand for generators. Nigerian government is promoting the manufacturing sector through Initiatives such as the ‘Nigeria First’ policy though which it is emphasising to prioritize local manufacturer good to reduce import dependency and other incentives will further drive the adoption of diesel gensets in the operations resulting in the growth of diesel gensets in the country.

South Africa is also witnessing a robust generator market growth owing to frequent power outages due to electricity demand exceeding power generation. Booming data center growth is projected to further put additional strain on already overloaded national grid. this is projected to provide push for diesel generator market growth in the country.

Africa Diesel Generator Market Major Players & Competitive Landscape

Several leading companies operating in the Africa diesel generator market are Cummins, Caterpillar, Kirloskar, Mikano, Himoinsa, AKSA, Kohler, MAN, Yorpower, Perkins, Scania, GE Vernova, Atlas Copco AB etc. The global brand dominates the Africa diesel generator market share especially in higher KVA and have pan Africa presence however, local manufacturers are also emerging. GMDTA Engineering manufactures generator in Sudan serving the local market.

Africa Diesel Generator Market News

-

- In May 2025, SANY Heavy Industry Zimbabwe Company has launched its range of SANY diesel generators in the local market. This introduction represents a key milestone in the company’s broader strategy to build a long-term presence within Africa’s critical power infrastructure sector

- In November 2024, TRAGADEL received a contract from Ministry of Economy, Planning and International Cooperation (Central African Republic) for providing diesel generators and photovoltaic street lighting in Bangui, the capital city of the Central African Republic (CAR).

|

Report Coverage |

Details |

| Market Size Value in 2024 |

USD 1.2 billion |

| Market Revenue Forecast in 2032 |

USD 1.7 billion |

| CAGR |

4.1% |

| Market Base Year |

2024 |

| Market Forecast Period |

2025-2032 |

| Base Year & Forecast Units |

Revenues (USD Billion) |

| Market Segment | By Power Rating, By Application, By End-Use |

| Regional Coverage | Africa |

| Companies Profiled | Cummins, Caterpillar, Kirloskar, Mikano, Himoinsa, AKSA, Kohler, MAN, Yorpower, Perkins, Scania, GE Vernova, Atlas Copco AB among others; a total of 13 companies covered. |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Africa Diesel Generator Market Scope of the Report

The Africa Diesel Genset market has been segmented on the basis of power rating, application, end-use, and key countries. Based on power rating, the market is segmented into Less than 75kVA, 75kVA – 375kVA, 375.1kVA – 750kVA, and more than 750kVA. Based on Application, the market is segmented into standby/backup power, peak shaving, prime & continuous power. Based on end-use, the market is segmented into Residential, Commercial, and Industrial.

Africa Diesel Genset market by Power Rating

-

- Less than 75kVA

- 75kVA – 375kVA

- 375.1kVA – 750kVA

- More than 750kVA

Africa Diesel Genset market By Application

-

- Standby/Backup Power

- Peak Shaving

- Prime & Continuous Power

Africa Diesel Genset market by End-Use

-

- Residential

- Commercial

- Industrial

Africa Diesel Genset market by Countries

-

- Nigeria Diesel Genset Market All-Up (Option 1: Free 25% Customization)

- Algeria Diesel Genset Market All-Up (Option 2: Free 25% Customization)

- Kenya Diesel Genset Market All-Up (Option 3: Free 25% Customization)

- South Africa Diesel Genset Market All-Up (Option 4: Free 25% Customization)

- Egypt Diesel Genset Market All-Up (Option 5: Free 25% Customization)

- Rest of Africa Diesel Genset Market All-Up (Option 6: Free 25% Customization)

Africa Diesel Genset Leading market players

-

- Cummins

- Caterpillar

- Kirloskar

- Mikano

- Himoinsa

- AKSA

- Kohler

- MAN

- Yorpower

- Perkins

- Scania

- GE Vernova

- Atlas Copco AB

Frequently Asked Question About This Report

Africa Diesel Generator Market [UP398A-00-0620]

Africa Diesel Generator Market size was estimated at USD 1.2 billion in 2024

The market growth is primarily driven by unreliable electricity grids, leading to frequent power outages, rising demand for electricity and the development of the industrial sector in the region.

Major players are Cummins, Caterpillar, Kirloskar, Mikano, Himoinsa, AKSA, Kohler, MAN, Yorpower, Perkins, Scania, GE Vernova, Mitsubishi Generators, Atlas Copco AB etc.

Nigeria and South Africa are the two largest market for diesel generators in Africa.

Industrial end-use dominates the diesel generator revenues in Africa and is expected to grow at a robust CAGR during the forecast period.

Generators which have a power rating of less than 75kVA dominates the market revenues.

Related Reports

- Published Date: Nov-2025

- Report Format: Excel/PPT

- Report Code: UP398A-00-0620

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

Africa Diesel Generator Market and Analysis Report – Opportunities and Forecast 2025-2032

$ 4,499.00 – $ 6,649.00Price range: $ 4,499.00 through $ 6,649.00

Why GMI Research