No products in the cart.

High Performance Plastics Market in Transportation Industry by Type, by Application and by Geography – Forecast, 2022-2029

High Performance Plastics Market in Transportation Industry by Type (Polyphenylene Sulfide, Polyketones, Fluoropolymers, Thermoplastic Polyimides, High Performance Polyamides), by Application (Automotive, Aviation, Railways & Marine), and by Geography

Report Description

Table Of Content

Sample Request

Request For Customization

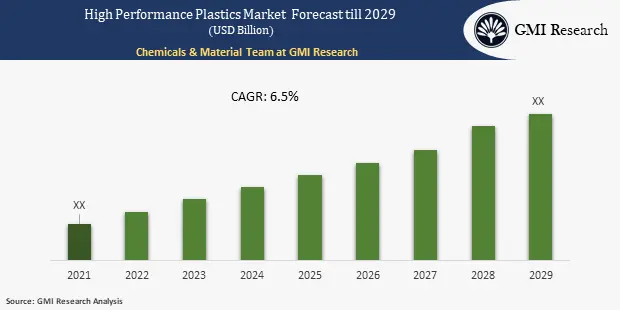

GMI Research analysis indicates that the High-Performance Plastics Market is slated to register a CAGR of 6.5% over the period, 2022-2029.

To have an edge over the competition by knowing the market dynamics and current trends of “High Performance Plastics Market,” request for Sample Report here

Key Drivers

The growing adoption of high-performance plastics for the production of various exterior and interior components of aircraft and automobiles, owing to their remarkable characteristics which include chemical resilience, heat stability, and mechanical strength, stands to be one of the major factors fueling the high performance plastics market growth. Ongoing technological innovation and growing emphasis towards the development of application-specific sophisticated thermoplastics for flame and abrasion resistant with improved strength is estimated to create lucrative opportunities for high-performance thermoplastics market participants.

The expansion of electrical and electronics industry primarily across the emerging economies, increasing application of high performance plastics across various end-use industries which include transportation and automotive applications, medical, Industrial, electrical and electronics, defense and building and construction applications and increasing industrialization especially in the developing countries are projected to augment the market growth. Increasing initiatives undertaken by the government agencies such as favourable norms will offer enormous opportunities to the market. However, the high cost of High-Performance Plastics coupled and growing environmental concerns will restrain the market growth. Easy accessibility of substitutes and volatility in the prices of raw materials will further obstruct the High-Performance Plastics market size.

Do you want to know more about the Research process and detailed Methodology, Request Research Methodology of this report

Type Segment Analysis

Polyamides segment is expected to hold a prominent share over the forecast period. The exceptional features including rigidity, better mechanical strength, and stability under heat makes them suitable for various applications in gears, fittings, bearings and tool which is a major factor propelling the market growth. The growing adoption of polyamide in industrial applications including sports equipment, consumer goods, construction, and electronics will drive the market growth. PPS is also used to produce specialty membranes, electrical insulation, gaskets and packaging/insulation/sealing has fueled the market growth. Higher elasticity, wrinkle-proof, and higher tensile strength has surge their adoption across the textile industry, strengthening the market growth.

Application Segment Analysis

Automotive application is estimated to lead the market during the forecast period. Growing application of high-performance plastics in the transportation systems, owing to the enhanced safety, strength, and better performance. The emerging need to obey fuel efficiency norms has augmented the demand for high performance plastics by the automotive manufacturers, boosting the market growth. Also, the HPPs are lighter in weight, which helps to decrease the fuel consumption and thus greenhouse emissions. Moreover, the remarkable flame and corrosion resistance capabilities of high-performance plastics has bolstered the interior applications across the automotive segment, which will strengthen the market growth. Further, the growing application of composites in aircraft structure has paved the way for aviation segment.

In case, any of your pain points areas are not covered in the current scope of this report, Request for Customization here

Regional – Segment Analysis

Geographically, European region is projected to lead the market over the forecast period because of the supportive government policies & regulations and expansion of the transportation industry. The presence of large number of automotive and aircraft manufacturers, will offer enormous growth opportunities to the market Besides that, Asia-Pacific region will witness a higher growth over the upcoming years because of the intensified investment in the consumer goods industry. Increasing adoption of high-performance plastics by leading automotive players in the region has augmented the market growth. China and Japan are the principal countries in the region in terms of production and consumption of high performance plastics, with China being the chief manufacturer of PPS with 30% of global production capacity.

The global high performance plastics market in the transportation industry is segmented on the basis of type, application, and geography:

For detailed scope of the “High Performance Plastics Market” report request a Sample Copy of the report

|

Report Coverage |

Details |

| Market Revenues (2021) |

USD Million |

| Market Base Year |

2021 |

| Market Forecast Period |

2022-2029 |

| Base Year & Forecast Units |

Revenues (USD Million) |

| Market Segment | By Type, By End-Use, By Region |

| Regional Coverage | Asia Pacific, Europe, North America, and RoW |

| Companies Profiled | |

| 25% Free Customization Available | We will customize this report up to 25% as a free customization to address our client’s specific requirements |

Market Segmentation

Global High Performance Plastics Market by Type

-

- Polyphenylene sulphide (PPS, PSU, PES, PPSU)

- Polyketones (PEEK, PEK, PEKK, AKP)

- Fluoropolymers (PTFE, PVDF, FEP, ECTFE, Fluoroleastomers)

- Thermoplastics Polyimides (PI, PAI, PEI)

- High Performance Polyamides (PPA, PA 9T)

Global High Performance Plastics Market by End-Use

-

- Automotive (Interior & Exterior)

- Aviation (Interior & Exterior)

- Railways

- Marine

Global High Performance Plastics Market by Region

-

- North America Global High Performance Plastics Market (Option 1: As a part of the free 25% customization)

- By Type

- By End-Use

- US Market All-Up

- Canada Market All-Up

- Europe Global High Performance Plastics Market (Option 2: As a part of the free 25% customization)

- By Type

- By End-Use

- UK Market All-Up

- Germany Market All-Up

- France Market All-Up

- Spain Market All-Up

- Rest of Europe Market All-Up

- Asia-Pacific Global High Performance Plastics Market (Option 3: As a part of the free 25% customization)

- By Type

- By End-Use

- China Market All-Up

- India Market All-Up

- Japan Market All-Up

- Rest of APAC Market All-Up

- RoW Global High Performance Plastics Market (Option 4: As a part of the free 25% customization)

- By Type

- By End-Use

- Brazil Market All-Up

- South Africa Market All-Up

- Saudi Arabia Market All-Up

- UAE Market All-Up

- Rest of world (remaining countries of the LAMEA region) Market All-Up

- North America Global High Performance Plastics Market (Option 1: As a part of the free 25% customization)

Countries with high growth opportunity for High Performance Plastics Market in the Transportation Industry Revenue Forecast, 2022-2029

-

- USA

- Germany

- France

- K.

- China

- Japan

- India

- Canada

Global High Performance Plastics Market in the Transportation Industry Competitive Landscape & Company Profiles

-

- Major Players and their Market Share Analysis

- New product launches

- Mergers and acquisitions

- Collaborations, partnerships, agreements and joint venture

- Published Date: Aug-2021

- Report Format: Excel/PPT

- Report Code: CF03A-00-0817

Get Free 25% Customization in this Report

Licensing Options

Single-User License:

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

The report is used by the purchaser (One Individual) only

Multi-User License:Report is shared with maximum 5 users (employees) including the purchaser of the purchasing corporation only

Corporate License:

Report is shared with unlimited user (employees) of the purchasing corporation only

High Performance Plastics Market in Transportation Industry by Type, by Application and by Geography – Forecast, 2022-2029

$ 4,499.00 – $ 6,649.00

SKU: CF03A-00-0817

Categories: Chemicals & Materials, Published, Report Store

Tags: high performance plastics market, High Performance Plastics Market Dynamics, High Performance Plastics Market Growth, High Performance Plastics Market Key players, High Performance Plastics Market Opportunity, High Performance Plastics Market Size, High Performance Plastics Market Trends

Why GMI Research