No products in the cart.

Press Release

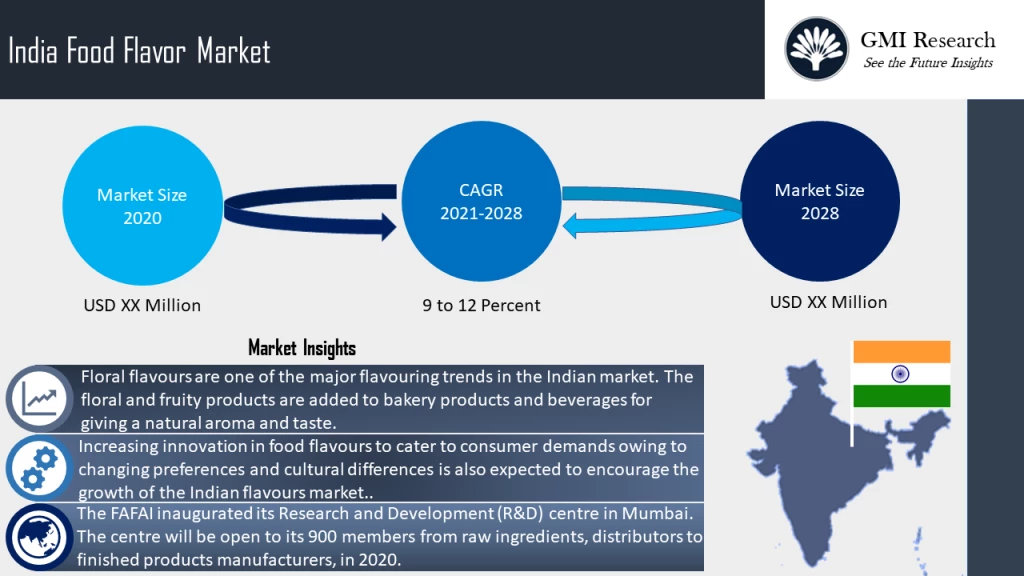

As per the GMI Research forecasts, the growing demand for processed food stands to be one of the key market drivers in the India Food Flavor Market. The market was estimated to be USD XX Million in 2020 and is predicted while growing at a CAGR of 9% to 12% during the forecast period (2021-2028).

The share of the Natural food flavours is low as compared to the other flavouring types such as Artificial and Nature-Identical flavours because of the high price associated with the natural flavours. Hence, the food flavour manufacturers are also more inclined towards the artificial and nature-identical flavours as they are cost-effective in manufacturing.

To have an edge over the competition by knowing the market dynamics and current trends of “India Food Flavor Market”, request for Sample Report here

The demand for the packaged foods is increasing among of the population of India. Furthermore, the food flavour manufacturers are evolving their production practices to meet the health-consciousness of consumers as well as demands for sustainability and environmental benefits. As a result, they have started adopting the industrial biotechnology, also known as White biotechnology, to enable enables production of flavours, fragrances and aroma ingredients through fermentation, which alleviates constraints on natural resources and replaces traditional chemical processes dependent on fossil fuel feedstocks. The commercial development of a few leading biotech processes for flavours and fragrances creates the potential for rapid development of new food ingredients, additives and process aids. Several biotechnology companies are directly involved in the Indian market. For instance, Novozymes is the largest supplier of industrial enzymes in India. Moreover, Firmenich and Amyris collaborated to develop Clearwood, a mixture of the sesquiterpenes and alcohols found in patchouli oil.

On the basis of the Fruits and Vegetables segment is expected to grow at the highest CAGR of 12.1% due to the high usage of flavouring agents of fruits and vegetables such as mango, orange, apple, lemon, among others in the beverage industry.

Key Developments:

-

- In 2020, Flavaroma Flavours and Fragrances Pvt. Ltd. launched new range of natural flavours, Naturaroma, which includes natural flavors, oils, and extracts. Naturaroma’s collection includes spicy, fruity, brown, minty, and flowery notes.

- In 2020, The Fragrances and Flavours Association of India (FAFAI) inaugurated its Research and Development (R&D) centre in Mumbai. The R&D centre will be open to its 900 members from raw ingredients, distributors to finished products manufacturers.

- In 2019, Firmenich launched Gulfood Flavour, which offers a wide range of Mediterranean flavours containing spices, basil, and garlic notes to consumers’ tastes in India. The flavors will be designed to be used within eight categories including, beverages, dairy, confectionery, savoury products, and others.

The India Food Flavor market has been segmented on the basis of Type and Application. Based on Type, the market is segmented into Herbs, Spices, Fruits and Vegetables and Others. Based on Application, the market is categorized into Confectionery, Beverages and Others.